| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 6406101000 | Doc | 40.0% | CN | US | 2025-05-12 |

| 3904210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 6406103000 | Doc | 63¢/pr. + 26.2%+37.5% | CN | US | 2025-05-12 |

| 5903101000 | Doc | 57.7% | CN | US | 2025-05-12 |

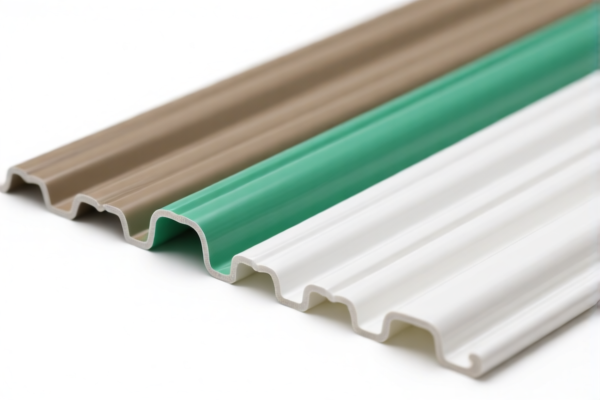

Product Name: PVC纺织品鞋面材料

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

Description:

- "Other plastic plates, sheets, films, foils and strips" made of chlorinated polyethylene (PVC), combined with textile materials.

- Matches the product name "PVC纺织品鞋面材料" (PVC textile shoe upper material).

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

✅ HS CODE: 6406101000

Description:

- Formed shoe uppers made of leather or synthetic leather (PVC is a type of synthetic leather).

- Suitable for shoe parts used by other personnel.

Tariff Summary:

- Base Tariff: 10.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 40.0%

✅ HS CODE: 3904210000

Description:

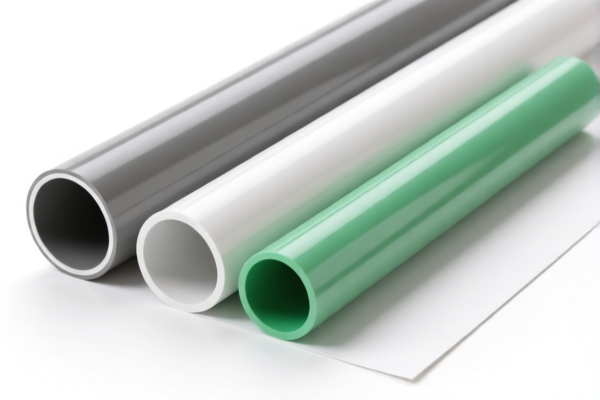

- Primary forms of polyvinyl chloride (PVC) or other halogenated ethylene polymers.

- Product name includes "PVC", which fits this category.

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

✅ HS CODE: 6406103000

Description:

- Formed shoe uppers made of textile materials, with a value per pair between $3 and $6.50.

- Suitable for textile-based shoe uppers.

Tariff Summary:

- Base Tariff: 63¢/pr. + 26.2%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 63¢/pr. + 26.2% + 37.5%

✅ HS CODE: 5903101000

Description:

- Textile fabrics coated, impregnated, or laminated with plastic (specifically PVC), made of cotton.

- Matches the product name "PVC涂层棉布-鞋面材料" (PVC-coated cotton fabric for shoe uppers).

Tariff Summary:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 57.7%

📌 Proactive Advice:

- Verify Material Composition: Confirm whether the product is primarily PVC, textile, or a combination (e.g., PVC-coated cotton). This will determine the correct HS CODE.

- Check Unit Price: For HS CODE 6406103000, the tax rate includes a per-unit charge (63¢/pr.), so ensure the declared value per pair is accurate.

- Certifications Required: Some HS CODEs may require specific certifications (e.g., textile origin, PVC content, etc.).

- Watch for April 11, 2025, Tariff Changes: All listed HS CODEs are subject to an additional 30% tariff after this date. Ensure compliance with updated regulations.

Let me know if you need help selecting the most appropriate HS CODE based on your product's exact specifications.

Product Name: PVC纺织品鞋面材料

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

Description:

- "Other plastic plates, sheets, films, foils and strips" made of chlorinated polyethylene (PVC), combined with textile materials.

- Matches the product name "PVC纺织品鞋面材料" (PVC textile shoe upper material).

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

✅ HS CODE: 6406101000

Description:

- Formed shoe uppers made of leather or synthetic leather (PVC is a type of synthetic leather).

- Suitable for shoe parts used by other personnel.

Tariff Summary:

- Base Tariff: 10.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 40.0%

✅ HS CODE: 3904210000

Description:

- Primary forms of polyvinyl chloride (PVC) or other halogenated ethylene polymers.

- Product name includes "PVC", which fits this category.

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

✅ HS CODE: 6406103000

Description:

- Formed shoe uppers made of textile materials, with a value per pair between $3 and $6.50.

- Suitable for textile-based shoe uppers.

Tariff Summary:

- Base Tariff: 63¢/pr. + 26.2%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 63¢/pr. + 26.2% + 37.5%

✅ HS CODE: 5903101000

Description:

- Textile fabrics coated, impregnated, or laminated with plastic (specifically PVC), made of cotton.

- Matches the product name "PVC涂层棉布-鞋面材料" (PVC-coated cotton fabric for shoe uppers).

Tariff Summary:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 57.7%

📌 Proactive Advice:

- Verify Material Composition: Confirm whether the product is primarily PVC, textile, or a combination (e.g., PVC-coated cotton). This will determine the correct HS CODE.

- Check Unit Price: For HS CODE 6406103000, the tax rate includes a per-unit charge (63¢/pr.), so ensure the declared value per pair is accurate.

- Certifications Required: Some HS CODEs may require specific certifications (e.g., textile origin, PVC content, etc.).

- Watch for April 11, 2025, Tariff Changes: All listed HS CODEs are subject to an additional 30% tariff after this date. Ensure compliance with updated regulations.

Let me know if you need help selecting the most appropriate HS CODE based on your product's exact specifications.

Customer Reviews

No reviews yet.