Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903101000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

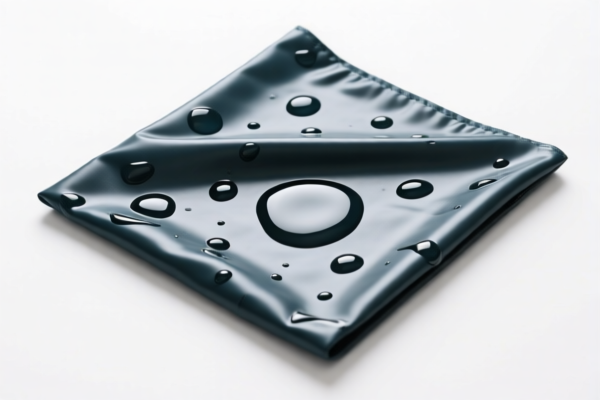

Product Classification: PVC-Coated Textile Dustproof Cloth

HS CODE: 3921121950 / 3921121910 / 5903101000

🔍 Classification Summary

- 3921121950: PVC-coated textile dustproof cloth, where the textile fiber content is not specified to exceed any single fiber type.

- 3921121910: PVC-coated textile anti-stain cloth or protective cloth, with similar fiber composition conditions.

- 5903101000: PVC-coated cotton cloth used as dustproof cloth, specifically for cotton-based textiles coated with plastic.

📊 Tariff Overview

All the above HS codes share the same tariff structure, with slight differences in product description and application.

✅ Base Tariff Rate

- 5.3% (applies to all listed HS codes)

⚠️ Additional Tariffs

- 25.0% (general additional tariff, applicable to all imports)

⚠️ Special Tariff After April 11, 2025

- 30.0% (additional tariff imposed after April 11, 2025)

📌 Total Tax Rate

- 60.3% (5.3% + 25.0% + 30.0%)

- Note: For 5903101000, the base tariff is 2.7%, but the total tax rate is still 57.7% (2.7% + 25.0% + 30.0%).

📌 Key Considerations for Customs Compliance

- Material Composition: Ensure the textile fiber content is clearly defined. If it's not specified that any single fiber exceeds others, 39211219 codes apply.

- Product Use: If the product is used for anti-stain or protection, it may fall under 3921121910.

- Material Type: If the textile is cotton-based, 5903101000 is the correct classification.

- Certifications: Verify if any import permits or environmental certifications are required for PVC-coated products.

- Unit Price: Confirm the unit price and quantity for accurate customs valuation.

🚨 Time-Sensitive Alert

- April 11, 2025: Additional tariffs of 30.0% will be imposed. Ensure your import plans are adjusted accordingly.

- Anti-dumping duties: Not applicable for this product category (no mention of iron or aluminum).

✅ Proactive Advice

- Verify the exact composition of the textile (e.g., cotton, polyester, etc.) to ensure correct HS code.

- Check the intended use (dustproof, anti-stain, protective) to determine the most accurate classification.

- Consult with customs brokers or trade compliance experts for complex cases.

- Keep documentation (e.g., material certificates, product specifications) ready for customs inspection.

Let me know if you need help with tariff calculation or customs documentation.

Product Classification: PVC-Coated Textile Dustproof Cloth

HS CODE: 3921121950 / 3921121910 / 5903101000

🔍 Classification Summary

- 3921121950: PVC-coated textile dustproof cloth, where the textile fiber content is not specified to exceed any single fiber type.

- 3921121910: PVC-coated textile anti-stain cloth or protective cloth, with similar fiber composition conditions.

- 5903101000: PVC-coated cotton cloth used as dustproof cloth, specifically for cotton-based textiles coated with plastic.

📊 Tariff Overview

All the above HS codes share the same tariff structure, with slight differences in product description and application.

✅ Base Tariff Rate

- 5.3% (applies to all listed HS codes)

⚠️ Additional Tariffs

- 25.0% (general additional tariff, applicable to all imports)

⚠️ Special Tariff After April 11, 2025

- 30.0% (additional tariff imposed after April 11, 2025)

📌 Total Tax Rate

- 60.3% (5.3% + 25.0% + 30.0%)

- Note: For 5903101000, the base tariff is 2.7%, but the total tax rate is still 57.7% (2.7% + 25.0% + 30.0%).

📌 Key Considerations for Customs Compliance

- Material Composition: Ensure the textile fiber content is clearly defined. If it's not specified that any single fiber exceeds others, 39211219 codes apply.

- Product Use: If the product is used for anti-stain or protection, it may fall under 3921121910.

- Material Type: If the textile is cotton-based, 5903101000 is the correct classification.

- Certifications: Verify if any import permits or environmental certifications are required for PVC-coated products.

- Unit Price: Confirm the unit price and quantity for accurate customs valuation.

🚨 Time-Sensitive Alert

- April 11, 2025: Additional tariffs of 30.0% will be imposed. Ensure your import plans are adjusted accordingly.

- Anti-dumping duties: Not applicable for this product category (no mention of iron or aluminum).

✅ Proactive Advice

- Verify the exact composition of the textile (e.g., cotton, polyester, etc.) to ensure correct HS code.

- Check the intended use (dustproof, anti-stain, protective) to determine the most accurate classification.

- Consult with customs brokers or trade compliance experts for complex cases.

- Keep documentation (e.g., material certificates, product specifications) ready for customs inspection.

Let me know if you need help with tariff calculation or customs documentation.

Customer Reviews

No reviews yet.