Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

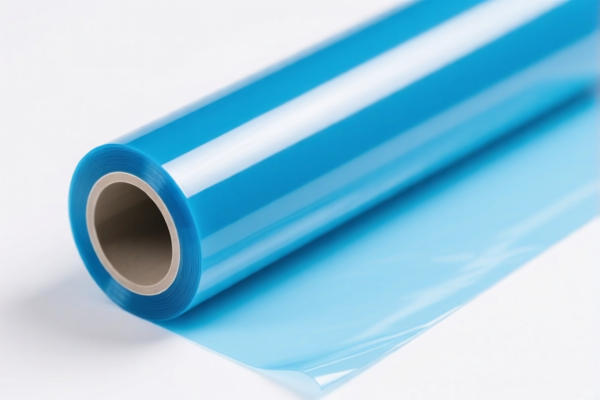

Product Name: PVC Coated Antistatic Packaging Film

Classification Analysis and Tax Information:

- HS CODE: 3921121500

- Description: PVC coated antistatic packaging film belongs to the category of plastic sheets, films, and plates. It is primarily composed of plastic, making classification under HS code 3921 appropriate.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This is the most likely classification for a PVC-coated antistatic film used for packaging, assuming it is a thin plastic film with a PVC coating.

- HS CODE: 3920435000

- Description: PVC antistatic film falls under plastic sheets, films, foils, and strips that contain plasticizers. This code applies if the film contains at least 6% plasticizers by weight.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is suitable if the product is a PVC film with added plasticizers for flexibility.

- HS CODE: 3920490000

- Description: This code covers other plastic films that do not fall under the more specific categories like 3920435000.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This is a catch-all category for PVC films that do not meet the specific criteria of other codes.

- HS CODE: 5903102010

- Description: This code applies to textile products that are impregnated, coated, or laminated with plastic, specifically PVC-coated textiles.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This is for PVC-coated fabric, not film. If your product is a fabric with PVC coating, this may be the correct code.

- HS CODE: 5903103000

- Description: This code covers textile products that are impregnated, coated, or laminated with plastic, specifically PVC-coated textiles that do not fall under the more specific category 5903102010.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This is for PVC-coated textiles that are not specifically listed under 5903102010.

✅ Proactive Advice:

- Verify the material composition (e.g., whether it is a film or fabric, and the percentage of PVC or plasticizers).

- Check the unit price and certifications required (e.g., antistatic certification, RoHS compliance, etc.).

- Confirm the product form (film vs. fabric) to ensure correct classification.

- Be aware of the April 11, 2025, special tariff which applies to all the above codes and may significantly increase the total tax burden.

Let me know if you need help with customs documentation or further classification clarification.

Product Name: PVC Coated Antistatic Packaging Film

Classification Analysis and Tax Information:

- HS CODE: 3921121500

- Description: PVC coated antistatic packaging film belongs to the category of plastic sheets, films, and plates. It is primarily composed of plastic, making classification under HS code 3921 appropriate.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This is the most likely classification for a PVC-coated antistatic film used for packaging, assuming it is a thin plastic film with a PVC coating.

- HS CODE: 3920435000

- Description: PVC antistatic film falls under plastic sheets, films, foils, and strips that contain plasticizers. This code applies if the film contains at least 6% plasticizers by weight.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is suitable if the product is a PVC film with added plasticizers for flexibility.

- HS CODE: 3920490000

- Description: This code covers other plastic films that do not fall under the more specific categories like 3920435000.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This is a catch-all category for PVC films that do not meet the specific criteria of other codes.

- HS CODE: 5903102010

- Description: This code applies to textile products that are impregnated, coated, or laminated with plastic, specifically PVC-coated textiles.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This is for PVC-coated fabric, not film. If your product is a fabric with PVC coating, this may be the correct code.

- HS CODE: 5903103000

- Description: This code covers textile products that are impregnated, coated, or laminated with plastic, specifically PVC-coated textiles that do not fall under the more specific category 5903102010.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This is for PVC-coated textiles that are not specifically listed under 5903102010.

✅ Proactive Advice:

- Verify the material composition (e.g., whether it is a film or fabric, and the percentage of PVC or plasticizers).

- Check the unit price and certifications required (e.g., antistatic certification, RoHS compliance, etc.).

- Confirm the product form (film vs. fabric) to ensure correct classification.

- Be aware of the April 11, 2025, special tariff which applies to all the above codes and may significantly increase the total tax burden.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.