Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

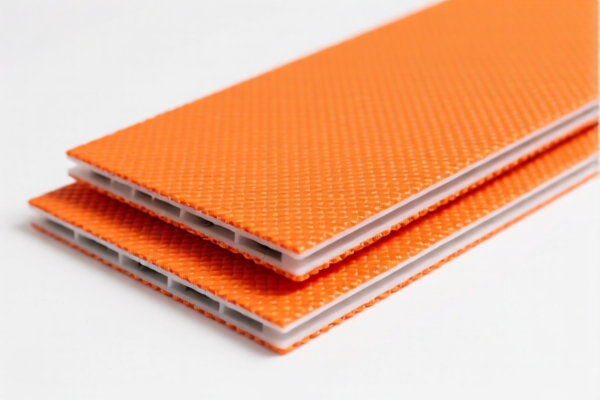

Product Name: PVC Textile Coated Fire Retardant Board

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

- Description: PVC textile coated fire retardant board, classified under HS CODE 3921, which refers to "Other plastic sheets, plates, films, foils and strips," including those combined with textile materials and made of chlorinated polyethylene.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for products that are PVC-coated textile boards with fire retardant properties.

✅ HS CODE: 3921121950

- Description: PVC-coated fire retardant textile, classified under HS CODE 3921.12.19.50, which refers to plastic sheets, plates, etc., combined with textile materials, specifically PVC (polyvinyl chloride).

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC-coated fire retardant textiles that are in sheet or plate form.

✅ HS CODE: 3904220000

- Description: PVC fire retardant board, classified under HS CODE 3904, which refers to "Plastics, in the form of sheets, plates, films, foils or strips, of chlorinated polyethylene, etc., including those plasticized."

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC fire retardant boards that are plasticized and not necessarily combined with textiles.

✅ HS CODE: 3921125000

- Description: PVC fire retardant board, classified under HS CODE 3921, which refers to "Other plastic sheets, plates, films, foils and strips," including those made of polyvinyl chloride (PVC).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC fire retardant boards that are not textile-based.

✅ HS CODE: 5903102010

- Description: PVC-coated fire retardant fabric, classified under HS CODE 5903102010, which refers to textile products coated, impregnated, or laminated with plastics, specifically PVC-coated yarns.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC-coated fire retardant fabrics (not in sheet or plate form).

📌 Proactive Advice:

- Verify the product composition: Confirm whether the product is a textile-based or non-textile-based PVC fire retardant board.

- Check the unit price and material specifications: This will help determine the correct HS CODE and avoid misclassification.

- Review required certifications: Some products may require fire retardant certification or other compliance documents.

- Be aware of the April 11, 2025, special tariff: This will increase the total tax rate by 30.0% for all the above HS CODEs. Ensure your import planning accounts for this.

Let me know if you need help with customs documentation or classification confirmation.

Product Name: PVC Textile Coated Fire Retardant Board

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

- Description: PVC textile coated fire retardant board, classified under HS CODE 3921, which refers to "Other plastic sheets, plates, films, foils and strips," including those combined with textile materials and made of chlorinated polyethylene.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for products that are PVC-coated textile boards with fire retardant properties.

✅ HS CODE: 3921121950

- Description: PVC-coated fire retardant textile, classified under HS CODE 3921.12.19.50, which refers to plastic sheets, plates, etc., combined with textile materials, specifically PVC (polyvinyl chloride).

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC-coated fire retardant textiles that are in sheet or plate form.

✅ HS CODE: 3904220000

- Description: PVC fire retardant board, classified under HS CODE 3904, which refers to "Plastics, in the form of sheets, plates, films, foils or strips, of chlorinated polyethylene, etc., including those plasticized."

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC fire retardant boards that are plasticized and not necessarily combined with textiles.

✅ HS CODE: 3921125000

- Description: PVC fire retardant board, classified under HS CODE 3921, which refers to "Other plastic sheets, plates, films, foils and strips," including those made of polyvinyl chloride (PVC).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC fire retardant boards that are not textile-based.

✅ HS CODE: 5903102010

- Description: PVC-coated fire retardant fabric, classified under HS CODE 5903102010, which refers to textile products coated, impregnated, or laminated with plastics, specifically PVC-coated yarns.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC-coated fire retardant fabrics (not in sheet or plate form).

📌 Proactive Advice:

- Verify the product composition: Confirm whether the product is a textile-based or non-textile-based PVC fire retardant board.

- Check the unit price and material specifications: This will help determine the correct HS CODE and avoid misclassification.

- Review required certifications: Some products may require fire retardant certification or other compliance documents.

- Be aware of the April 11, 2025, special tariff: This will increase the total tax rate by 30.0% for all the above HS CODEs. Ensure your import planning accounts for this.

Let me know if you need help with customs documentation or classification confirmation.

Customer Reviews

No reviews yet.