| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4202190000 | Doc | 75.0% | CN | US | 2025-05-12 |

| 4202924500 | Doc | 75.0% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926206000 | Doc | 55.0% | CN | US | 2025-05-12 |

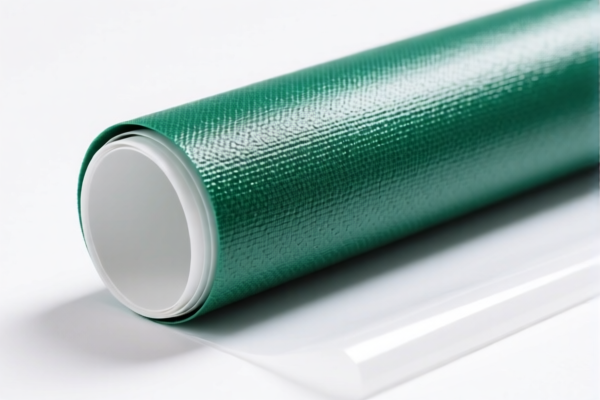

Product Classification and Tariff Analysis for "PVC Textile Travel Luggage"

Below is a structured breakdown of the HS codes and associated tariffs for the product "PVC纺织品旅行箱包" (PVC textile travel luggage), based on the provided data:

✅ HS CODE: 3921121500

Description:

- PVC textile travel luggage classified under HS code 3921, which covers plastic products combined with textile materials (e.g., PVC + fabric).

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This classification is suitable if the product is a composite of PVC and textile materials.

- Ensure the product is not purely plastic (e.g., no fabric component) to avoid misclassification.

✅ HS CODE: 4202190000

Description:

- PVC travel luggage classified under HS code 4202, which covers travel bags made of plastic (PVC is a type of plastic).

Tariff Summary:

- Base Tariff: 20.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 75.0%

Key Notes:

- This code is for general plastic travel bags.

- If the product has a textile component, this may not be the correct classification.

✅ HS CODE: 4202924500

Description:

- PVC travel luggage classified under HS code 4202924500, which covers travel bags with an outer surface made of plastic sheeting (PVC is a type of plastic).

Tariff Summary:

- Base Tariff: 20.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 75.0%

Key Notes:

- This code is more specific than 4202190000 and may apply if the product has a defined structure or design.

- Confirm the product's construction (e.g., sheeting, panels) to ensure correct classification.

✅ HS CODE: 3921121100

Description:

- PVC textile composite handbag classified under HS code 3921, which covers plastic products combined with textile materials (e.g., PVC + fabric).

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 59.2%

Key Notes:

- This code is for handbags or similar items, not travel luggage.

- If the product is a handbag, this may be the correct classification.

✅ HS CODE: 3926206000

Description:

- PVC travel coat classified under HS code 3926206000, which covers rainwear made of polyvinyl chloride (PVC), such as jackets, coats, and raincoats.

Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Key Notes:

- This code is for clothing items, not travel luggage.

- If the product is a raincoat or similar, this may be the correct classification.

📌 Proactive Advice for Users:

- Verify Material Composition:

-

Confirm whether the product is made of PVC alone, PVC + textile, or other materials. This will determine the correct HS code.

-

Check Product Type:

-

Is it a handbag, travel bag, raincoat, or something else? This will help in selecting the right HS code.

-

Review Unit Price and Certification:

-

Some HS codes may require specific certifications (e.g., textile content, plastic composition). Ensure compliance with customs documentation.

-

Be Aware of Tariff Changes:

-

Additional tariffs of 25% and 30% (after April 11, 2025) apply to all the above HS codes. This may significantly increase the total cost.

-

Consult a Customs Expert:

- For complex or high-value shipments, consider consulting a customs broker or compliance expert to avoid misclassification and penalties.

Let me know if you need help selecting the most appropriate HS code for your specific product. Product Classification and Tariff Analysis for "PVC Textile Travel Luggage"

Below is a structured breakdown of the HS codes and associated tariffs for the product "PVC纺织品旅行箱包" (PVC textile travel luggage), based on the provided data:

✅ HS CODE: 3921121500

Description:

- PVC textile travel luggage classified under HS code 3921, which covers plastic products combined with textile materials (e.g., PVC + fabric).

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This classification is suitable if the product is a composite of PVC and textile materials.

- Ensure the product is not purely plastic (e.g., no fabric component) to avoid misclassification.

✅ HS CODE: 4202190000

Description:

- PVC travel luggage classified under HS code 4202, which covers travel bags made of plastic (PVC is a type of plastic).

Tariff Summary:

- Base Tariff: 20.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 75.0%

Key Notes:

- This code is for general plastic travel bags.

- If the product has a textile component, this may not be the correct classification.

✅ HS CODE: 4202924500

Description:

- PVC travel luggage classified under HS code 4202924500, which covers travel bags with an outer surface made of plastic sheeting (PVC is a type of plastic).

Tariff Summary:

- Base Tariff: 20.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 75.0%

Key Notes:

- This code is more specific than 4202190000 and may apply if the product has a defined structure or design.

- Confirm the product's construction (e.g., sheeting, panels) to ensure correct classification.

✅ HS CODE: 3921121100

Description:

- PVC textile composite handbag classified under HS code 3921, which covers plastic products combined with textile materials (e.g., PVC + fabric).

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 59.2%

Key Notes:

- This code is for handbags or similar items, not travel luggage.

- If the product is a handbag, this may be the correct classification.

✅ HS CODE: 3926206000

Description:

- PVC travel coat classified under HS code 3926206000, which covers rainwear made of polyvinyl chloride (PVC), such as jackets, coats, and raincoats.

Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Key Notes:

- This code is for clothing items, not travel luggage.

- If the product is a raincoat or similar, this may be the correct classification.

📌 Proactive Advice for Users:

- Verify Material Composition:

-

Confirm whether the product is made of PVC alone, PVC + textile, or other materials. This will determine the correct HS code.

-

Check Product Type:

-

Is it a handbag, travel bag, raincoat, or something else? This will help in selecting the right HS code.

-

Review Unit Price and Certification:

-

Some HS codes may require specific certifications (e.g., textile content, plastic composition). Ensure compliance with customs documentation.

-

Be Aware of Tariff Changes:

-

Additional tariffs of 25% and 30% (after April 11, 2025) apply to all the above HS codes. This may significantly increase the total cost.

-

Consult a Customs Expert:

- For complex or high-value shipments, consider consulting a customs broker or compliance expert to avoid misclassification and penalties.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.