| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

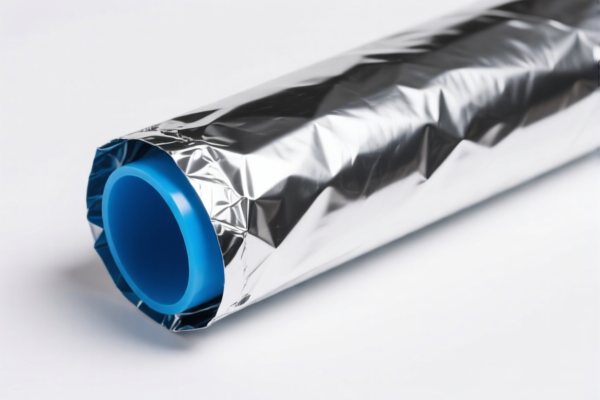

Product Name: PVC Coated Art Fabric

Classification HS Code Analysis:

- HS CODE 3921121100

- Description: PVC-coated art fabric, classified under HS code 3921, which covers plastic sheets, plates, films, foils, and strips made of polyvinyl chloride (PVC). The product is described as a combination of PVC with textile materials, aligning with the 8–10 digit HS code features.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is repeated in the list, but the classification logic remains consistent.

-

HS CODE 5903103000

- Description: PVC-coated decorative fabric, classified under HS code 5903103000, which covers textile fabrics coated, impregnated, or laminated with plastics, specifically polyvinyl chloride (PVC), and falls under the "other" category.

- Total Tax Rate: 57.7%

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is more suitable if the product is primarily a textile fabric with PVC coating.

-

HS CODE 3904400000

- Description: PVC-coated fabric classified under HS code 3904, which covers primary forms of polyvinyl chloride (PVC) polymer. Although the product is a finished item, it is primarily composed of PVC, and thus may be classified under this code.

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for raw or primary forms of PVC, so it may not be the most accurate for a finished product like PVC-coated fabric.

-

HS CODE 3920435000

- Description: PVC-coated fabric classified under HS code 3920, which covers plastic sheets, plates, films, etc., made of PVC, often with plasticizers for flexibility.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for products that are primarily plastic films or sheets with PVC coating.

-

HS CODE 3921121100 (repeated)

- Same as above.

✅ Recommendation:

- Preferred HS Code: 5903103000 if the product is primarily a textile fabric with PVC coating (e.g., decorative or artistic fabric).

- Alternative HS Code: 3921121100 or 3920435000 if the product is more plastic-based with textile integration.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- Anti-dumping duties: Not explicitly mentioned for this product, but always verify if applicable based on the country of origin.

- Certifications: Confirm if any certifications (e.g., REACH, RoHS) are required for the product in the destination market.

- Material Verification: Confirm the exact composition and unit price to ensure correct classification and tax calculation.

📌 Action Items:

- Verify the primary material (textile vs. plastic) to determine the most accurate HS code.

- Confirm the country of origin to check for any anti-dumping or special tariffs.

- Check if certifications are required for the product in the importing country.

-

Review the import timeline to avoid unexpected increases in tariffs after April 11, 2025. Product Name: PVC Coated Art Fabric

Classification HS Code Analysis: -

HS CODE 3921121100

- Description: PVC-coated art fabric, classified under HS code 3921, which covers plastic sheets, plates, films, foils, and strips made of polyvinyl chloride (PVC). The product is described as a combination of PVC with textile materials, aligning with the 8–10 digit HS code features.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is repeated in the list, but the classification logic remains consistent.

-

HS CODE 5903103000

- Description: PVC-coated decorative fabric, classified under HS code 5903103000, which covers textile fabrics coated, impregnated, or laminated with plastics, specifically polyvinyl chloride (PVC), and falls under the "other" category.

- Total Tax Rate: 57.7%

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is more suitable if the product is primarily a textile fabric with PVC coating.

-

HS CODE 3904400000

- Description: PVC-coated fabric classified under HS code 3904, which covers primary forms of polyvinyl chloride (PVC) polymer. Although the product is a finished item, it is primarily composed of PVC, and thus may be classified under this code.

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for raw or primary forms of PVC, so it may not be the most accurate for a finished product like PVC-coated fabric.

-

HS CODE 3920435000

- Description: PVC-coated fabric classified under HS code 3920, which covers plastic sheets, plates, films, etc., made of PVC, often with plasticizers for flexibility.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for products that are primarily plastic films or sheets with PVC coating.

-

HS CODE 3921121100 (repeated)

- Same as above.

✅ Recommendation:

- Preferred HS Code: 5903103000 if the product is primarily a textile fabric with PVC coating (e.g., decorative or artistic fabric).

- Alternative HS Code: 3921121100 or 3920435000 if the product is more plastic-based with textile integration.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- Anti-dumping duties: Not explicitly mentioned for this product, but always verify if applicable based on the country of origin.

- Certifications: Confirm if any certifications (e.g., REACH, RoHS) are required for the product in the destination market.

- Material Verification: Confirm the exact composition and unit price to ensure correct classification and tax calculation.

📌 Action Items:

- Verify the primary material (textile vs. plastic) to determine the most accurate HS code.

- Confirm the country of origin to check for any anti-dumping or special tariffs.

- Check if certifications are required for the product in the importing country.

- Review the import timeline to avoid unexpected increases in tariffs after April 11, 2025.

Customer Reviews

No reviews yet.