| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

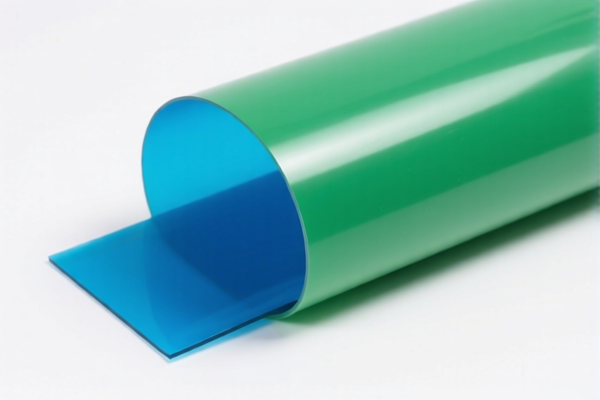

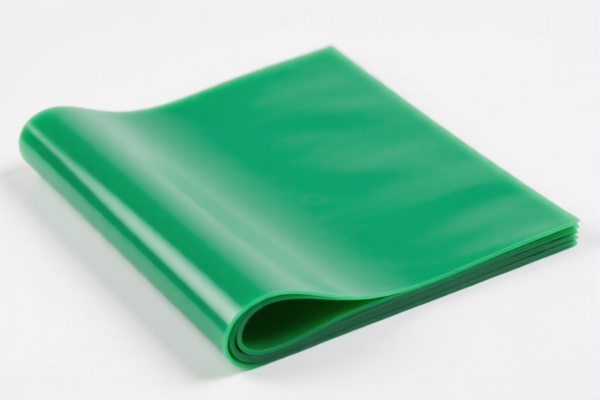

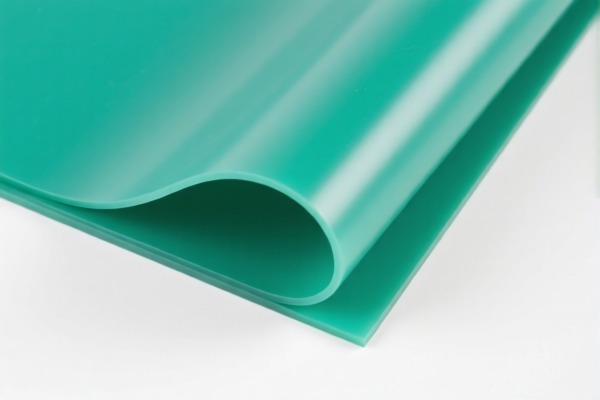

Product Name: PVC Coated Antistatic Fabric

Classification Analysis: Based on the provided HS codes and descriptions, the product can be classified under several HS codes depending on the specific composition and application. Below is a structured breakdown of the relevant HS codes and their associated tax rates:

✅ HS CODE: 5903103000

- Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those made with polyvinyl chloride (PVC), other categories.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a common classification for PVC-coated fabrics used in industrial or ESD (electrostatic discharge) applications.

✅ HS CODE: 3921121100

- Description: Plastic sheets, plates, films, foils and strips, of polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification is more suitable if the product is primarily a PVC film or sheet with minimal textile content.

✅ HS CODE: 5903102010

- Description: Textile products impregnated, coated, covered or laminated with plastics, specifically those made with polyvinyl chloride (PVC).

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a more specific classification for PVC-coated textiles, especially if the fabric is the primary component.

✅ HS CODE: 3921121500

- Description: Plastic sheets, plates, films, etc., made of chlor乙烯 polymer (PVC).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Similar to 3921121100, but may apply to different thicknesses or forms of PVC.

✅ HS CODE: 5903101500

- Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those made with polyvinyl chloride (PVC) and polyester fibers.

- Total Tax Rate: 37.5%

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is the most favorable tax rate if the fabric is made of polyester fibers coated with PVC.

📌 Key Considerations for Classification:

- Material Composition: The primary material (textile vs. plastic) and the percentage of PVC coating will determine the correct HS code.

- End Use: If the fabric is used for ESD protection, it may fall under a more specific category.

- Certifications: Ensure the product meets any required certifications (e.g., ESD standards, fire resistance).

- Unit Price: Verify the unit price and material breakdown to ensure accurate classification and tax calculation.

🚨 Important Alerts:

- April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after this date.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with the latest customs updates.

- Customs Declaration: Ensure the product description includes details on the base fabric (e.g., polyester), coating material (PVC), and intended use.

✅ Proactive Advice:

- Verify Material Composition: Confirm the fabric type (e.g., polyester, cotton) and PVC coating percentage.

- Check Certifications: Ensure compliance with ESD or industry-specific standards.

- Consult Customs Authority: For final confirmation, especially if the product is used in specialized applications.

Let me know if you need help with a specific customs declaration or tariff calculation.

Product Name: PVC Coated Antistatic Fabric

Classification Analysis: Based on the provided HS codes and descriptions, the product can be classified under several HS codes depending on the specific composition and application. Below is a structured breakdown of the relevant HS codes and their associated tax rates:

✅ HS CODE: 5903103000

- Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those made with polyvinyl chloride (PVC), other categories.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a common classification for PVC-coated fabrics used in industrial or ESD (electrostatic discharge) applications.

✅ HS CODE: 3921121100

- Description: Plastic sheets, plates, films, foils and strips, of polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification is more suitable if the product is primarily a PVC film or sheet with minimal textile content.

✅ HS CODE: 5903102010

- Description: Textile products impregnated, coated, covered or laminated with plastics, specifically those made with polyvinyl chloride (PVC).

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a more specific classification for PVC-coated textiles, especially if the fabric is the primary component.

✅ HS CODE: 3921121500

- Description: Plastic sheets, plates, films, etc., made of chlor乙烯 polymer (PVC).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Similar to 3921121100, but may apply to different thicknesses or forms of PVC.

✅ HS CODE: 5903101500

- Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those made with polyvinyl chloride (PVC) and polyester fibers.

- Total Tax Rate: 37.5%

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is the most favorable tax rate if the fabric is made of polyester fibers coated with PVC.

📌 Key Considerations for Classification:

- Material Composition: The primary material (textile vs. plastic) and the percentage of PVC coating will determine the correct HS code.

- End Use: If the fabric is used for ESD protection, it may fall under a more specific category.

- Certifications: Ensure the product meets any required certifications (e.g., ESD standards, fire resistance).

- Unit Price: Verify the unit price and material breakdown to ensure accurate classification and tax calculation.

🚨 Important Alerts:

- April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after this date.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with the latest customs updates.

- Customs Declaration: Ensure the product description includes details on the base fabric (e.g., polyester), coating material (PVC), and intended use.

✅ Proactive Advice:

- Verify Material Composition: Confirm the fabric type (e.g., polyester, cotton) and PVC coating percentage.

- Check Certifications: Ensure compliance with ESD or industry-specific standards.

- Consult Customs Authority: For final confirmation, especially if the product is used in specialized applications.

Let me know if you need help with a specific customs declaration or tariff calculation.

Customer Reviews

No reviews yet.