Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

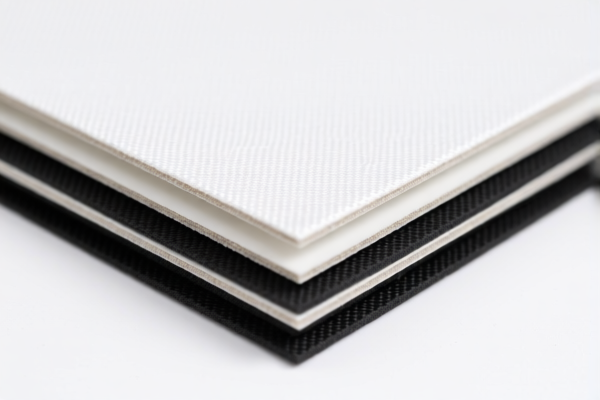

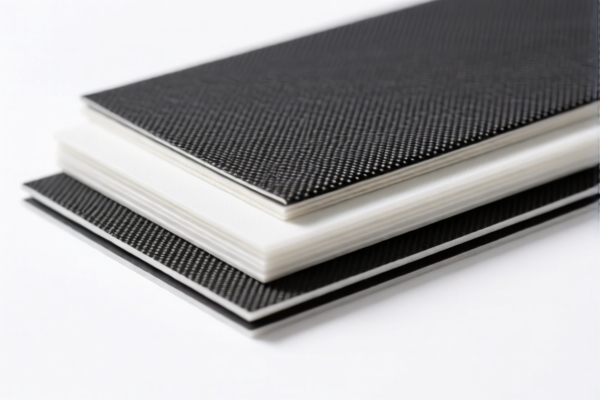

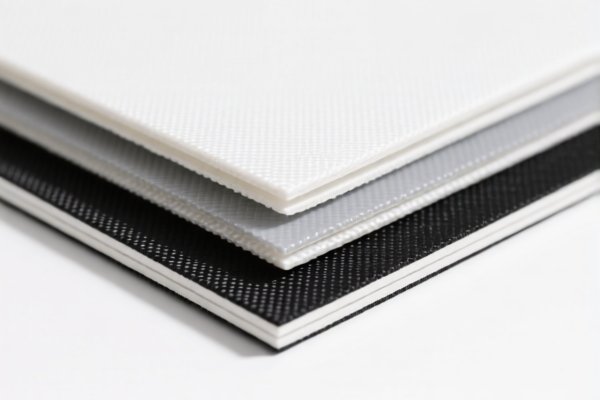

Product Name: PVC纺织复合医用床单

Classification HS CODE: 3921121910 (Primary Code)

🔍 HS CODE Details:

- HS CODE: 3921121910

- Description: PVC纺织复合医用床单,符合HSCODE 3921121910的描述,涵盖以聚氯乙烯为基础,与纺织材料结合的产品。

- Total Tax Rate: 60.3%

📊 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (product is PVC and textile composite, not metal-based)

⚠️ Time-sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a critical date for customs clearance planning and cost estimation.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed a composite of PVC and textile materials, as this is the key factor for classification under HS CODE 3921121910.

- Check Unit Price: The total tax rate is heavily influenced by the base tariff and additional tariffs. Confirm the unit price for accurate cost calculation.

- Certifications Required: Confirm if any specific certifications (e.g., medical device certification, safety standards) are required for import into the destination country.

- Alternative HS CODEs: Other codes such as 3921121100 and 3921121500 may apply to similar products (e.g., PVC textile composite pillow covers or bedspreads), but they have slightly different tax rates. Ensure the product description matches the most accurate HS CODE.

📌 Comparison with Other HS CODEs:

| HS CODE | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|---|

| 3921121910 | PVC纺织复合医用床单 | 60.3% | 5.3% | 25.0% | 30.0% |

| 3921121100 | PVC纺织复合枕套/床单 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921121500 | PVC纺织品医用床单/床罩 | 61.5% | 6.5% | 25.0% | 30.0% |

✅ Conclusion:

For PVC纺织复合医用床单, the most accurate HS CODE is 3921121910, with a total tax rate of 60.3%. Be mindful of the 30.0% additional tariff after April 11, 2025, and ensure your product description and documentation align with the classification criteria.

Product Name: PVC纺织复合医用床单

Classification HS CODE: 3921121910 (Primary Code)

🔍 HS CODE Details:

- HS CODE: 3921121910

- Description: PVC纺织复合医用床单,符合HSCODE 3921121910的描述,涵盖以聚氯乙烯为基础,与纺织材料结合的产品。

- Total Tax Rate: 60.3%

📊 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (product is PVC and textile composite, not metal-based)

⚠️ Time-sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a critical date for customs clearance planning and cost estimation.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed a composite of PVC and textile materials, as this is the key factor for classification under HS CODE 3921121910.

- Check Unit Price: The total tax rate is heavily influenced by the base tariff and additional tariffs. Confirm the unit price for accurate cost calculation.

- Certifications Required: Confirm if any specific certifications (e.g., medical device certification, safety standards) are required for import into the destination country.

- Alternative HS CODEs: Other codes such as 3921121100 and 3921121500 may apply to similar products (e.g., PVC textile composite pillow covers or bedspreads), but they have slightly different tax rates. Ensure the product description matches the most accurate HS CODE.

📌 Comparison with Other HS CODEs:

| HS CODE | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|---|

| 3921121910 | PVC纺织复合医用床单 | 60.3% | 5.3% | 25.0% | 30.0% |

| 3921121100 | PVC纺织复合枕套/床单 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921121500 | PVC纺织品医用床单/床罩 | 61.5% | 6.5% | 25.0% | 30.0% |

✅ Conclusion:

For PVC纺织复合医用床单, the most accurate HS CODE is 3921121910, with a total tax rate of 60.3%. Be mindful of the 30.0% additional tariff after April 11, 2025, and ensure your product description and documentation align with the classification criteria.

Customer Reviews

No reviews yet.