Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

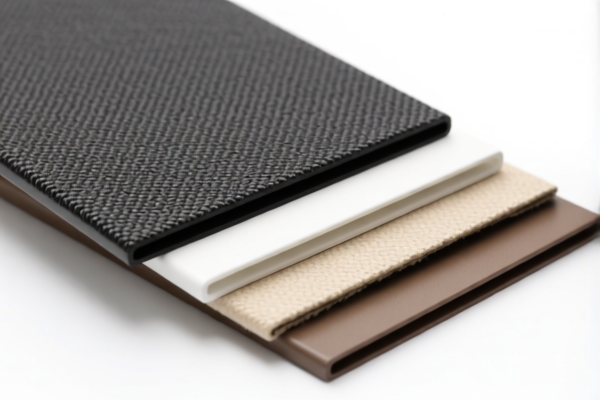

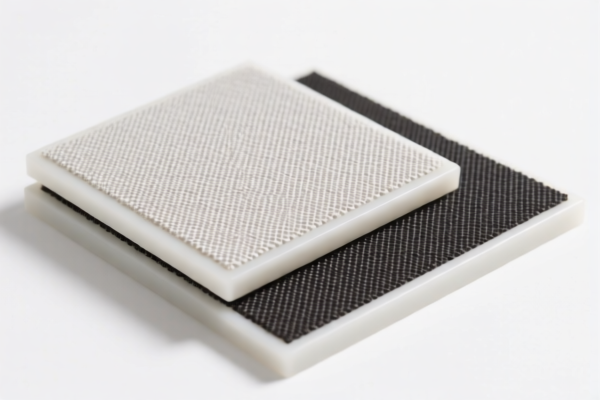

Product Name: PVC Textile Tablecloth

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for PVC textile tablecloths, based on the provided data:

✅ HS CODE: 3921121500

- Description: PVC textile tablecloth, which is classified under HS Code 3921. PVC is a plastic material combined with textile materials. The classification aligns with the description that the textile component is made of synthetic fibers, and the weight of synthetic fibers exceeds that of any single natural fiber.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is primarily composed of synthetic fibers and is considered a textile product.

✅ HS CODE: 3921121950

- Description: PVC textile table flag, which fits the description of HS Code 3921.12.19.50. PVC corresponds to polyvinyl chloride (PVC) polymer, and the textile component is combined with the plastic. However, it does not clearly indicate that the plant fiber weight exceeds any single textile fiber.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is a textile item with PVC but does not meet the criteria for synthetic fiber dominance.

✅ HS CODE: 3920435000

- Description: PVC tablecloth, which fits the description of HS Code 3920. PVC is a chlorinated vinyl polymer, and the tablecloth is classified as a plastic sheet, film, or foil. It typically contains at least 6% plasticizer to increase flexibility.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is primarily a plastic film or sheet with added plasticizer.

✅ HS CODE: 3920490000

- Description: PVC tablecloth, which fits the description of HS Code 3920.49.00.00. PVC is a polyvinyl chloride polymer, and the tablecloth is classified as a non-cellular, non-reinforced plastic sheet, film, foil, or strip. It may be laminated or combined with other materials.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is a non-cellular, non-reinforced plastic sheet or film.

✅ HS CODE: 3904220000

- Description: PVC tablecloth, which fits the description of HS Code 3904. PVC is a halogenated ethylene polymer, and the tablecloth is classified as a plastic product. Therefore, it is reasonable to classify it under HS Code 3904.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is primarily a plastic product and not classified under textile or film categories.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact composition of the product (e.g., percentage of PVC, type of textile fibers used).

- Check Unit Price: The tariff rate may vary depending on the declared value and classification.

- Certifications Required: Ensure that the product meets any required certifications (e.g., safety, environmental compliance).

- Tariff Changes After April 11, 2025: Be aware of the additional 30% tariff that will apply after this date for all the above HS codes.

Let me know if you need help with customs documentation or classification confirmation.

Product Name: PVC Textile Tablecloth

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for PVC textile tablecloths, based on the provided data:

✅ HS CODE: 3921121500

- Description: PVC textile tablecloth, which is classified under HS Code 3921. PVC is a plastic material combined with textile materials. The classification aligns with the description that the textile component is made of synthetic fibers, and the weight of synthetic fibers exceeds that of any single natural fiber.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is primarily composed of synthetic fibers and is considered a textile product.

✅ HS CODE: 3921121950

- Description: PVC textile table flag, which fits the description of HS Code 3921.12.19.50. PVC corresponds to polyvinyl chloride (PVC) polymer, and the textile component is combined with the plastic. However, it does not clearly indicate that the plant fiber weight exceeds any single textile fiber.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is a textile item with PVC but does not meet the criteria for synthetic fiber dominance.

✅ HS CODE: 3920435000

- Description: PVC tablecloth, which fits the description of HS Code 3920. PVC is a chlorinated vinyl polymer, and the tablecloth is classified as a plastic sheet, film, or foil. It typically contains at least 6% plasticizer to increase flexibility.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is primarily a plastic film or sheet with added plasticizer.

✅ HS CODE: 3920490000

- Description: PVC tablecloth, which fits the description of HS Code 3920.49.00.00. PVC is a polyvinyl chloride polymer, and the tablecloth is classified as a non-cellular, non-reinforced plastic sheet, film, foil, or strip. It may be laminated or combined with other materials.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is a non-cellular, non-reinforced plastic sheet or film.

✅ HS CODE: 3904220000

- Description: PVC tablecloth, which fits the description of HS Code 3904. PVC is a halogenated ethylene polymer, and the tablecloth is classified as a plastic product. Therefore, it is reasonable to classify it under HS Code 3904.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is primarily a plastic product and not classified under textile or film categories.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact composition of the product (e.g., percentage of PVC, type of textile fibers used).

- Check Unit Price: The tariff rate may vary depending on the declared value and classification.

- Certifications Required: Ensure that the product meets any required certifications (e.g., safety, environmental compliance).

- Tariff Changes After April 11, 2025: Be aware of the additional 30% tariff that will apply after this date for all the above HS codes.

Let me know if you need help with customs documentation or classification confirmation.

Customer Reviews

No reviews yet.