| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

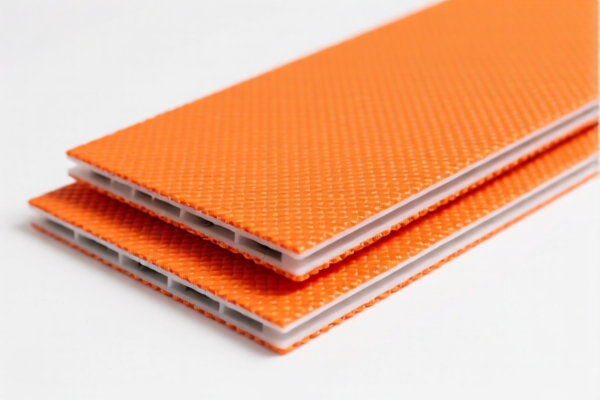

Product Name: PVC Coated Flame-Retardant Textile Products

Classification HS Code: Multiple options based on specific product details (see below)

🔍 HS Code Classification Overview

Below are the HS codes and associated tariff details for PVC-coated flame-retardant textile products. The classification depends on the specific composition and characteristics of the product.

📌 HS Code 3921.12.19.50

Description:

- PVC-coated flame-retardant textile products, classified under the category of plastic sheets, films, foils, and strips combined with textile materials.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 HS Code 3921.12.15.00

Description:

- PVC-coated flame-retardant textile boards, classified under other plastic sheets, films, foils, and strips made of polyvinyl chloride (PVC) combined with textile materials.

Tariff Details:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 HS Code 3921.12.19.10

Description:

- PVC-coated flame-retardant and anti-stain textile fabric, classified under plastic sheets, films, foils, and strips combined with textile materials that do not meet the vegetable fiber content requirements.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 HS Code 3921.12.11.00

Description:

- PVC-coated flame-retardant fabric, classified under chlorinated polyethylene-coated fabric combined with textile materials.

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes and Recommendations

- Time-Sensitive Policy:

-

A special tariff of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date if you wish to avoid the additional charge.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for this product category, but always verify with the latest customs updates.

-

Certifications Required:

-

Flame-retardant textiles may require fire safety certifications (e.g., GB/T 5455, EN 13501-1) depending on the end-use and destination country.

-

Material Verification:

-

Confirm the exact composition (e.g., percentage of PVC, textile fiber content, and additives) to ensure correct HS code classification.

-

Unit Price and Tax Calculation:

- Verify the unit price and total value of the goods, as customs may apply different tax rates based on the declared value and product classification.

✅ Proactive Advice

- Double-check the product composition (e.g., whether it contains vegetable fibers or not) to determine the correct HS code.

- Consult with customs or a qualified customs broker for the most up-to-date classification and tariff information.

- Keep documentation ready (e.g., material certificates, test reports, and product specifications) to support your classification and avoid delays in customs clearance.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: PVC Coated Flame-Retardant Textile Products

Classification HS Code: Multiple options based on specific product details (see below)

🔍 HS Code Classification Overview

Below are the HS codes and associated tariff details for PVC-coated flame-retardant textile products. The classification depends on the specific composition and characteristics of the product.

📌 HS Code 3921.12.19.50

Description:

- PVC-coated flame-retardant textile products, classified under the category of plastic sheets, films, foils, and strips combined with textile materials.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 HS Code 3921.12.15.00

Description:

- PVC-coated flame-retardant textile boards, classified under other plastic sheets, films, foils, and strips made of polyvinyl chloride (PVC) combined with textile materials.

Tariff Details:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 HS Code 3921.12.19.10

Description:

- PVC-coated flame-retardant and anti-stain textile fabric, classified under plastic sheets, films, foils, and strips combined with textile materials that do not meet the vegetable fiber content requirements.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 HS Code 3921.12.11.00

Description:

- PVC-coated flame-retardant fabric, classified under chlorinated polyethylene-coated fabric combined with textile materials.

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes and Recommendations

- Time-Sensitive Policy:

-

A special tariff of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date if you wish to avoid the additional charge.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for this product category, but always verify with the latest customs updates.

-

Certifications Required:

-

Flame-retardant textiles may require fire safety certifications (e.g., GB/T 5455, EN 13501-1) depending on the end-use and destination country.

-

Material Verification:

-

Confirm the exact composition (e.g., percentage of PVC, textile fiber content, and additives) to ensure correct HS code classification.

-

Unit Price and Tax Calculation:

- Verify the unit price and total value of the goods, as customs may apply different tax rates based on the declared value and product classification.

✅ Proactive Advice

- Double-check the product composition (e.g., whether it contains vegetable fibers or not) to determine the correct HS code.

- Consult with customs or a qualified customs broker for the most up-to-date classification and tariff information.

- Keep documentation ready (e.g., material certificates, test reports, and product specifications) to support your classification and avoid delays in customs clearance.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.