| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3924901010 | Doc | 33.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

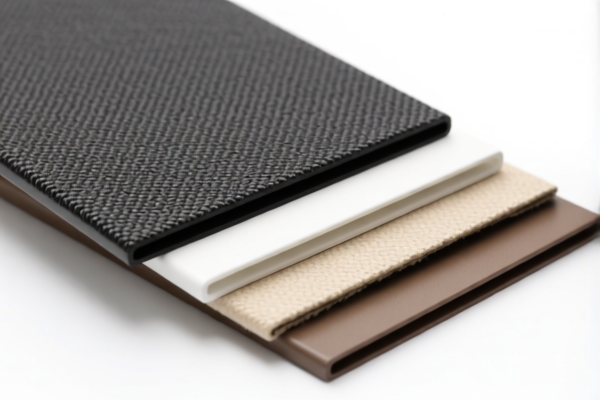

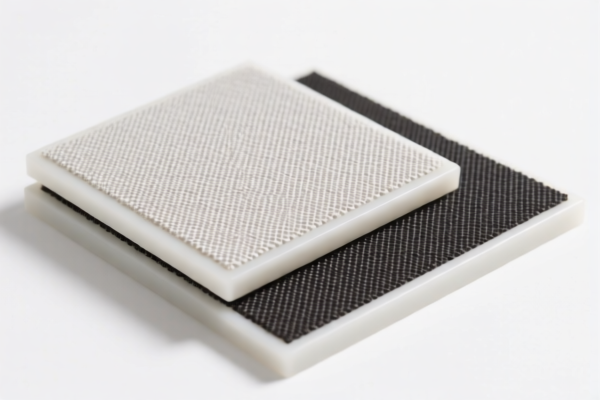

Product Name: PVC Textile Table Mats

Classification HS Code Analysis:

✅ HS CODE: 3921121950

Description: PVC-coated textile table mats, classified under 3921.12.19.50, which falls under the category of "Other plastic sheets, plates, films, foils and strips: cellular: based on polyvinyl chloride (PVC): combined with textile materials: other."

- Key Features:

- Contains PVC (polyvinyl chloride) and textile materials.

- The textile component is combined with PVC.

- Does not meet the specific criteria for more detailed subheadings (e.g., 3921121910).

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921121100

Description: PVC textile composite table mats, classified under 3921.12.11.00, which applies to "Plastic sheets, plates, etc., based on PVC, combined with textile materials, where the textile component contains man-made fibers in greater weight than any other single fiber, and the plastic weight exceeds 70%."

- Key Features:

- PVC-based composite material.

- Textile component contains more man-made fibers than any other fiber.

- Plastic content exceeds 70% by weight.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3924901010

Description: PVC table mats, classified under 3924.90.10.10, which applies to "Plastic table mats, kitchen utensils, other household goods, or sanitary or toilet articles."

- Key Features:

- Made entirely of PVC (plastic).

- Not combined with textile materials.

- Falls under the broader category of plastic household items.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for this product category (PVC table mats), as they are not subject to current anti-dumping measures on iron or aluminum. -

Certifications Required:

- Verify the material composition (e.g., PVC content, textile fiber type).

- Confirm the unit price and product specifications to ensure correct HS code classification.

- Check if customs documentation (e.g., commercial invoice, packing list) includes all necessary details for customs clearance.

📌 Proactive Advice:

- Double-check the product composition to ensure it aligns with the HS code you are using.

- Consult with a customs broker or classification expert if the product contains multiple materials or is a composite.

- Keep records of product samples and technical specifications for future reference.

Product Name: PVC Textile Table Mats

Classification HS Code Analysis:

✅ HS CODE: 3921121950

Description: PVC-coated textile table mats, classified under 3921.12.19.50, which falls under the category of "Other plastic sheets, plates, films, foils and strips: cellular: based on polyvinyl chloride (PVC): combined with textile materials: other."

- Key Features:

- Contains PVC (polyvinyl chloride) and textile materials.

- The textile component is combined with PVC.

- Does not meet the specific criteria for more detailed subheadings (e.g., 3921121910).

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921121100

Description: PVC textile composite table mats, classified under 3921.12.11.00, which applies to "Plastic sheets, plates, etc., based on PVC, combined with textile materials, where the textile component contains man-made fibers in greater weight than any other single fiber, and the plastic weight exceeds 70%."

- Key Features:

- PVC-based composite material.

- Textile component contains more man-made fibers than any other fiber.

- Plastic content exceeds 70% by weight.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3924901010

Description: PVC table mats, classified under 3924.90.10.10, which applies to "Plastic table mats, kitchen utensils, other household goods, or sanitary or toilet articles."

- Key Features:

- Made entirely of PVC (plastic).

- Not combined with textile materials.

- Falls under the broader category of plastic household items.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for this product category (PVC table mats), as they are not subject to current anti-dumping measures on iron or aluminum. -

Certifications Required:

- Verify the material composition (e.g., PVC content, textile fiber type).

- Confirm the unit price and product specifications to ensure correct HS code classification.

- Check if customs documentation (e.g., commercial invoice, packing list) includes all necessary details for customs clearance.

📌 Proactive Advice:

- Double-check the product composition to ensure it aligns with the HS code you are using.

- Consult with a customs broker or classification expert if the product contains multiple materials or is a composite.

- Keep records of product samples and technical specifications for future reference.

Customer Reviews

No reviews yet.