| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 6210307000 | Doc | 40.8% | CN | US | 2025-05-12 |

| 6210207000 | Doc | 33.3% | CN | US | 2025-05-12 |

| 6210507500 | Doc | 40.8% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

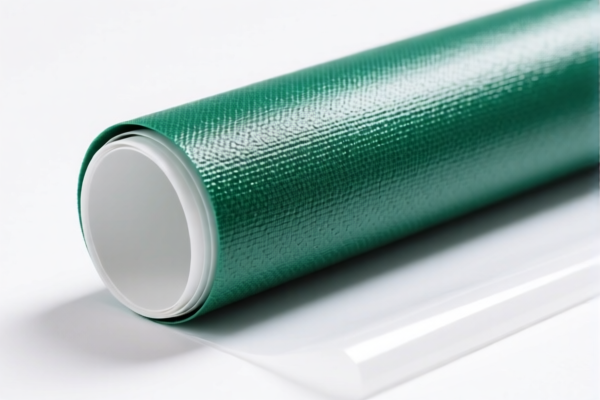

Product Name: PVC Textile Protective Clothing

Classification Analysis and Tax Information:

✅ HS CODE: 3921121500

Description:

- Applies to PVC textile protective clothing, classified under HS CODE 3921, which covers "other plastic sheets, plates, films, foils, and strips, including chlorinated polyethylene products combined with textile materials."

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This classification is suitable for products where PVC is combined with textile materials, such as lab coats or protective clothing made from PVC-coated fabric.

- Proactive Advice: Confirm the product is made of PVC combined with textile materials, not just PVC film. Check if it's used for industrial or medical purposes, as this may affect classification.

✅ HS CODE: 6210307000

Description:

- Applies to PVC-coated protective clothing, classified under HS CODE 6210307000, which covers clothing with the outer surface impregnated, coated, covered, or laminated with rubber or plastic materials, fully covering the base fabric.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.8%

Key Notes:

- This code is for clothing where the entire base fabric is covered with PVC.

- Proactive Advice: Ensure the fabric is fully coated and not just partially treated. Verify the unit price and whether it's for industrial or personal use.

✅ HS CODE: 6210207000

Description:

- Applies to PVC-coated protective clothing, classified under HS CODE 6210207000, which covers clothing with the outer surface impregnated, coated, covered, or laminated with rubber or plastic materials, fully covering the underlying fabric.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.3%

Key Notes:

- This code is similar to 6210307000 but may apply to different types of fabric or usage.

- Proactive Advice: Confirm the fabric type and usage (e.g., industrial, medical) to ensure correct classification.

✅ HS CODE: 6210507500

Description:

- Applies to PVC-coated women's protective clothing, classified under HS CODE 6210507500, which covers clothing with the outer surface impregnated, coated, covered, or laminated with rubber or plastic materials.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.8%

Key Notes:

- This code is specific to women's protective clothing with PVC coating.

- Proactive Advice: Confirm the product is for women and check if it's for industrial or personal use.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025.

- Certifications Required: Depending on the use (e.g., medical, industrial), certifications such as CE, FDA, or ISO may be required.

- Material Verification: Confirm the exact composition (e.g., PVC-coated fabric vs. PVC film) to avoid misclassification.

- Unit Price: The tax rate may vary based on the unit price and whether it's considered a "textile product" or "plastic product."

Final Recommendation:

Before customs clearance, verify the product's material composition, usage, and target market. If in doubt, consult a customs broker or classification expert to ensure compliance and avoid delays.

Product Name: PVC Textile Protective Clothing

Classification Analysis and Tax Information:

✅ HS CODE: 3921121500

Description:

- Applies to PVC textile protective clothing, classified under HS CODE 3921, which covers "other plastic sheets, plates, films, foils, and strips, including chlorinated polyethylene products combined with textile materials."

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This classification is suitable for products where PVC is combined with textile materials, such as lab coats or protective clothing made from PVC-coated fabric.

- Proactive Advice: Confirm the product is made of PVC combined with textile materials, not just PVC film. Check if it's used for industrial or medical purposes, as this may affect classification.

✅ HS CODE: 6210307000

Description:

- Applies to PVC-coated protective clothing, classified under HS CODE 6210307000, which covers clothing with the outer surface impregnated, coated, covered, or laminated with rubber or plastic materials, fully covering the base fabric.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.8%

Key Notes:

- This code is for clothing where the entire base fabric is covered with PVC.

- Proactive Advice: Ensure the fabric is fully coated and not just partially treated. Verify the unit price and whether it's for industrial or personal use.

✅ HS CODE: 6210207000

Description:

- Applies to PVC-coated protective clothing, classified under HS CODE 6210207000, which covers clothing with the outer surface impregnated, coated, covered, or laminated with rubber or plastic materials, fully covering the underlying fabric.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.3%

Key Notes:

- This code is similar to 6210307000 but may apply to different types of fabric or usage.

- Proactive Advice: Confirm the fabric type and usage (e.g., industrial, medical) to ensure correct classification.

✅ HS CODE: 6210507500

Description:

- Applies to PVC-coated women's protective clothing, classified under HS CODE 6210507500, which covers clothing with the outer surface impregnated, coated, covered, or laminated with rubber or plastic materials.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.8%

Key Notes:

- This code is specific to women's protective clothing with PVC coating.

- Proactive Advice: Confirm the product is for women and check if it's for industrial or personal use.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025.

- Certifications Required: Depending on the use (e.g., medical, industrial), certifications such as CE, FDA, or ISO may be required.

- Material Verification: Confirm the exact composition (e.g., PVC-coated fabric vs. PVC film) to avoid misclassification.

- Unit Price: The tax rate may vary based on the unit price and whether it's considered a "textile product" or "plastic product."

Final Recommendation:

Before customs clearance, verify the product's material composition, usage, and target market. If in doubt, consult a customs broker or classification expert to ensure compliance and avoid delays.

Customer Reviews

No reviews yet.