| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903903090 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

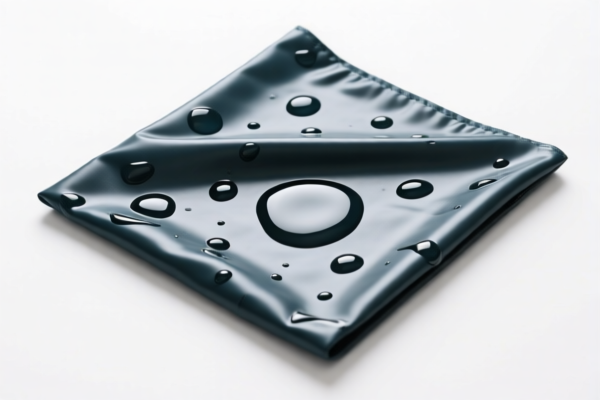

Product Name: PVC Coated Waterproof Textile Fabric

Classification Notes: Based on the provided HS codes and descriptions, the product can be classified under multiple HS codes depending on specific characteristics such as end-use, material composition, and technical specifications. Below is a structured breakdown of the classification and associated tariffs:

🔍 HS Code Classification Overview

1. HS Code: 3921121950

- Description: Plastic sheets, films, foils, and strips based on polyvinyl chloride (PVC), combined with textile materials (e.g., PVC-coated waterproof textiles, anti-stain textiles, breathable textiles).

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Notes: This code is used for products where the primary material is PVC plastic combined with textile materials.

2. HS Code: 5903903090

- Description: Textile fabrics coated, impregnated, or laminated with plastics (e.g., PVC-coated waterproof textiles), not elsewhere specified.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Notes: This code is more general and applies to textile fabrics with plastic coatings, including PVC.

3. HS Code: 5903102010

- Description: Textile fabrics coated, impregnated, or laminated with plastics, specifically those containing polyvinyl chloride (PVC), intended for building use.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Notes: This code is specific to building or construction use, and may be more suitable if the product is intended for such applications.

📌 Key Tax Rate Changes (April 2, 2025)

- All codes listed above will have an additional 30.0% tariff applied after April 2, 2025.

- This is a time-sensitive policy, and importers should plan accordingly to avoid unexpected costs.

⚠️ Important Considerations

- Material Composition: Confirm whether the product is primarily PVC-based or textile-based with PVC coating. This will determine the correct HS code.

- End Use: If the product is for construction, 5903102010 may be more appropriate.

- Unit Price and Certification: Verify the material composition, unit price, and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Tariff Impact: The 30.0% additional tariff after April 2, 2025, could significantly increase the total cost. Consider tariff planning or alternative classifications if applicable.

✅ Proactive Advice

- Verify the exact product description and composition (e.g., is it a textile with PVC coating or a PVC film with textile backing?).

- Check the intended use (e.g., construction, general use, industrial) to determine the most accurate HS code.

- Review the latest customs regulations and consult with a customs broker or tax expert for accurate classification and compliance.

Let me know if you need help determining the most suitable HS code for your specific product.

Product Name: PVC Coated Waterproof Textile Fabric

Classification Notes: Based on the provided HS codes and descriptions, the product can be classified under multiple HS codes depending on specific characteristics such as end-use, material composition, and technical specifications. Below is a structured breakdown of the classification and associated tariffs:

🔍 HS Code Classification Overview

1. HS Code: 3921121950

- Description: Plastic sheets, films, foils, and strips based on polyvinyl chloride (PVC), combined with textile materials (e.g., PVC-coated waterproof textiles, anti-stain textiles, breathable textiles).

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Notes: This code is used for products where the primary material is PVC plastic combined with textile materials.

2. HS Code: 5903903090

- Description: Textile fabrics coated, impregnated, or laminated with plastics (e.g., PVC-coated waterproof textiles), not elsewhere specified.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Notes: This code is more general and applies to textile fabrics with plastic coatings, including PVC.

3. HS Code: 5903102010

- Description: Textile fabrics coated, impregnated, or laminated with plastics, specifically those containing polyvinyl chloride (PVC), intended for building use.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Notes: This code is specific to building or construction use, and may be more suitable if the product is intended for such applications.

📌 Key Tax Rate Changes (April 2, 2025)

- All codes listed above will have an additional 30.0% tariff applied after April 2, 2025.

- This is a time-sensitive policy, and importers should plan accordingly to avoid unexpected costs.

⚠️ Important Considerations

- Material Composition: Confirm whether the product is primarily PVC-based or textile-based with PVC coating. This will determine the correct HS code.

- End Use: If the product is for construction, 5903102010 may be more appropriate.

- Unit Price and Certification: Verify the material composition, unit price, and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Tariff Impact: The 30.0% additional tariff after April 2, 2025, could significantly increase the total cost. Consider tariff planning or alternative classifications if applicable.

✅ Proactive Advice

- Verify the exact product description and composition (e.g., is it a textile with PVC coating or a PVC film with textile backing?).

- Check the intended use (e.g., construction, general use, industrial) to determine the most accurate HS code.

- Review the latest customs regulations and consult with a customs broker or tax expert for accurate classification and compliance.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.