| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

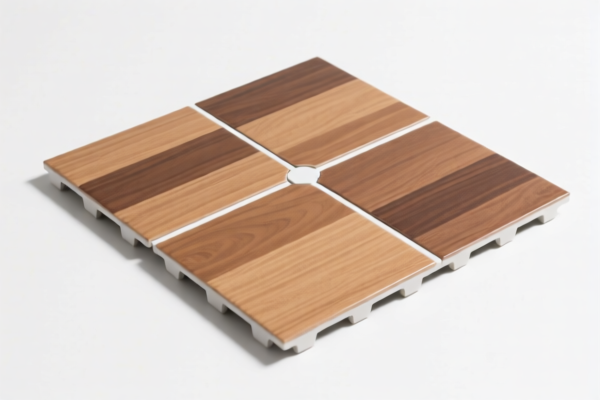

Product Name: PVC Textile Floor Mat

Classification: HS Code (Harmonized System Code) for PVC Textile Floor Mats

Below is the detailed classification and tariff information for the product based on the provided HS codes:

✅ HS CODE: 3921121910

Description: Other PVC textile floor mats

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This classification is for "other" types of PVC textile floor mats, not specifically for composite or specific materials.

✅ HS CODE: 3921121500

Description: PVC textile floor mats, classified under 3921

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is more specific than 3921121910 and may apply to certain types of PVC textile floor mats with defined characteristics.

✅ HS CODE: 3921121100

Description: PVC textile composite floor mats, classified under 3921

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This code applies to composite materials, possibly including both PVC and textile components.

✅ HS CODE: 3921125000

Description: PVC floor mats, classified under other plastic sheets, films, etc.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a broader category for PVC floor mats, not specifically textile-based.

✅ HS CODE: 3904400000

Description: PVC floor mats, classified under polyvinyl chloride or other halogenated ethylene polymers, in primary form

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies to raw or primary form PVC, not finished products like floor mats.

⚠️ Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: A 30% additional tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is a composite of PVC and textile, or purely PVC). This will determine the correct HS code.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that the total tax rate is applied to the CIF (Cost, Insurance, Freight) value, so the unit price and packaging method may affect the final tax amount.

📌 Proactive Advice:

- Consult a customs broker or a classification expert to confirm the most accurate HS code for your specific product.

- Keep documentation on the product's composition, manufacturing process, and intended use to support customs declarations.

- Monitor policy updates related to import tariffs, especially after April 11, 2025, as these could significantly impact your costs.

Product Name: PVC Textile Floor Mat

Classification: HS Code (Harmonized System Code) for PVC Textile Floor Mats

Below is the detailed classification and tariff information for the product based on the provided HS codes:

✅ HS CODE: 3921121910

Description: Other PVC textile floor mats

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This classification is for "other" types of PVC textile floor mats, not specifically for composite or specific materials.

✅ HS CODE: 3921121500

Description: PVC textile floor mats, classified under 3921

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is more specific than 3921121910 and may apply to certain types of PVC textile floor mats with defined characteristics.

✅ HS CODE: 3921121100

Description: PVC textile composite floor mats, classified under 3921

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This code applies to composite materials, possibly including both PVC and textile components.

✅ HS CODE: 3921125000

Description: PVC floor mats, classified under other plastic sheets, films, etc.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a broader category for PVC floor mats, not specifically textile-based.

✅ HS CODE: 3904400000

Description: PVC floor mats, classified under polyvinyl chloride or other halogenated ethylene polymers, in primary form

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies to raw or primary form PVC, not finished products like floor mats.

⚠️ Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: A 30% additional tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is a composite of PVC and textile, or purely PVC). This will determine the correct HS code.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that the total tax rate is applied to the CIF (Cost, Insurance, Freight) value, so the unit price and packaging method may affect the final tax amount.

📌 Proactive Advice:

- Consult a customs broker or a classification expert to confirm the most accurate HS code for your specific product.

- Keep documentation on the product's composition, manufacturing process, and intended use to support customs declarations.

- Monitor policy updates related to import tariffs, especially after April 11, 2025, as these could significantly impact your costs.

Customer Reviews

No reviews yet.