| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

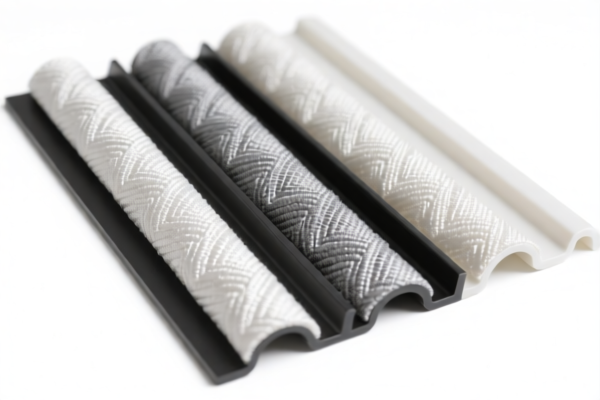

Product Classification and Tariff Analysis for PVC Textile Decorative Hangings

Below is a structured breakdown of the HS codes and associated tariffs for the declared product "PVC纺织品装饰挂布" (PVC textile decorative hangings), based on the provided data:

✅ HS CODE: 3921121950

Description: Other plastic sheets, plates, films, foils and strips, with textile components.

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies to products that are plastic-based with textile components, such as PVC textile decorative hangings, gift wrapping fabric, and display fabric.

✅ HS CODE: 5903103000

Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those with polyvinyl chloride (PVC), other categories.

Total Tax Rate: 57.7%

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for PVC-coated textile fabrics, such as decorative fabric, but not specifically for polyester-based products.

✅ HS CODE: 5903101800

Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those with polyvinyl chloride (PVC), based on man-made fibers.

Total Tax Rate: 69.1%

- Base Tariff Rate: 14.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies to PVC-coated polyester decorative fabric. The higher base tariff reflects the use of man-made fibers.

📌 Key Observations and Recommendations:

- Tariff Differences:

-

3921121950 has a higher total tax rate (60.3%) compared to 5903103000 (57.7%), but 5903101800 has the highest total tax rate (69.1%) due to the man-made fiber base.

-

April 11, 2025 Special Tariff:

-

All classifications are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin and product composition.

-

Certifications and Documentation:

- Verify the material composition (e.g., whether it is PVC-coated textile or plastic with textile components) to ensure correct classification.

- Confirm the unit price and product use (e.g., decorative, gift wrapping, display) to avoid misclassification.

- Ensure compliance with customs documentation and product certification requirements (e.g., textile content, plastic content, etc.).

🛑 Proactive Advice:

- Double-check the product composition (e.g., whether it is a textile fabric with PVC coating or a plastic film with textile components).

- Confirm the HS code with customs or a classification expert if the product is borderline between categories.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Review any applicable anti-dumping duties based on the country of origin and product type.

Let me know if you need help with customs documentation templates or classification confirmation. Product Classification and Tariff Analysis for PVC Textile Decorative Hangings

Below is a structured breakdown of the HS codes and associated tariffs for the declared product "PVC纺织品装饰挂布" (PVC textile decorative hangings), based on the provided data:

✅ HS CODE: 3921121950

Description: Other plastic sheets, plates, films, foils and strips, with textile components.

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies to products that are plastic-based with textile components, such as PVC textile decorative hangings, gift wrapping fabric, and display fabric.

✅ HS CODE: 5903103000

Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those with polyvinyl chloride (PVC), other categories.

Total Tax Rate: 57.7%

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for PVC-coated textile fabrics, such as decorative fabric, but not specifically for polyester-based products.

✅ HS CODE: 5903101800

Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those with polyvinyl chloride (PVC), based on man-made fibers.

Total Tax Rate: 69.1%

- Base Tariff Rate: 14.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies to PVC-coated polyester decorative fabric. The higher base tariff reflects the use of man-made fibers.

📌 Key Observations and Recommendations:

- Tariff Differences:

-

3921121950 has a higher total tax rate (60.3%) compared to 5903103000 (57.7%), but 5903101800 has the highest total tax rate (69.1%) due to the man-made fiber base.

-

April 11, 2025 Special Tariff:

-

All classifications are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin and product composition.

-

Certifications and Documentation:

- Verify the material composition (e.g., whether it is PVC-coated textile or plastic with textile components) to ensure correct classification.

- Confirm the unit price and product use (e.g., decorative, gift wrapping, display) to avoid misclassification.

- Ensure compliance with customs documentation and product certification requirements (e.g., textile content, plastic content, etc.).

🛑 Proactive Advice:

- Double-check the product composition (e.g., whether it is a textile fabric with PVC coating or a plastic film with textile components).

- Confirm the HS code with customs or a classification expert if the product is borderline between categories.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Review any applicable anti-dumping duties based on the country of origin and product type.

Let me know if you need help with customs documentation templates or classification confirmation.

Customer Reviews

No reviews yet.