| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

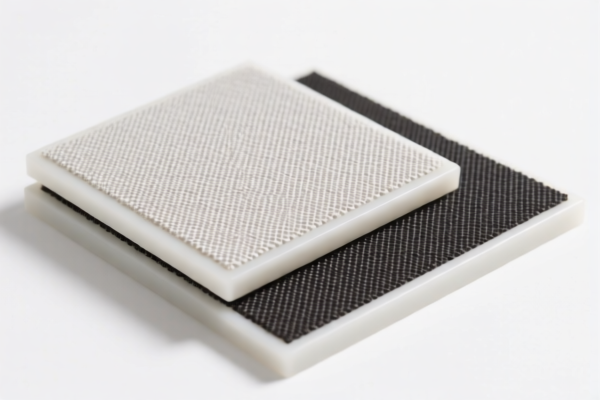

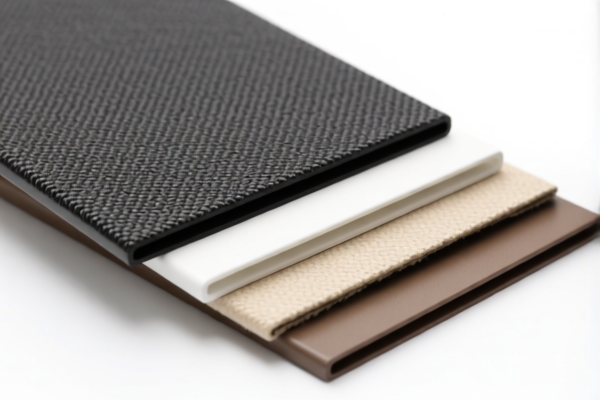

Product Name: PVC Coated Textile Tablecloth

Classification HS Code Analysis:

- HS CODE: 3921.12.19.50

- Description: PVC-coated textile tablecloth, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, other.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921.12.19.10

- Description: PVC-coated textile tablecloth, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, where textile component weight exceeds that of any single textile fiber.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921.12.11.00

- Description: PVC-coated textile tablecloth, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, other.

-

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921.12.19.50 (repeated)

- Description: PVC-coated polyester tablecloth, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, other.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921.12.19.50 (repeated)

- Description: PVC textile table mat, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, other.

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ Key Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after this date. This is a time-sensitive policy and must be considered in cost planning.

- Base Tariff Differences: The HS code 3921.12.11.00 has a lower base tariff (4.2%) compared to others (5.3%), which may be due to material or composition differences.

- Material Composition Matters: The classification depends on the weight ratio of textile components. If the textile weight is greater than any single fiber, it falls under a different HS code (e.g., 3921.12.19.10).

🛑 Proactive Advice:

- Verify Material Composition: Confirm the exact composition (e.g., polyester, cotton, or other fibers) and the weight ratio of textile to PVC.

- Check Unit Price and Certification: Ensure compliance with any required certifications (e.g., food safety, environmental standards) for textile products used in food contact.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult Customs Authority: For precise classification, especially if the product is borderline between categories.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: PVC Coated Textile Tablecloth

Classification HS Code Analysis:

- HS CODE: 3921.12.19.50

- Description: PVC-coated textile tablecloth, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, other.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921.12.19.10

- Description: PVC-coated textile tablecloth, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, where textile component weight exceeds that of any single textile fiber.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921.12.11.00

- Description: PVC-coated textile tablecloth, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, other.

-

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921.12.19.50 (repeated)

- Description: PVC-coated polyester tablecloth, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, other.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921.12.19.50 (repeated)

- Description: PVC textile table mat, other plastic sheets, films, etc., based on polyvinyl chloride polymer, combined with textile materials, other.

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ Key Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after this date. This is a time-sensitive policy and must be considered in cost planning.

- Base Tariff Differences: The HS code 3921.12.11.00 has a lower base tariff (4.2%) compared to others (5.3%), which may be due to material or composition differences.

- Material Composition Matters: The classification depends on the weight ratio of textile components. If the textile weight is greater than any single fiber, it falls under a different HS code (e.g., 3921.12.19.10).

🛑 Proactive Advice:

- Verify Material Composition: Confirm the exact composition (e.g., polyester, cotton, or other fibers) and the weight ratio of textile to PVC.

- Check Unit Price and Certification: Ensure compliance with any required certifications (e.g., food safety, environmental standards) for textile products used in food contact.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult Customs Authority: For precise classification, especially if the product is borderline between categories.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.