| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

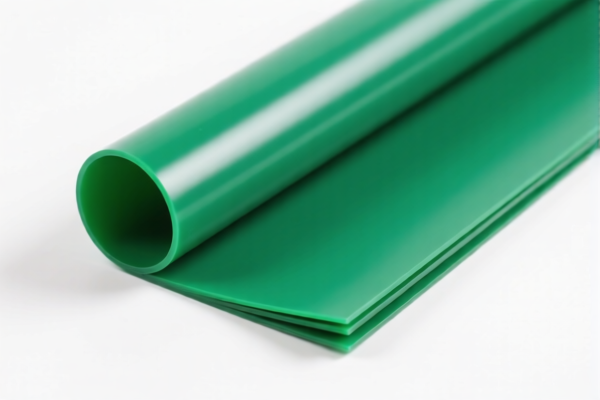

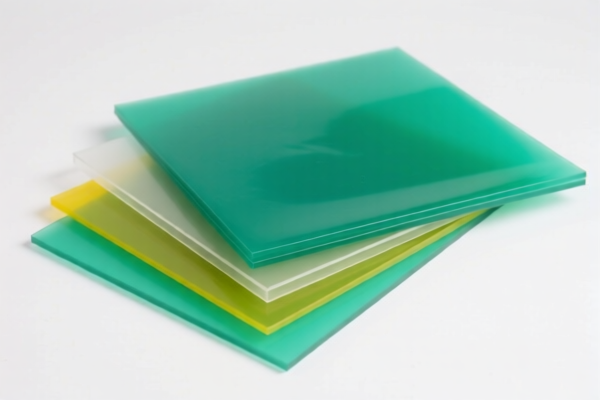

Product Classification: PVC Coated Textile Protective Fabric

Classification Options and Tax Details:

Option 1: HS Code 3921121910

Description:

- This code applies to PVC-coated textile protective fabric that is classified under plastic sheets, films, foils, and strips combined with textile materials, where the vegetable fiber content is not clearly specified to exceed other single textile fibers.

Tax Details:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes: - This classification is suitable if the fabric is primarily a plastic-coated textile with no clear dominance of vegetable fibers. - Time-sensitive: The 30.0% additional tariff applies after April 11, 2025.

Option 2: HS Code 5903102010

Description:

- This code applies to PVC-coated textile protective fabric that is classified under textiles coated, impregnated, or laminated with plastics, specifically PVC-coated yarns.

Tax Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This classification is suitable if the fabric is made from PVC-coated yarns and is textile-based. - Time-sensitive: The 30.0% additional tariff applies after April 11, 2025.

Proactive Advice:

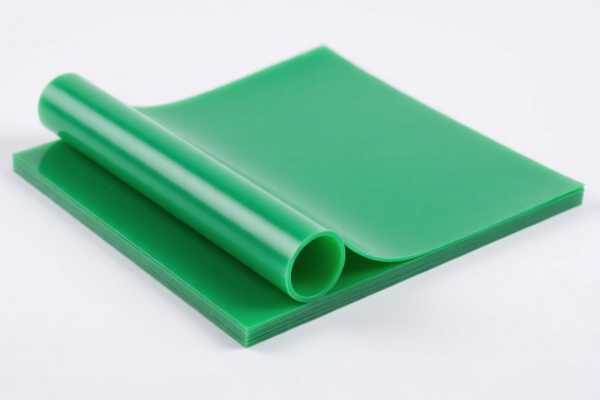

- Verify Material Composition: Confirm whether the fabric is made from PVC-coated yarns (for HS 5903102010) or plastic-coated textile (for HS 3921121910).

- Check Unit Price and Certification: Ensure that the product meets any customs or safety certification requirements (e.g., fire resistance, chemical resistance).

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special additional tariff.

- Consult with Customs Broker: For accurate classification and tax calculation, especially if the product has mixed materials or special uses.

Let me know if you need help determining which HS code applies to your specific product.

Product Classification: PVC Coated Textile Protective Fabric

Classification Options and Tax Details:

Option 1: HS Code 3921121910

Description:

- This code applies to PVC-coated textile protective fabric that is classified under plastic sheets, films, foils, and strips combined with textile materials, where the vegetable fiber content is not clearly specified to exceed other single textile fibers.

Tax Details:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes: - This classification is suitable if the fabric is primarily a plastic-coated textile with no clear dominance of vegetable fibers. - Time-sensitive: The 30.0% additional tariff applies after April 11, 2025.

Option 2: HS Code 5903102010

Description:

- This code applies to PVC-coated textile protective fabric that is classified under textiles coated, impregnated, or laminated with plastics, specifically PVC-coated yarns.

Tax Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This classification is suitable if the fabric is made from PVC-coated yarns and is textile-based. - Time-sensitive: The 30.0% additional tariff applies after April 11, 2025.

Proactive Advice:

- Verify Material Composition: Confirm whether the fabric is made from PVC-coated yarns (for HS 5903102010) or plastic-coated textile (for HS 3921121910).

- Check Unit Price and Certification: Ensure that the product meets any customs or safety certification requirements (e.g., fire resistance, chemical resistance).

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special additional tariff.

- Consult with Customs Broker: For accurate classification and tax calculation, especially if the product has mixed materials or special uses.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.