Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

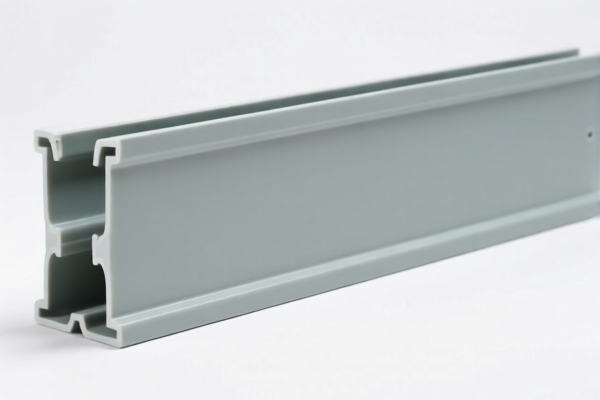

Product Classification: PVC Textile Automotive Door Panels

HS CODE: 3921121500

🔍 Classification Explanation

- The product is classified under HS CODE 3921121500, which falls under the category of "Plastics and articles thereof".

- This code specifically applies to PVC (polyvinyl chloride) products combined with textile materials, such as automotive door panels.

- The product is a composite material made of PVC and textile components, used in automotive interior parts.

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs.

📌 Key Considerations

- Material Composition: Confirm that the product is PVC combined with textile materials. If the textile content is minimal or not combined, the classification may change.

- Unit Price: Verify the unit price and material breakdown to ensure correct classification and tariff calculation.

- Certifications: Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country.

- Product Use: Ensure the product is intended for automotive use (e.g., door panels, seat covers, etc.), as this may affect classification.

✅ Proactive Advice

- Double-check the product composition (PVC + textile) to confirm it falls under HS CODE 3921121500.

- Review the exact product description and technical specifications to avoid misclassification.

- Plan customs clearance before April 11, 2025, to avoid the 30.0% additional tariff.

- Consult with a customs broker or trade compliance expert if the product is part of a larger kit or bundle.

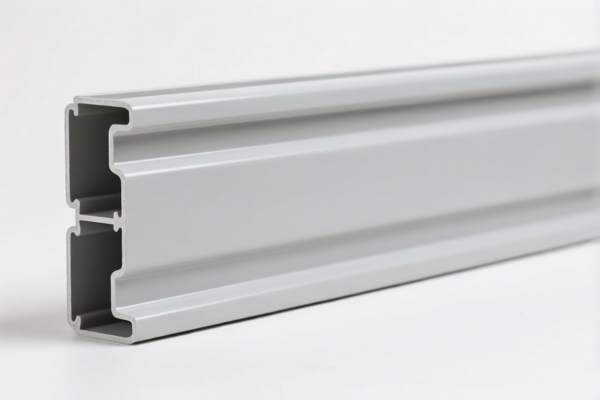

Product Classification: PVC Textile Automotive Door Panels

HS CODE: 3921121500

🔍 Classification Explanation

- The product is classified under HS CODE 3921121500, which falls under the category of "Plastics and articles thereof".

- This code specifically applies to PVC (polyvinyl chloride) products combined with textile materials, such as automotive door panels.

- The product is a composite material made of PVC and textile components, used in automotive interior parts.

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs.

📌 Key Considerations

- Material Composition: Confirm that the product is PVC combined with textile materials. If the textile content is minimal or not combined, the classification may change.

- Unit Price: Verify the unit price and material breakdown to ensure correct classification and tariff calculation.

- Certifications: Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country.

- Product Use: Ensure the product is intended for automotive use (e.g., door panels, seat covers, etc.), as this may affect classification.

✅ Proactive Advice

- Double-check the product composition (PVC + textile) to confirm it falls under HS CODE 3921121500.

- Review the exact product description and technical specifications to avoid misclassification.

- Plan customs clearance before April 11, 2025, to avoid the 30.0% additional tariff.

- Consult with a customs broker or trade compliance expert if the product is part of a larger kit or bundle.

Customer Reviews

No reviews yet.