| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

Product Classification and Tariff Analysis for PVC Textile Display Fabric

Based on the provided HS codes and tariff details

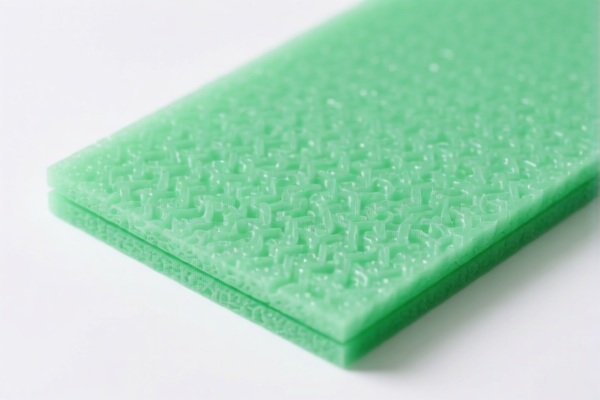

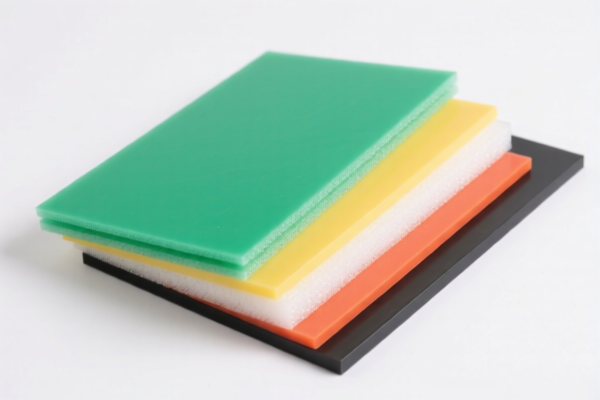

✅ HS CODE: 3921121950

Description:

- Applicable to PVC textile display fabric, where the product is a combination of PVC and textile materials, and does not meet the condition of plant fiber weight exceeding any single textile fiber.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

Notes: - This code is also used for PVC textile fabric used for gifts and decorations. - Ensure the product does not meet the criteria for plant fiber weight dominance (i.e., plant fiber weight must not exceed any single textile fiber).

✅ HS CODE: 3921121910

Description:

- Applicable to PVC textile decorative hanging fabric, classified under "other plastic sheets, plates, films, foils, and strips."

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

Notes: - This code is for PVC textile products that fall under the broader category of "other plastics." - Confirm the product is not classified under a more specific code (e.g., 3921121100).

✅ HS CODE: 5903103000

Description:

- Applicable to PVC-coated industrial fabric, which is a textile fabric that is impregnated, coated, covered, or laminated with plastic (PVC).

Tariff Breakdown:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 57.7%

Notes: - This code is for textile fabric with PVC coating, not for pure PVC film. - Ensure the product is not a pure PVC film (which would fall under 3921121100 or 3921121950).

✅ HS CODE: 3921121100

Description:

- Applicable to PVC-coated industrial fabric, classified under "plastic sheets, plates, films (coated fabric can be classified as film)."

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 59.2%

Notes: - This code is for PVC-coated fabric classified as a plastic film. - Ensure the product is not a textile fabric with PVC coating (which would fall under 5903103000).

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is a textile fabric with PVC coating or a PVC film with textile components.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., environmental, safety, or textile-related).

- Confirm HS Code Accuracy: Use the most specific HS code available to avoid overpayment or classification errors.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all the above codes, so plan accordingly for cost estimation and compliance.

Let me know if you need help determining the correct HS code based on product specifications or documentation.

Product Classification and Tariff Analysis for PVC Textile Display Fabric

Based on the provided HS codes and tariff details

✅ HS CODE: 3921121950

Description:

- Applicable to PVC textile display fabric, where the product is a combination of PVC and textile materials, and does not meet the condition of plant fiber weight exceeding any single textile fiber.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

Notes: - This code is also used for PVC textile fabric used for gifts and decorations. - Ensure the product does not meet the criteria for plant fiber weight dominance (i.e., plant fiber weight must not exceed any single textile fiber).

✅ HS CODE: 3921121910

Description:

- Applicable to PVC textile decorative hanging fabric, classified under "other plastic sheets, plates, films, foils, and strips."

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

Notes: - This code is for PVC textile products that fall under the broader category of "other plastics." - Confirm the product is not classified under a more specific code (e.g., 3921121100).

✅ HS CODE: 5903103000

Description:

- Applicable to PVC-coated industrial fabric, which is a textile fabric that is impregnated, coated, covered, or laminated with plastic (PVC).

Tariff Breakdown:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 57.7%

Notes: - This code is for textile fabric with PVC coating, not for pure PVC film. - Ensure the product is not a pure PVC film (which would fall under 3921121100 or 3921121950).

✅ HS CODE: 3921121100

Description:

- Applicable to PVC-coated industrial fabric, classified under "plastic sheets, plates, films (coated fabric can be classified as film)."

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 59.2%

Notes: - This code is for PVC-coated fabric classified as a plastic film. - Ensure the product is not a textile fabric with PVC coating (which would fall under 5903103000).

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is a textile fabric with PVC coating or a PVC film with textile components.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., environmental, safety, or textile-related).

- Confirm HS Code Accuracy: Use the most specific HS code available to avoid overpayment or classification errors.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all the above codes, so plan accordingly for cost estimation and compliance.

Let me know if you need help determining the correct HS code based on product specifications or documentation.

Customer Reviews

No reviews yet.