| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

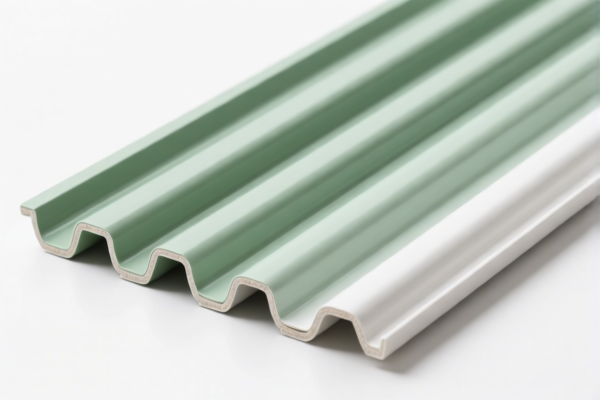

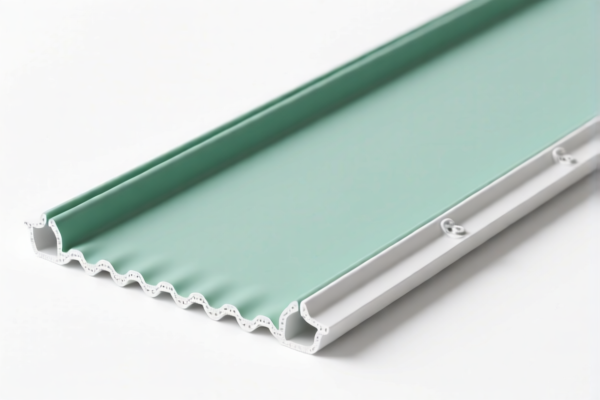

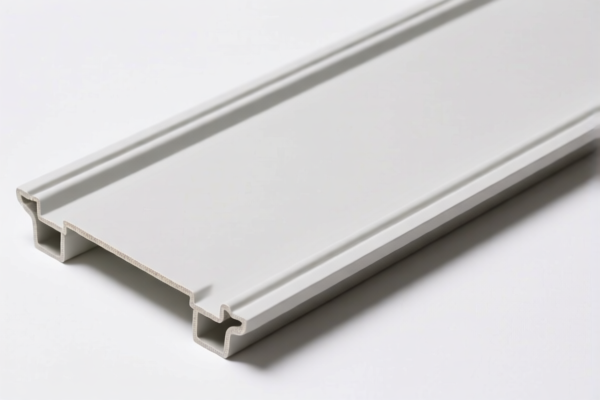

Product Name: PVC磨砂天花板板

Classification HS CODEs: Multiple options available based on product specifics. Below is a structured breakdown of the HS codes and associated tariffs:

✅ HS CODE: 3918105000

Description: PVC磨砂天花板板,用于天花板覆盖,主要材料为聚氯乙烯(PVC)。

Total Tax Rate: 59.2%

Tariff Details:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not related to PVC products)

Notes:

- This code is suitable for PVC磨砂天花板板 that are specifically used for ceiling coverings.

- Ensure the product is not classified under other HS codes (e.g., 3921.90.39) if it has different structural or functional characteristics.

✅ HS CODE: 3921125000

Description: PVC磨砂板,归类为聚氯乙烯聚合物制成的蜂窝状塑料板、片、薄膜、箔和条。

Total Tax Rate: 61.5%

Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Notes:

- This code is more suitable for PVC磨砂板 that are not specifically for ceiling or wall coverings, but rather for general plastic sheeting or panels.

- Confirm the product structure and intended use to avoid misclassification.

✅ HS CODE: 3918102000

Description: PVC天花板板,归类为塑料制的地毯、地板或墙面/天花板覆盖物,材料为聚氯乙烯。

Total Tax Rate: 60.3%

Tariff Details:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Notes:

- This code is suitable for PVC天花板板 that are used for ceiling or wall coverings.

- Ensure the product is not used for other purposes (e.g., flooring) that may fall under a different HS code.

✅ HS CODE: 3918901000

Description: PVC天花板板,归类为塑料制墙壁或天花板覆盖物,PVC属于塑料的一种。

Total Tax Rate: 60.3%

Tariff Details:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Notes:

- This code is suitable for PVC天花板板 that are not specifically described in other subheadings (e.g., 3918102000).

- Confirm the product description and specifications to ensure correct classification.

✅ HS CODE: 3918105000 (repeated)

Description: PVC磨砂墙面装饰板,归类为“其他”类别,用于墙面装饰。

Total Tax Rate: 59.2%

Tariff Details:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Notes:

- This code is suitable for PVC磨砂墙面装饰板 that are used for wall decoration.

- Ensure the product is not used for ceiling coverings, which may fall under a different HS code.

📌 Proactive Advice for Users:

- Verify the product's material and intended use (e.g., ceiling, wall, or general-purpose plastic sheeting) to determine the correct HS code.

- Check the unit price and product specifications to ensure compliance with customs regulations.

- Confirm if any certifications are required (e.g., fire resistance, environmental standards) for import into the destination country.

- Be aware of the April 11, 2025, special tariff and its impact on total import costs.

- Consult a customs broker or classification expert if the product has complex features or dual uses.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: PVC磨砂天花板板

Classification HS CODEs: Multiple options available based on product specifics. Below is a structured breakdown of the HS codes and associated tariffs:

✅ HS CODE: 3918105000

Description: PVC磨砂天花板板,用于天花板覆盖,主要材料为聚氯乙烯(PVC)。

Total Tax Rate: 59.2%

Tariff Details:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not related to PVC products)

Notes:

- This code is suitable for PVC磨砂天花板板 that are specifically used for ceiling coverings.

- Ensure the product is not classified under other HS codes (e.g., 3921.90.39) if it has different structural or functional characteristics.

✅ HS CODE: 3921125000

Description: PVC磨砂板,归类为聚氯乙烯聚合物制成的蜂窝状塑料板、片、薄膜、箔和条。

Total Tax Rate: 61.5%

Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Notes:

- This code is more suitable for PVC磨砂板 that are not specifically for ceiling or wall coverings, but rather for general plastic sheeting or panels.

- Confirm the product structure and intended use to avoid misclassification.

✅ HS CODE: 3918102000

Description: PVC天花板板,归类为塑料制的地毯、地板或墙面/天花板覆盖物,材料为聚氯乙烯。

Total Tax Rate: 60.3%

Tariff Details:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Notes:

- This code is suitable for PVC天花板板 that are used for ceiling or wall coverings.

- Ensure the product is not used for other purposes (e.g., flooring) that may fall under a different HS code.

✅ HS CODE: 3918901000

Description: PVC天花板板,归类为塑料制墙壁或天花板覆盖物,PVC属于塑料的一种。

Total Tax Rate: 60.3%

Tariff Details:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Notes:

- This code is suitable for PVC天花板板 that are not specifically described in other subheadings (e.g., 3918102000).

- Confirm the product description and specifications to ensure correct classification.

✅ HS CODE: 3918105000 (repeated)

Description: PVC磨砂墙面装饰板,归类为“其他”类别,用于墙面装饰。

Total Tax Rate: 59.2%

Tariff Details:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Notes:

- This code is suitable for PVC磨砂墙面装饰板 that are used for wall decoration.

- Ensure the product is not used for ceiling coverings, which may fall under a different HS code.

📌 Proactive Advice for Users:

- Verify the product's material and intended use (e.g., ceiling, wall, or general-purpose plastic sheeting) to determine the correct HS code.

- Check the unit price and product specifications to ensure compliance with customs regulations.

- Confirm if any certifications are required (e.g., fire resistance, environmental standards) for import into the destination country.

- Be aware of the April 11, 2025, special tariff and its impact on total import costs.

- Consult a customs broker or classification expert if the product has complex features or dual uses.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

该页面非常详细,但我觉得有点令人望而生畏。如果每个HS编码都有一个更清晰的布局部分,会更容易阅读。

我发现HS编码3918901000部分非常有信息量。它帮助我理解何时使用它而不是其他编码如3918102000。

主动建议部分非常有帮助。它提醒我在将产品归类到正确的HS编码之前,要先检查产品的用途和结构。

该页面有很多有用的信息,但重复的HS编码3918105000有点令人困惑。不过,关税细节是准确的。

HS编码3918102000的关税细节解释得很好。它让我更容易理解60.3%的税率及其分解方式。