| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for PVC纺织品涂层隔音板 (PVC-coated textile sound-absorbing panels), based on the provided HS codes and tax details:

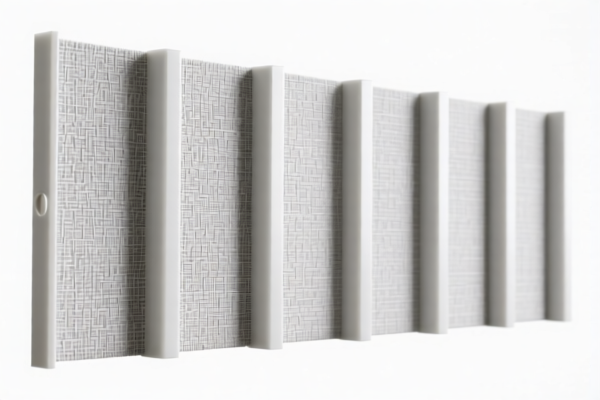

✅ HS CODE: 3921121500

Product Description:

PVC-coated textile sound-absorbing panels, classified under 3921, which refers to "Other plastic sheets, plates, films, foils and strips: cellular plastics, of polymers of vinyl chloride, combined with textile materials, where man-made fibers weigh more than any other single textile fiber, other (229)."

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

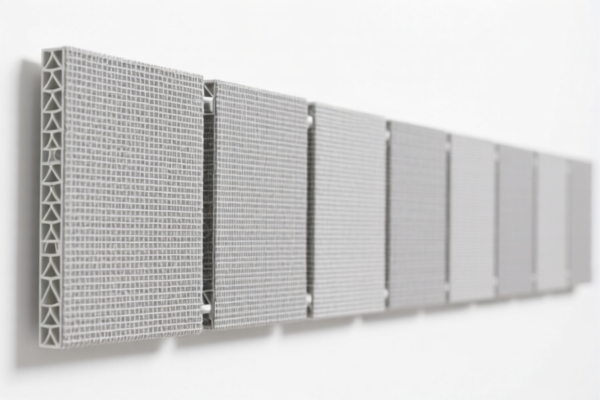

✅ HS CODE: 3920435000

Product Description:

PVC sound-absorbing panels, made of polyvinyl chloride (PVC), which is a polymer of vinyl chloride. These panels often contain plasticizers (≥6%) to achieve flexibility and are classified under 3920 as "Other plastics, not elsewhere specified."

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

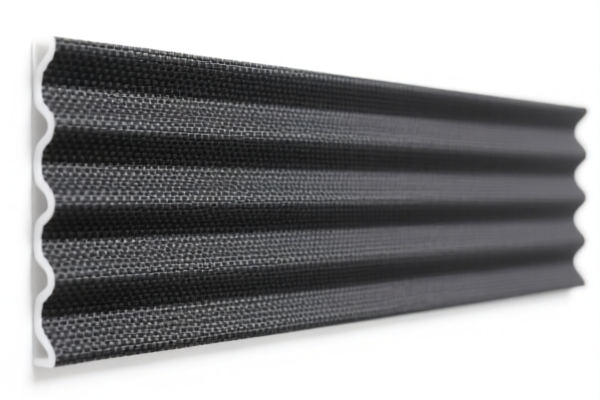

✅ HS CODE: 5903101800

Product Description:

PVC-coated polyester fiber sound-absorbing fabric, classified under 5903101800, which refers to "Textile products, impregnated, coated or otherwise worked, with plastics: with polyvinyl chloride (PVC), polyester fiber, sound-absorbing fabric."

Tariff Summary:

- Base Tariff Rate: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

✅ HS CODE: 3918104050

Product Description:

PVC wall sound-absorbing panels, classified under 3918104050, which refers to "Plastics, of polymers of vinyl chloride, in the form of sheets, plates, etc., for walls or ceilings."

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921901500

Product Description:

Textile-laminated plastic sound-absorbing panels, classified under 3921901500, which refers to "Other plastics combined with other materials, especially with textile materials, with a weight not exceeding 1.492 kg/m²."

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied after April 11, 2025. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact composition of the product (e.g., PVC content, textile fiber type, and weight) to ensure correct HS code classification. -

Certifications Required:

Depending on the destination country, certifications such as CE, RoHS, or fire resistance may be required. Verify with local customs or import agents. -

Unit Price and Classification:

The unit price and product form (e.g., panel, fabric, sheet) can affect the final classification and tax rate. Double-check with customs or a classification expert if in doubt.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for PVC纺织品涂层隔音板 (PVC-coated textile sound-absorbing panels), based on the provided HS codes and tax details:

✅ HS CODE: 3921121500

Product Description:

PVC-coated textile sound-absorbing panels, classified under 3921, which refers to "Other plastic sheets, plates, films, foils and strips: cellular plastics, of polymers of vinyl chloride, combined with textile materials, where man-made fibers weigh more than any other single textile fiber, other (229)."

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3920435000

Product Description:

PVC sound-absorbing panels, made of polyvinyl chloride (PVC), which is a polymer of vinyl chloride. These panels often contain plasticizers (≥6%) to achieve flexibility and are classified under 3920 as "Other plastics, not elsewhere specified."

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 5903101800

Product Description:

PVC-coated polyester fiber sound-absorbing fabric, classified under 5903101800, which refers to "Textile products, impregnated, coated or otherwise worked, with plastics: with polyvinyl chloride (PVC), polyester fiber, sound-absorbing fabric."

Tariff Summary:

- Base Tariff Rate: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

✅ HS CODE: 3918104050

Product Description:

PVC wall sound-absorbing panels, classified under 3918104050, which refers to "Plastics, of polymers of vinyl chloride, in the form of sheets, plates, etc., for walls or ceilings."

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921901500

Product Description:

Textile-laminated plastic sound-absorbing panels, classified under 3921901500, which refers to "Other plastics combined with other materials, especially with textile materials, with a weight not exceeding 1.492 kg/m²."

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied after April 11, 2025. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact composition of the product (e.g., PVC content, textile fiber type, and weight) to ensure correct HS code classification. -

Certifications Required:

Depending on the destination country, certifications such as CE, RoHS, or fire resistance may be required. Verify with local customs or import agents. -

Unit Price and Classification:

The unit price and product form (e.g., panel, fabric, sheet) can affect the final classification and tax rate. Double-check with customs or a classification expert if in doubt.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.