| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918104010 | Doc | 60.3% | CN | US | 2025-05-12 |

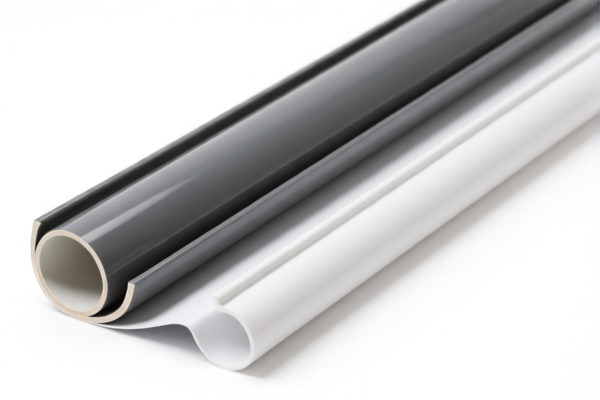

Product Name: PVC Coated Knitted Fabric Wall Fabric

Classification Analysis and Tax Information:

✅ HS CODE: 3921121500

Description:

- Plastic sheets, plates, films, foils and strips containing polymers of vinyl chloride (PVC), combined with textile materials.

- Applicable to PVC-coated knitted fabric wall fabric where the textile is combined with PVC.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 5903102010

Description:

- Textile products coated, impregnated, covered or laminated with plastics, containing polyvinyl chloride (PVC).

- Applicable to PVC-coated knitted fabric where the textile is coated with PVC.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 5903103000

Description:

- Textile fabrics impregnated, coated, covered or laminated with plastics, using polyvinyl chloride (PVC).

- Applicable to PVC-coated knitted fabric where the textile is coated with PVC.

Tariff Summary:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 57.7%

✅ HS CODE: 3918104010

Description:

- Plastic-made carpets, floor coverings, wall or ceiling materials, made of polyvinyl chloride (PVC), with textile fiber backing, woven products.

- Applicable to woven PVC wall fabric with textile backing.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 2, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is recommended to check the latest customs announcements for any updates. -

Certifications Required:

Ensure that the product meets all required certifications (e.g., fire resistance, environmental standards) depending on the destination market.

📌 Proactive Advice:

- Verify Material Composition: Confirm whether the product is a textile with PVC coating or a textile combined with PVC, as this will determine the correct HS code.

- Check Unit Price: The tax rate can significantly impact the final cost, so ensure accurate pricing and classification.

- Consult Customs Authority: For high-value or complex products, it is advisable to consult local customs or a customs broker for confirmation.

Let me know if you need help with HS code selection or customs documentation.

Product Name: PVC Coated Knitted Fabric Wall Fabric

Classification Analysis and Tax Information:

✅ HS CODE: 3921121500

Description:

- Plastic sheets, plates, films, foils and strips containing polymers of vinyl chloride (PVC), combined with textile materials.

- Applicable to PVC-coated knitted fabric wall fabric where the textile is combined with PVC.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 5903102010

Description:

- Textile products coated, impregnated, covered or laminated with plastics, containing polyvinyl chloride (PVC).

- Applicable to PVC-coated knitted fabric where the textile is coated with PVC.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 5903103000

Description:

- Textile fabrics impregnated, coated, covered or laminated with plastics, using polyvinyl chloride (PVC).

- Applicable to PVC-coated knitted fabric where the textile is coated with PVC.

Tariff Summary:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 57.7%

✅ HS CODE: 3918104010

Description:

- Plastic-made carpets, floor coverings, wall or ceiling materials, made of polyvinyl chloride (PVC), with textile fiber backing, woven products.

- Applicable to woven PVC wall fabric with textile backing.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 2, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is recommended to check the latest customs announcements for any updates. -

Certifications Required:

Ensure that the product meets all required certifications (e.g., fire resistance, environmental standards) depending on the destination market.

📌 Proactive Advice:

- Verify Material Composition: Confirm whether the product is a textile with PVC coating or a textile combined with PVC, as this will determine the correct HS code.

- Check Unit Price: The tax rate can significantly impact the final cost, so ensure accurate pricing and classification.

- Consult Customs Authority: For high-value or complex products, it is advisable to consult local customs or a customs broker for confirmation.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.