| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

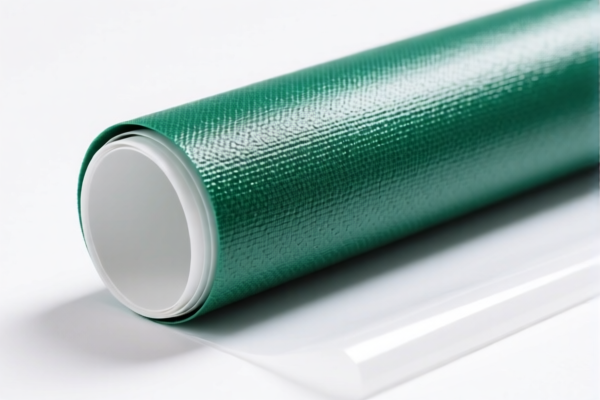

Product Name: PVC Coated Textile Shock-Absorbing Fabric

Classification: Plastic sheets, films, foils, and strips combined with textile materials (HS Code: 3921121950)

🔍 HS CODE: 3921121950

Description:

- This code applies to PVC-coated textile materials such as shock-absorbing, anti-slip, protective, radiation-proof, and dust-proof fabrics.

- The product is classified under Chapter 39 (Plastics and articles thereof), specifically Heading 3921 (Plastic sheets, films, foils and strips, of plastics, not elsewhere specified or included).

- It is further specified under Subheading 3921.12.19.50, which includes plastic sheets, films, etc., combined with textile materials, but not meeting the criteria of 3921.12.19.10 (e.g., vegetable fiber content not exceeding any other single textile fiber).

📊 Tariff Overview (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 60.3%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

✅ Action Required: Confirm the import timeline and consider adjusting the logistics schedule accordingly. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, always verify with customs or a trade compliance expert if the product is subject to any ongoing investigations.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure that the vegetable fiber content does not exceed any other single textile fiber, as this could affect the HS code classification. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., safety, environmental, or textile standards) are required for import. -

Consult Customs Authority:

For products with complex compositions or special functions (e.g., radiation-proof), it is advisable to consult customs or a customs broker to confirm the correct classification and applicable duties.

📚 Summary Table

| Tariff Component | Rate |

|---|---|

| Base Tariff | 5.3% |

| General Additional Tariff | 25.0% |

| Special Tariff (after April 11, 2025) | 30.0% |

| Total Tariff | 60.3% |

If you have more details about the product (e.g., fiber composition, end-use, or country of origin), I can provide a more tailored analysis.

Product Name: PVC Coated Textile Shock-Absorbing Fabric

Classification: Plastic sheets, films, foils, and strips combined with textile materials (HS Code: 3921121950)

🔍 HS CODE: 3921121950

Description:

- This code applies to PVC-coated textile materials such as shock-absorbing, anti-slip, protective, radiation-proof, and dust-proof fabrics.

- The product is classified under Chapter 39 (Plastics and articles thereof), specifically Heading 3921 (Plastic sheets, films, foils and strips, of plastics, not elsewhere specified or included).

- It is further specified under Subheading 3921.12.19.50, which includes plastic sheets, films, etc., combined with textile materials, but not meeting the criteria of 3921.12.19.10 (e.g., vegetable fiber content not exceeding any other single textile fiber).

📊 Tariff Overview (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 60.3%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

✅ Action Required: Confirm the import timeline and consider adjusting the logistics schedule accordingly. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, always verify with customs or a trade compliance expert if the product is subject to any ongoing investigations.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure that the vegetable fiber content does not exceed any other single textile fiber, as this could affect the HS code classification. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., safety, environmental, or textile standards) are required for import. -

Consult Customs Authority:

For products with complex compositions or special functions (e.g., radiation-proof), it is advisable to consult customs or a customs broker to confirm the correct classification and applicable duties.

📚 Summary Table

| Tariff Component | Rate |

|---|---|

| Base Tariff | 5.3% |

| General Additional Tariff | 25.0% |

| Special Tariff (after April 11, 2025) | 30.0% |

| Total Tariff | 60.3% |

If you have more details about the product (e.g., fiber composition, end-use, or country of origin), I can provide a more tailored analysis.

Customer Reviews

No reviews yet.