| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

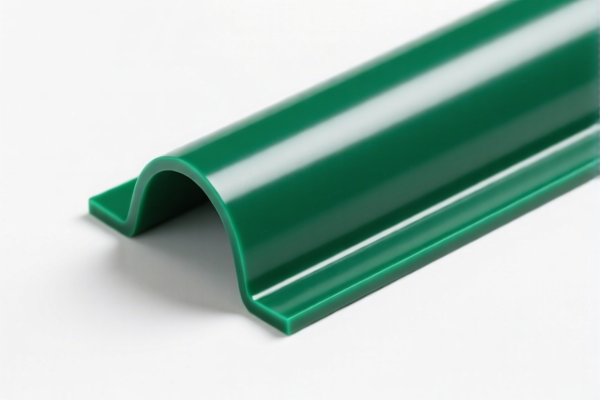

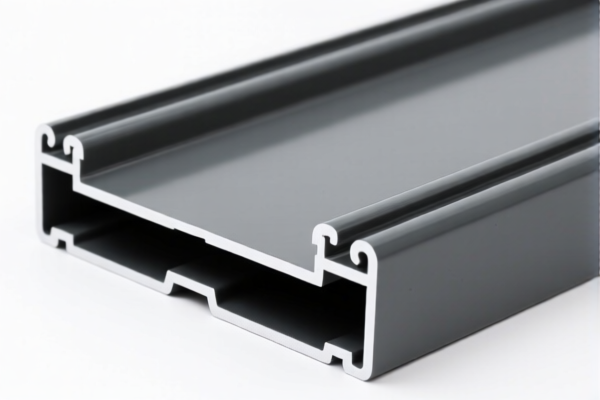

Product Name: PVC Coated Corrosion-Resistant Fabric

Classification HS Code Analysis:

- HS CODE 3921121100

- Description: PVC-coated corrosion-resistant fabric falls under HS code 3921, which is for plastic sheets, plates, and films.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is suitable for products primarily made of plastic, not textile-based.

-

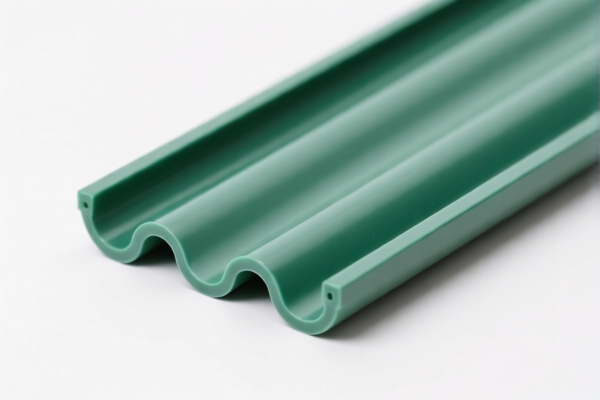

HS CODE 5903101800

- Description: PVC-coated polyester fiber corrosion-resistant fabric falls under HS code 5903101800, which is for textile fabrics coated with plastics (PVC).

- Total Tax Rate: 69.1%

- Tax Breakdown:

- Base Tariff: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification applies to textile-based products with PVC coating, but where the plastic weight is less than 60%.

-

HS CODE 5903101500 (Two Entries)

- Description: PVC-coated polyester fiber corrosion-resistant waterproof fabric and PVC-coated man-made fiber corrosion-resistant fabric both fall under HS code 5903101500. This code applies to textile fabrics coated with plastics (PVC) where the plastic weight exceeds 60%.

- Total Tax Rate: 37.5%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most favorable tax rate among the options, but only applicable if the plastic content exceeds 60% by weight.

-

HS CODE 3920435000

- Description: PVC-coated fabric falls under HS code 3920, which is for plastic sheets, plates, and films combined with other materials via lamination or similar methods.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is similar to 3921121100 and is not ideal for textile-based products.

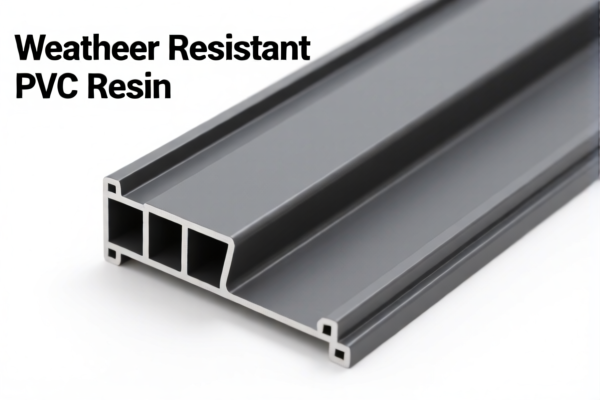

✅ Proactive Advice:

- Verify Material Composition: Confirm the exact composition and weight percentage of PVC in the product to determine the correct HS code.

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., safety, environmental, or industry-specific standards) for import.

- Monitor Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, which could significantly increase the total cost.

-

Consult Customs Authority: For high-value or complex products, it is recommended to consult with customs or a professional customs broker to ensure accurate classification and compliance. Product Name: PVC Coated Corrosion-Resistant Fabric

Classification HS Code Analysis: -

HS CODE 3921121100

- Description: PVC-coated corrosion-resistant fabric falls under HS code 3921, which is for plastic sheets, plates, and films.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is suitable for products primarily made of plastic, not textile-based.

-

HS CODE 5903101800

- Description: PVC-coated polyester fiber corrosion-resistant fabric falls under HS code 5903101800, which is for textile fabrics coated with plastics (PVC).

- Total Tax Rate: 69.1%

- Tax Breakdown:

- Base Tariff: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification applies to textile-based products with PVC coating, but where the plastic weight is less than 60%.

-

HS CODE 5903101500 (Two Entries)

- Description: PVC-coated polyester fiber corrosion-resistant waterproof fabric and PVC-coated man-made fiber corrosion-resistant fabric both fall under HS code 5903101500. This code applies to textile fabrics coated with plastics (PVC) where the plastic weight exceeds 60%.

- Total Tax Rate: 37.5%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most favorable tax rate among the options, but only applicable if the plastic content exceeds 60% by weight.

-

HS CODE 3920435000

- Description: PVC-coated fabric falls under HS code 3920, which is for plastic sheets, plates, and films combined with other materials via lamination or similar methods.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is similar to 3921121100 and is not ideal for textile-based products.

✅ Proactive Advice:

- Verify Material Composition: Confirm the exact composition and weight percentage of PVC in the product to determine the correct HS code.

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., safety, environmental, or industry-specific standards) for import.

- Monitor Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, which could significantly increase the total cost.

- Consult Customs Authority: For high-value or complex products, it is recommended to consult with customs or a professional customs broker to ensure accurate classification and compliance.

Customer Reviews

No reviews yet.