| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5907006000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

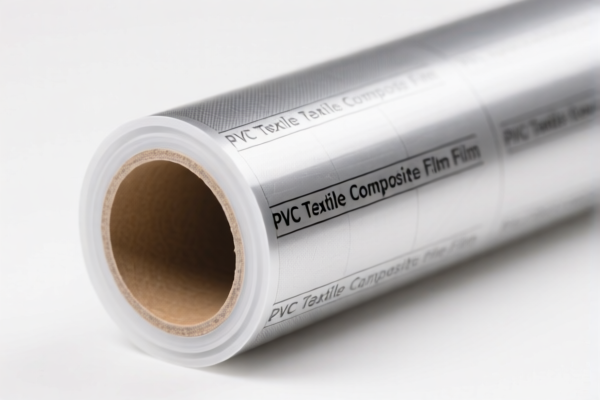

Product Classification: PVC Textile Advertising Banners

HS CODEs and Tax Details (as of April 2025):

✅ HS CODE: 3921121950

Description: PVC textile advertising banners, classified under other plastic sheets, films, foils, and strips, not limited by textile content or fiber type.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This classification is suitable for banners where the PVC is the primary material and textile components are not specifically defined.

✅ HS CODE: 3921121500

Description: PVC textile advertising banners made from polyvinyl chloride (PVC) plastic sheets combined with textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code applies when the product is a combination of PVC and textile materials.

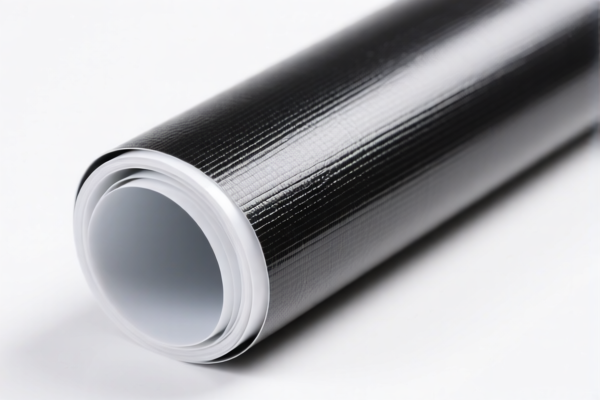

✅ HS CODE: 5903103000

Description: PVC-coated advertising banner fabric, classified under textile fabrics coated with plastic (PVC), other categories.

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Notes: This is a lower tax rate compared to the 3921 series, suitable for fabric that is coated with PVC.

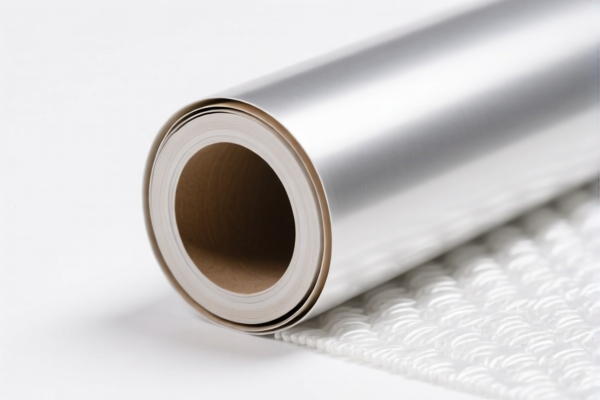

✅ HS CODE: 5907006000

Description: Coated textile advertising banners, other coated, impregnated, or covered textile fabrics made of man-made fibers.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This is the lowest total tax rate among the options, ideal for man-made fiber-based coated banners.

✅ HS CODE: 5903102500

Description: PVC-coated man-made fiber advertising banner fabric, classified under textile fabrics coated with plastic (PVC), made of man-made fibers.

- Base Tariff Rate: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.5%

- Notes: This code applies specifically to man-made fiber-based PVC-coated banners and has the highest total tax rate.

📌 Key Considerations for Customs Compliance:

- Material Composition: Confirm whether the product is primarily PVC, textile, or a combination. This will determine the correct HS code.

- Unit Price: The tax rate may vary depending on the declared value and whether the product is subject to additional tariffs.

- Certifications: Ensure that the product meets any required certifications (e.g., safety, environmental standards) for import.

- April 11, 2025 Policy: Be aware of the additional 30% tariff imposed after this date, which applies to all the above HS codes.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with the latest customs updates.

🛑 Proactive Advice:

- Verify the exact composition of the product (e.g., percentage of PVC vs. textile).

- Check the unit price to determine if the product falls under any preferential tariff schemes.

- Consult with customs brokers or import experts to ensure accurate classification and compliance.

- Keep documentation such as material certificates, product specifications, and invoices ready for customs inspection.

Product Classification: PVC Textile Advertising Banners

HS CODEs and Tax Details (as of April 2025):

✅ HS CODE: 3921121950

Description: PVC textile advertising banners, classified under other plastic sheets, films, foils, and strips, not limited by textile content or fiber type.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This classification is suitable for banners where the PVC is the primary material and textile components are not specifically defined.

✅ HS CODE: 3921121500

Description: PVC textile advertising banners made from polyvinyl chloride (PVC) plastic sheets combined with textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code applies when the product is a combination of PVC and textile materials.

✅ HS CODE: 5903103000

Description: PVC-coated advertising banner fabric, classified under textile fabrics coated with plastic (PVC), other categories.

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Notes: This is a lower tax rate compared to the 3921 series, suitable for fabric that is coated with PVC.

✅ HS CODE: 5907006000

Description: Coated textile advertising banners, other coated, impregnated, or covered textile fabrics made of man-made fibers.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This is the lowest total tax rate among the options, ideal for man-made fiber-based coated banners.

✅ HS CODE: 5903102500

Description: PVC-coated man-made fiber advertising banner fabric, classified under textile fabrics coated with plastic (PVC), made of man-made fibers.

- Base Tariff Rate: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.5%

- Notes: This code applies specifically to man-made fiber-based PVC-coated banners and has the highest total tax rate.

📌 Key Considerations for Customs Compliance:

- Material Composition: Confirm whether the product is primarily PVC, textile, or a combination. This will determine the correct HS code.

- Unit Price: The tax rate may vary depending on the declared value and whether the product is subject to additional tariffs.

- Certifications: Ensure that the product meets any required certifications (e.g., safety, environmental standards) for import.

- April 11, 2025 Policy: Be aware of the additional 30% tariff imposed after this date, which applies to all the above HS codes.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with the latest customs updates.

🛑 Proactive Advice:

- Verify the exact composition of the product (e.g., percentage of PVC vs. textile).

- Check the unit price to determine if the product falls under any preferential tariff schemes.

- Consult with customs brokers or import experts to ensure accurate classification and compliance.

- Keep documentation such as material certificates, product specifications, and invoices ready for customs inspection.

Customer Reviews

No reviews yet.