| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

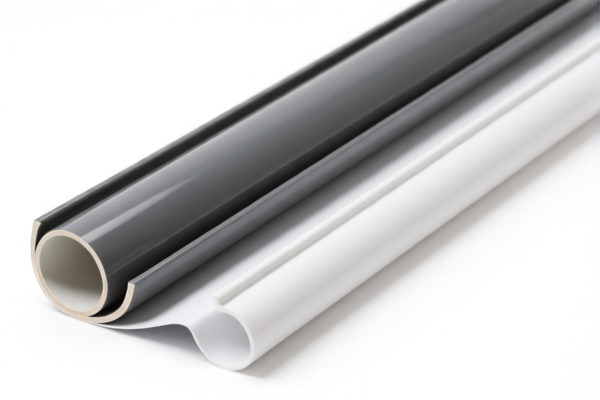

Product Name: PVC Textile Sofa Covers

Classification HS CODE: 3921.12.15.00, 3921.12.19.10, 3921.12.19.50

✅ HS CODE Classification Summary:

- 3921.12.15.00

- Description: PVC textile sofa covers, classified under Chapter 39 (Plastics and articles thereof), heading 3921 (Plastic plates, sheets, film, foil and strips, of plastics and articles thereof), and subheading 3921.12.15.00 (Chlorinated polyethylene, etc., combined with textile materials).

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3921.12.19.10

- Description: PVC textile sofa pads, classified under the same heading but with a different subheading.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3921.12.19.50

- Description: PVC textile sofa fabric, classified under the same heading but with a different subheading.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all products classified under these HS codes after April 11, 2025.

-

This is a time-sensitive policy and must be considered in cost planning and customs clearance.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for this product category. However, it is recommended to verify if any anti-dumping or countervailing duties apply based on the country of origin and product composition.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure that the product is indeed a combination of PVC (plastic) and textile materials, as this is the key factor for classification under HS code 3921.12.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Review Tariff Impact: Calculate the total import cost including the base, additional, and special tariffs to avoid unexpected expenses.

- Consult Customs Broker: For complex cases, especially if the product is a customized or hybrid item, consult a customs broker or compliance expert for accurate classification.

📊 Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921.12.15.00 | PVC Textile Sofa Covers | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921.12.19.10 | PVC Textile Sofa Pads | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921.12.19.50 | PVC Textile Sofa Fabric | 5.3% | 25.0% | 30.0% | 60.3% |

If you need further assistance with customs documentation, tariff calculation, or product classification, feel free to ask.

Product Name: PVC Textile Sofa Covers

Classification HS CODE: 3921.12.15.00, 3921.12.19.10, 3921.12.19.50

✅ HS CODE Classification Summary:

- 3921.12.15.00

- Description: PVC textile sofa covers, classified under Chapter 39 (Plastics and articles thereof), heading 3921 (Plastic plates, sheets, film, foil and strips, of plastics and articles thereof), and subheading 3921.12.15.00 (Chlorinated polyethylene, etc., combined with textile materials).

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3921.12.19.10

- Description: PVC textile sofa pads, classified under the same heading but with a different subheading.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3921.12.19.50

- Description: PVC textile sofa fabric, classified under the same heading but with a different subheading.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all products classified under these HS codes after April 11, 2025.

-

This is a time-sensitive policy and must be considered in cost planning and customs clearance.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for this product category. However, it is recommended to verify if any anti-dumping or countervailing duties apply based on the country of origin and product composition.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure that the product is indeed a combination of PVC (plastic) and textile materials, as this is the key factor for classification under HS code 3921.12.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Review Tariff Impact: Calculate the total import cost including the base, additional, and special tariffs to avoid unexpected expenses.

- Consult Customs Broker: For complex cases, especially if the product is a customized or hybrid item, consult a customs broker or compliance expert for accurate classification.

📊 Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921.12.15.00 | PVC Textile Sofa Covers | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921.12.19.10 | PVC Textile Sofa Pads | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921.12.19.50 | PVC Textile Sofa Fabric | 5.3% | 25.0% | 30.0% | 60.3% |

If you need further assistance with customs documentation, tariff calculation, or product classification, feel free to ask.

Customer Reviews

No reviews yet.