| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

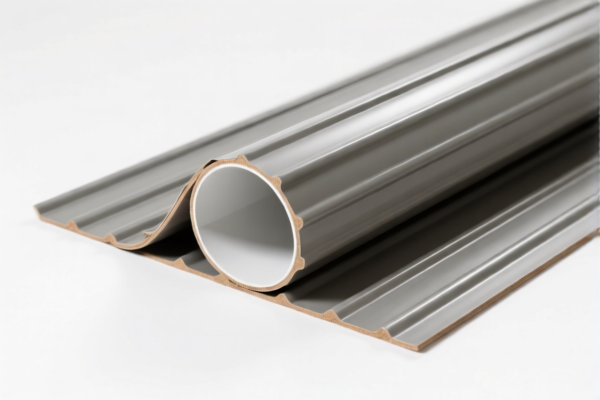

Product Name: PVC Textile Cleaning Cloth

Classification HS Code: 3921121950 / 3921121910 (depending on specific composition and description)

✅ HS CODE Classification Overview

- HS CODE 3921121950

- Description: PVC (polyvinyl chloride) textile cleaning cloth, where the product is a combination of plastic (PVC) and textile materials, and does not meet the criteria of having plant fibers exceeding any single textile fiber.

-

Applicable Products: PVC-coated textile cleaning cloths, dust cloths, protective cloths, etc., where the textile component is not the dominant fiber type.

-

HS CODE 3921121910

- Description: PVC-coated textile anti-stain cloth, where the product is a combination of PVC and other textile materials, and does not specify that plant fibers exceed any other single textile fiber.

- Applicable Products: PVC-coated textile protective cloths, where the textile component is not clearly defined as the dominant fiber.

📊 Tariff Summary (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 60.3%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on products classified under these HS codes after April 11, 2025.

-

This is a time-sensitive policy, and importers should plan accordingly to avoid unexpected costs.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for this product category at this time.

- However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin and product composition.

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Ensure the product does not meet the criteria for plant fibers exceeding any single textile fiber (this may affect HS code classification).

-

Check Unit Price and Certification:

-

Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

-

Review HS Code Classification:

-

Double-check the HS code based on the exact product description and material composition to avoid misclassification and penalties.

-

Monitor Tariff Updates:

- Stay informed about tariff changes after April 11, 2025, and consider adjusting import timelines or seeking duty exemptions if applicable.

📌 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 3921121950 | PVC + textile, no plant fiber dominance | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921121910 | PVC + textile, unspecified fiber content | 5.3% | 25.0% | 30.0% | 60.3% |

If you have more details about the material composition, end-use, or country of origin, I can provide a more tailored classification and compliance strategy.

Product Name: PVC Textile Cleaning Cloth

Classification HS Code: 3921121950 / 3921121910 (depending on specific composition and description)

✅ HS CODE Classification Overview

- HS CODE 3921121950

- Description: PVC (polyvinyl chloride) textile cleaning cloth, where the product is a combination of plastic (PVC) and textile materials, and does not meet the criteria of having plant fibers exceeding any single textile fiber.

-

Applicable Products: PVC-coated textile cleaning cloths, dust cloths, protective cloths, etc., where the textile component is not the dominant fiber type.

-

HS CODE 3921121910

- Description: PVC-coated textile anti-stain cloth, where the product is a combination of PVC and other textile materials, and does not specify that plant fibers exceed any other single textile fiber.

- Applicable Products: PVC-coated textile protective cloths, where the textile component is not clearly defined as the dominant fiber.

📊 Tariff Summary (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 60.3%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on products classified under these HS codes after April 11, 2025.

-

This is a time-sensitive policy, and importers should plan accordingly to avoid unexpected costs.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for this product category at this time.

- However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin and product composition.

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Ensure the product does not meet the criteria for plant fibers exceeding any single textile fiber (this may affect HS code classification).

-

Check Unit Price and Certification:

-

Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

-

Review HS Code Classification:

-

Double-check the HS code based on the exact product description and material composition to avoid misclassification and penalties.

-

Monitor Tariff Updates:

- Stay informed about tariff changes after April 11, 2025, and consider adjusting import timelines or seeking duty exemptions if applicable.

📌 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 3921121950 | PVC + textile, no plant fiber dominance | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921121910 | PVC + textile, unspecified fiber content | 5.3% | 25.0% | 30.0% | 60.3% |

If you have more details about the material composition, end-use, or country of origin, I can provide a more tailored classification and compliance strategy.

Customer Reviews

No reviews yet.