| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

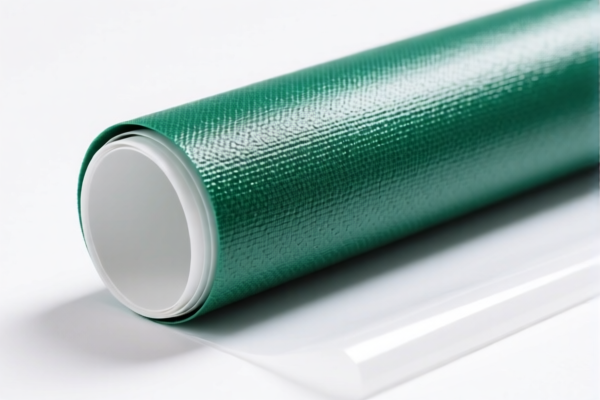

Product Classification: PVC Textile Furniture Fabrics

HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3921121500

- Description: PVC textile furniture fabric

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to "PVC textile furniture fabric" and may apply to general use in furniture.

-

HS CODE: 3921121950

- Description: PVC textile fabric for sofas, chairs, bedspreads, etc.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is used for various types of PVC textile fabrics used in furniture, including sofas, chairs, and bedspreads.

-

HS CODE: 5903101500

- Description: PVC-coated synthetic fiber furniture fabric

- Total Tax Rate: 37.5%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to PVC-coated synthetic fiber fabrics used in furniture.

-

HS CODE: 5903103000

- Description: PVC-coated furniture fabric

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general PVC-coated furniture fabric, not limited to specific furniture types.

Key Policy Notes:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category (PVC textile furniture fabric).

- Certifications: Ensure that the product meets relevant import standards and certifications (e.g., fire resistance, environmental compliance) depending on the destination country.

Proactive Advice:

- Verify Material Composition: Confirm whether the fabric is PVC-coated, PVC textile, or synthetic fiber-based, as this determines the correct HS code.

- Check Unit Price: The tax rate is calculated based on the unit price, so ensure accurate pricing for customs valuation.

- Review Certification Requirements: Some countries may require specific certifications (e.g., flame retardancy, eco-labels) for furniture fabrics.

-

Monitor Policy Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025. Product Classification: PVC Textile Furniture Fabrics

HS CODEs and Tax Details (as of current regulations): -

HS CODE: 3921121500

- Description: PVC textile furniture fabric

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to "PVC textile furniture fabric" and may apply to general use in furniture.

-

HS CODE: 3921121950

- Description: PVC textile fabric for sofas, chairs, bedspreads, etc.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is used for various types of PVC textile fabrics used in furniture, including sofas, chairs, and bedspreads.

-

HS CODE: 5903101500

- Description: PVC-coated synthetic fiber furniture fabric

- Total Tax Rate: 37.5%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to PVC-coated synthetic fiber fabrics used in furniture.

-

HS CODE: 5903103000

- Description: PVC-coated furniture fabric

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general PVC-coated furniture fabric, not limited to specific furniture types.

Key Policy Notes:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category (PVC textile furniture fabric).

- Certifications: Ensure that the product meets relevant import standards and certifications (e.g., fire resistance, environmental compliance) depending on the destination country.

Proactive Advice:

- Verify Material Composition: Confirm whether the fabric is PVC-coated, PVC textile, or synthetic fiber-based, as this determines the correct HS code.

- Check Unit Price: The tax rate is calculated based on the unit price, so ensure accurate pricing for customs valuation.

- Review Certification Requirements: Some countries may require specific certifications (e.g., flame retardancy, eco-labels) for furniture fabrics.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025.

Customer Reviews

No reviews yet.