Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926905700 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926905900 | Doc | 57.4% | CN | US | 2025-05-12 |

| 4010394500 | Doc | 61.4% | CN | US | 2025-05-12 |

| 3926906090 | Doc | 59.2% | CN | US | 2025-05-12 |

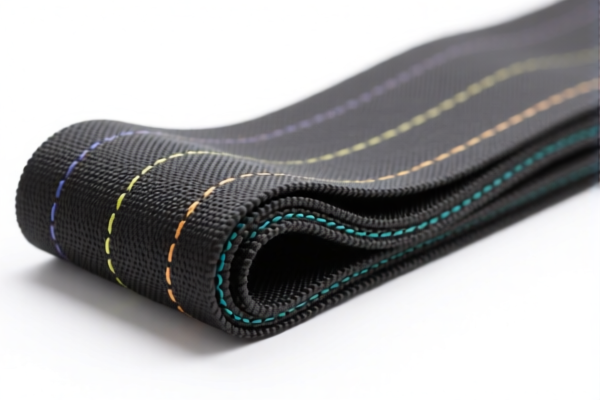

Product Classification: PVC Textile Industrial Conveyor Belt

HS CODE: 3926905700 (Primary Classification)

🔍 Classification Summary:

- HS CODE: 3926905700

- Description: Conveyor belts and belts for machinery containing textile fibers — other — other

- Material: PVC (Polyvinyl Chloride) combined with textile fibers

- Application: Industrial conveyor belts used in textile or manufacturing processes

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 2.4%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 57.4%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation.

- Anti-dumping duties: Not applicable for this product category.

- Other HS CODEs for reference:

- 3921121500: PVC combined with textile fibers (if the product is more film-like or sheet-like)

- 4010394500: Rubber conveyor belts (not applicable if PVC is the main material)

- 3926906090: Other types of mechanical belts (if the product doesn't fit the above description)

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is primarily PVC with textile fibers and not rubber or other materials.

- Check Unit Price and Quantity: Tariff rates can vary based on the value and quantity of the goods.

- Certifications Required: Confirm if any certifications (e.g., CE, RoHS, or industry-specific) are needed for import compliance.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product is borderline between multiple HS codes.

📌 Action Required:

- Before April 11, 2025: Consider importing or planning shipments to avoid the 30% additional tariff.

- After April 11, 2025: Be prepared for higher costs and ensure all documentation is in order to avoid delays.

Let me know if you need help with customs documentation or further classification clarification.

Product Classification: PVC Textile Industrial Conveyor Belt

HS CODE: 3926905700 (Primary Classification)

🔍 Classification Summary:

- HS CODE: 3926905700

- Description: Conveyor belts and belts for machinery containing textile fibers — other — other

- Material: PVC (Polyvinyl Chloride) combined with textile fibers

- Application: Industrial conveyor belts used in textile or manufacturing processes

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 2.4%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 57.4%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation.

- Anti-dumping duties: Not applicable for this product category.

- Other HS CODEs for reference:

- 3921121500: PVC combined with textile fibers (if the product is more film-like or sheet-like)

- 4010394500: Rubber conveyor belts (not applicable if PVC is the main material)

- 3926906090: Other types of mechanical belts (if the product doesn't fit the above description)

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is primarily PVC with textile fibers and not rubber or other materials.

- Check Unit Price and Quantity: Tariff rates can vary based on the value and quantity of the goods.

- Certifications Required: Confirm if any certifications (e.g., CE, RoHS, or industry-specific) are needed for import compliance.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product is borderline between multiple HS codes.

📌 Action Required:

- Before April 11, 2025: Consider importing or planning shipments to avoid the 30% additional tariff.

- After April 11, 2025: Be prepared for higher costs and ensure all documentation is in order to avoid delays.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.