| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

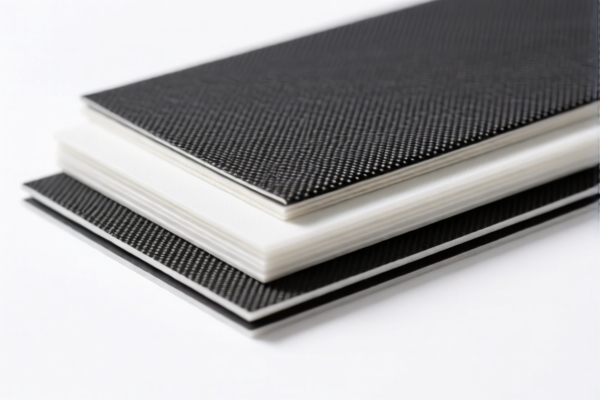

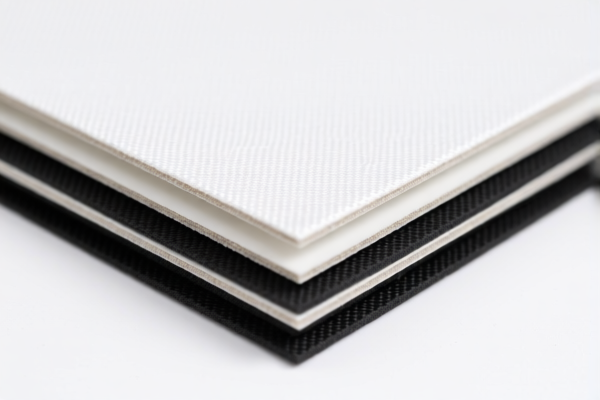

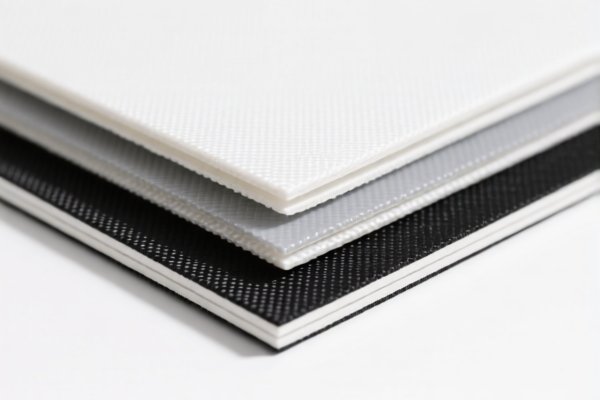

Product Name: PVC Textile Medical Bed Sheets

Classification HS Code: Multiple options based on composition and material weight ratio. Below is a structured breakdown of the HS codes and associated tariffs:

✅ HS CODE: 3921121500

Description: PVC textile medical bed sheets, made of polyvinyl chloride (PVC) polymer combined with textile materials.

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to products where PVC is combined with textile materials, but the plastic weight is not specified to be over 70%.

✅ HS CODE: 3921121910

Description: PVC textile composite medical bed sheets, where the textile material is primarily composed of vegetable fibers.

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for products where the textile component is mainly made of plant-based fibers.

✅ HS CODE: 3921121100

Description: PVC textile composite bed sheets, where the plastic (PVC) weight exceeds 70% of the total product.

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is the most favorable tax rate for products with a high PVC content.

✅ HS CODE: 3921121950

Description: PVC-coated medical textile products, classified under 3921.12.19.50, which includes plastic sheets, films, or foils combined with textile materials.

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for coated or laminated textile products with PVC as the base material.

📌 Important Notes and Recommendations:

- Material Composition: Confirm the exact composition (PVC percentage, type of textile fiber) to ensure correct HS code classification.

- Unit Price: Verify the unit price to determine if additional tariffs or anti-dumping duties apply.

- Certifications: Check if any certifications (e.g., medical device approvals, safety standards) are required for import.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. Plan your import schedule accordingly.

- Anti-Dumping Duties: While not explicitly mentioned here, ensure that your product is not subject to anti-dumping duties on iron or aluminum (if applicable).

🛠️ Proactive Advice:

- Consult a customs broker to confirm the most accurate HS code based on your product's exact specifications.

- Keep documentation on material composition, manufacturing process, and certifications ready for customs inspection.

- Monitor policy updates for any changes in tariff rates or classification rules after April 11, 2025.

Product Name: PVC Textile Medical Bed Sheets

Classification HS Code: Multiple options based on composition and material weight ratio. Below is a structured breakdown of the HS codes and associated tariffs:

✅ HS CODE: 3921121500

Description: PVC textile medical bed sheets, made of polyvinyl chloride (PVC) polymer combined with textile materials.

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to products where PVC is combined with textile materials, but the plastic weight is not specified to be over 70%.

✅ HS CODE: 3921121910

Description: PVC textile composite medical bed sheets, where the textile material is primarily composed of vegetable fibers.

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for products where the textile component is mainly made of plant-based fibers.

✅ HS CODE: 3921121100

Description: PVC textile composite bed sheets, where the plastic (PVC) weight exceeds 70% of the total product.

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is the most favorable tax rate for products with a high PVC content.

✅ HS CODE: 3921121950

Description: PVC-coated medical textile products, classified under 3921.12.19.50, which includes plastic sheets, films, or foils combined with textile materials.

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for coated or laminated textile products with PVC as the base material.

📌 Important Notes and Recommendations:

- Material Composition: Confirm the exact composition (PVC percentage, type of textile fiber) to ensure correct HS code classification.

- Unit Price: Verify the unit price to determine if additional tariffs or anti-dumping duties apply.

- Certifications: Check if any certifications (e.g., medical device approvals, safety standards) are required for import.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. Plan your import schedule accordingly.

- Anti-Dumping Duties: While not explicitly mentioned here, ensure that your product is not subject to anti-dumping duties on iron or aluminum (if applicable).

🛠️ Proactive Advice:

- Consult a customs broker to confirm the most accurate HS code based on your product's exact specifications.

- Keep documentation on material composition, manufacturing process, and certifications ready for customs inspection.

- Monitor policy updates for any changes in tariff rates or classification rules after April 11, 2025.

Customer Reviews

No reviews yet.