| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 8421210000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903903090 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

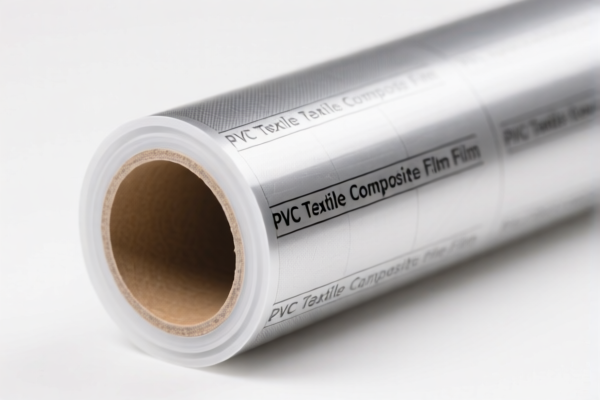

Product Name: PVC纺织品过滤材料

Classification HS CODEs and Tax Details:

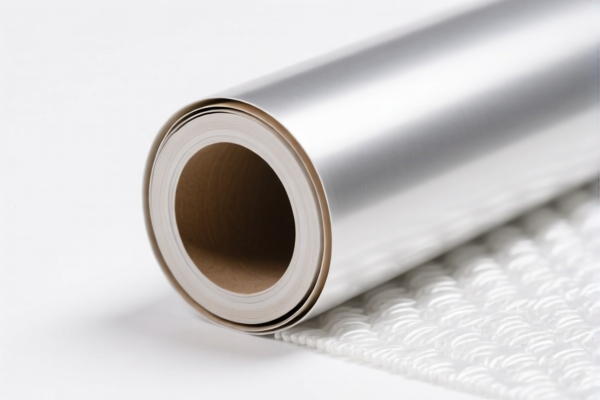

✅ HS CODE: 3921121500

Description: PVC纺织品过滤材料符合HSCODE 3921的归类描述,涵盖其他塑料板、片、薄膜、箔和条,且描述中包含与纺织材料结合的塑料。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This classification is suitable for PVC-based materials combined with textile fabrics.

- Ensure the product is not classified under other HS codes like 5903 or 8421 if it is more accurately described as a composite material.

✅ HS CODE: 8421210000

Description: PVC过滤器符合HSCODE 8421210000的解释。

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code is for filters or filtering devices, not the raw materials.

- If your product is a finished filter device, this may be the correct code.

- Confirm whether the product is a device or a material for filtering.

✅ HS CODE: 3921121950

Description: PVC涂层透气纺织品符合HSCODE 3921.12.19.50的归类解释,该商品为以聚氯乙烯聚合物为基础的塑料板、片、薄膜、箔和条,与纺织材料结合。

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This is for PVC-coated breathable textile products.

- Ensure the product is not a finished filter device, but a material used in filtration.

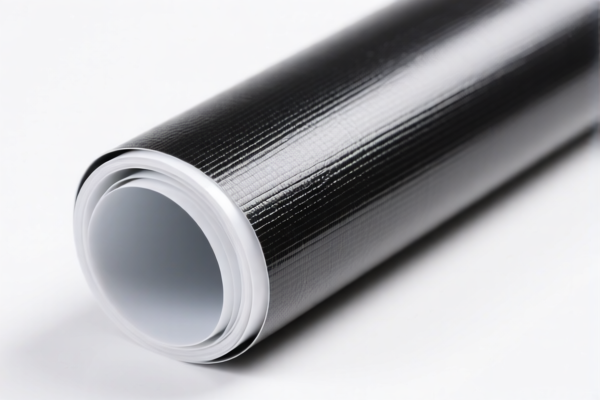

✅ HS CODE: 5903903090

Description: 过滤用塑料涂层纺织品符合HSCODE 5903903090的描述,该商品为塑料涂层纺织品,归类在第5903章浸渍、涂层、覆盖或层压有塑料的纺织织物。

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Key Notes:

- This is for plastic-coated textile fabrics used in filtration.

- This is a general category for coated textiles, not specific to PVC.

- If the product is PVC-coated, consider 5903103000 instead.

✅ HS CODE: 5903103000

Description: PVC涂层过滤布符合HSCODE 5903103000的描述,该HSCODE描述的是浸渍、涂层、覆盖或层压有塑料的纺织织物,具体为用聚氯乙烯者中的其他类别。

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Key Notes:

- This is for PVC-coated textile fabrics used in filtration.

- This is a specific category for PVC-coated textiles.

- If the product is PVC-coated, this is a more accurate classification than 5903903090.

📌 Proactive Advice:

- Verify the product's composition and function (e.g., is it a raw material or a finished filter device?).

- Check the unit price and material specifications to ensure correct HS code selection.

- Confirm if any certifications (e.g., RoHS, REACH) are required for import.

- Be aware of the April 11, 2025, special tariff and its impact on total tax costs.

- Consult a customs broker or classification expert if the product is complex or borderline between categories.

Product Name: PVC纺织品过滤材料

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

Description: PVC纺织品过滤材料符合HSCODE 3921的归类描述,涵盖其他塑料板、片、薄膜、箔和条,且描述中包含与纺织材料结合的塑料。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This classification is suitable for PVC-based materials combined with textile fabrics.

- Ensure the product is not classified under other HS codes like 5903 or 8421 if it is more accurately described as a composite material.

✅ HS CODE: 8421210000

Description: PVC过滤器符合HSCODE 8421210000的解释。

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code is for filters or filtering devices, not the raw materials.

- If your product is a finished filter device, this may be the correct code.

- Confirm whether the product is a device or a material for filtering.

✅ HS CODE: 3921121950

Description: PVC涂层透气纺织品符合HSCODE 3921.12.19.50的归类解释,该商品为以聚氯乙烯聚合物为基础的塑料板、片、薄膜、箔和条,与纺织材料结合。

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This is for PVC-coated breathable textile products.

- Ensure the product is not a finished filter device, but a material used in filtration.

✅ HS CODE: 5903903090

Description: 过滤用塑料涂层纺织品符合HSCODE 5903903090的描述,该商品为塑料涂层纺织品,归类在第5903章浸渍、涂层、覆盖或层压有塑料的纺织织物。

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Key Notes:

- This is for plastic-coated textile fabrics used in filtration.

- This is a general category for coated textiles, not specific to PVC.

- If the product is PVC-coated, consider 5903103000 instead.

✅ HS CODE: 5903103000

Description: PVC涂层过滤布符合HSCODE 5903103000的描述,该HSCODE描述的是浸渍、涂层、覆盖或层压有塑料的纺织织物,具体为用聚氯乙烯者中的其他类别。

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Key Notes:

- This is for PVC-coated textile fabrics used in filtration.

- This is a specific category for PVC-coated textiles.

- If the product is PVC-coated, this is a more accurate classification than 5903903090.

📌 Proactive Advice:

- Verify the product's composition and function (e.g., is it a raw material or a finished filter device?).

- Check the unit price and material specifications to ensure correct HS code selection.

- Confirm if any certifications (e.g., RoHS, REACH) are required for import.

- Be aware of the April 11, 2025, special tariff and its impact on total tax costs.

- Consult a customs broker or classification expert if the product is complex or borderline between categories.

Customer Reviews

No reviews yet.