| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

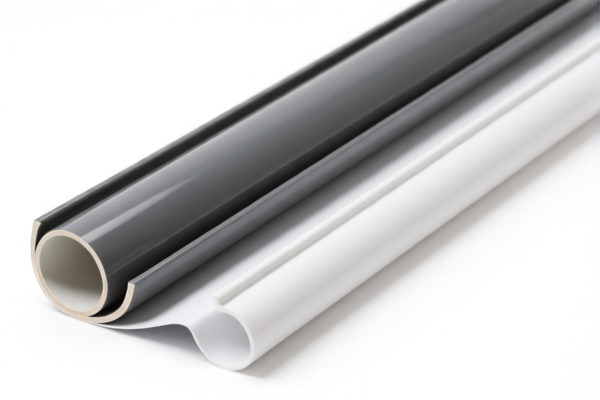

Product Name: PVC Textile Radiation Shielding Fabric

Classification HS Code Analysis:

✅ HS CODE: 3921.12.19.50

Description:

- This code applies to PVC (polyvinyl chloride) textile composite radiation shielding fabric.

- The product is a combination of PVC polymer with textile materials, but does not meet the requirement that plant fibers (vegetable fibers) exceed any other single textile fiber in weight.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921.12.19.10

Description:

- This code applies to PVC-coated textile radiation shielding fabric.

- The product is a combination of PVC polymer with textile materials, and vegetable fibers are the dominant component by weight.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 5903.10.18.00

Description:

- This code applies to PVC-coated polyester fiber radiation shielding fabric.

- "PVC coating" corresponds to polyvinyl chloride, "polyester fiber" corresponds to man-made fibers, and "radiation shielding fabric" falls under other textile items under Chapter XI, Note 9.

Tariff Details:

- Base Tariff Rate: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

✅ HS CODE: 5903.10.25.00

Description:

- This code applies to PVC-coated man-made fiber radiation shielding fabric.

- "PVC coating" corresponds to the plastic coating under 5903, and "man-made fiber" corresponds to the fiber type in the code.

Tariff Details:

- Base Tariff Rate: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.5%

📌 Key Notes and Recommendations:

- Material Composition: Confirm the dominant fiber type (e.g., vegetable fiber, polyester, or man-made fiber) to determine the correct HS code.

- Unit Price: Verify the unit price and weight of the product, as these may affect classification and tax calculation.

- Certifications: Check if certifications (e.g., radiation shielding standards, safety compliance) are required for import.

- April 11, 2025 Policy: Be aware of the special tariff imposed after this date, which may increase the total tax burden.

- Anti-dumping duties: Not applicable for this product category, but always verify with the latest customs regulations.

🛑 Action Required:

- Confirm the exact composition of the fabric (e.g., percentage of PVC, type of textile fiber).

- Ensure product documentation (e.g., material test reports, certificates) is complete for customs clearance.

- Consider consulting a customs broker for accurate classification and tax calculation.

Product Name: PVC Textile Radiation Shielding Fabric

Classification HS Code Analysis:

✅ HS CODE: 3921.12.19.50

Description:

- This code applies to PVC (polyvinyl chloride) textile composite radiation shielding fabric.

- The product is a combination of PVC polymer with textile materials, but does not meet the requirement that plant fibers (vegetable fibers) exceed any other single textile fiber in weight.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921.12.19.10

Description:

- This code applies to PVC-coated textile radiation shielding fabric.

- The product is a combination of PVC polymer with textile materials, and vegetable fibers are the dominant component by weight.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 5903.10.18.00

Description:

- This code applies to PVC-coated polyester fiber radiation shielding fabric.

- "PVC coating" corresponds to polyvinyl chloride, "polyester fiber" corresponds to man-made fibers, and "radiation shielding fabric" falls under other textile items under Chapter XI, Note 9.

Tariff Details:

- Base Tariff Rate: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

✅ HS CODE: 5903.10.25.00

Description:

- This code applies to PVC-coated man-made fiber radiation shielding fabric.

- "PVC coating" corresponds to the plastic coating under 5903, and "man-made fiber" corresponds to the fiber type in the code.

Tariff Details:

- Base Tariff Rate: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.5%

📌 Key Notes and Recommendations:

- Material Composition: Confirm the dominant fiber type (e.g., vegetable fiber, polyester, or man-made fiber) to determine the correct HS code.

- Unit Price: Verify the unit price and weight of the product, as these may affect classification and tax calculation.

- Certifications: Check if certifications (e.g., radiation shielding standards, safety compliance) are required for import.

- April 11, 2025 Policy: Be aware of the special tariff imposed after this date, which may increase the total tax burden.

- Anti-dumping duties: Not applicable for this product category, but always verify with the latest customs regulations.

🛑 Action Required:

- Confirm the exact composition of the fabric (e.g., percentage of PVC, type of textile fiber).

- Ensure product documentation (e.g., material test reports, certificates) is complete for customs clearance.

- Consider consulting a customs broker for accurate classification and tax calculation.

Customer Reviews

No reviews yet.