Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

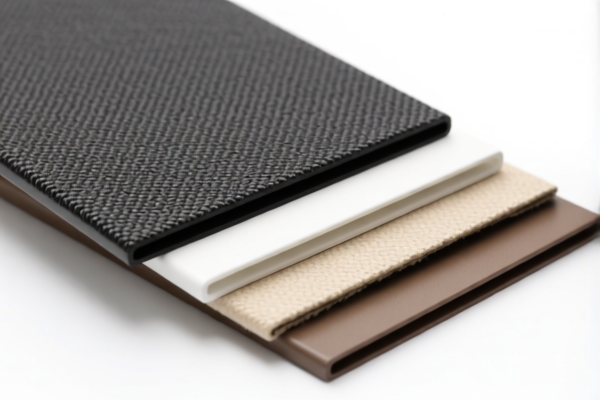

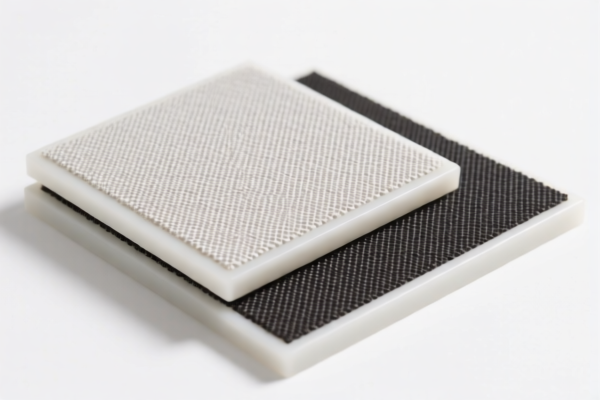

Product Name: PVC纺织复合地垫

Classification HS Codes and Tax Details:

- HS CODE: 3921121100

- Description: PVC纺织复合地垫符合HS编码3921的描述,属于塑料板、片、薄膜、箔和条的范畴,且符合8-10位HS编码对蜂窝塑料、以聚氯乙烯聚合物为基础、与纺织材料结合、纺织成分中人造纤维重量超过任何其他单一纺织纤维、塑料重量占比超过70%的要求。

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

-

HS CODE: 3921121500

- Description: PVC纺织品地垫符合HS编码3921的归类描述,PVC(氯乙烯聚合物)是塑料,且与纺织材料结合,描述与8-10位HS编码的解释相符。

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

-

HS CODE: 3921121910

- Description: PVC纺织品地垫符合HS编码3921121950的归类解释,该商品为PVC(氯乙烯聚合物)制成的纺织品,属于塑料板、片、薄膜、箔和条,且未明确说明纺织成分重量超过任何单一纺织纤维的重量,因此归类为3921121950的“其他”类别。

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

-

HS CODE: 3921125000

- Description: PVC地垫是聚氯乙烯(PVC)制成的板材,符合HS编码3921开头的归类描述,HS编码3921涵盖了其他塑料板、片、薄膜、箔和条,包括由氯乙烯聚合物制成的泡沫塑料板、片、薄膜、箔和条。

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

-

HS CODE: 3904400000

- Description: PVC地垫是聚氯乙烯(PVC)制品,符合HS编码3904聚氯乙烯或其他卤代烯烃的聚合物,初级形态的归类描述,更具体到其他聚氯乙烯共聚物(8-10位编码),PVC地垫通常被归类于此。

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

✅ Proactive Advice:

- Verify Material Composition: Ensure the product is indeed a composite of PVC and textile materials, and confirm the weight ratio of plastic to textile components, as this will determine the correct HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Monitor Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, which may significantly increase the total import cost.

-

Consult Customs Authority: For precise classification, it is recommended to consult with local customs or a customs broker to ensure compliance and avoid delays. Product Name: PVC纺织复合地垫

Classification HS Codes and Tax Details: -

HS CODE: 3921121100

- Description: PVC纺织复合地垫符合HS编码3921的描述,属于塑料板、片、薄膜、箔和条的范畴,且符合8-10位HS编码对蜂窝塑料、以聚氯乙烯聚合物为基础、与纺织材料结合、纺织成分中人造纤维重量超过任何其他单一纺织纤维、塑料重量占比超过70%的要求。

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

-

HS CODE: 3921121500

- Description: PVC纺织品地垫符合HS编码3921的归类描述,PVC(氯乙烯聚合物)是塑料,且与纺织材料结合,描述与8-10位HS编码的解释相符。

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

-

HS CODE: 3921121910

- Description: PVC纺织品地垫符合HS编码3921121950的归类解释,该商品为PVC(氯乙烯聚合物)制成的纺织品,属于塑料板、片、薄膜、箔和条,且未明确说明纺织成分重量超过任何单一纺织纤维的重量,因此归类为3921121950的“其他”类别。

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

-

HS CODE: 3921125000

- Description: PVC地垫是聚氯乙烯(PVC)制成的板材,符合HS编码3921开头的归类描述,HS编码3921涵盖了其他塑料板、片、薄膜、箔和条,包括由氯乙烯聚合物制成的泡沫塑料板、片、薄膜、箔和条。

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

-

HS CODE: 3904400000

- Description: PVC地垫是聚氯乙烯(PVC)制品,符合HS编码3904聚氯乙烯或其他卤代烯烃的聚合物,初级形态的归类描述,更具体到其他聚氯乙烯共聚物(8-10位编码),PVC地垫通常被归类于此。

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

✅ Proactive Advice:

- Verify Material Composition: Ensure the product is indeed a composite of PVC and textile materials, and confirm the weight ratio of plastic to textile components, as this will determine the correct HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Monitor Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, which may significantly increase the total import cost.

- Consult Customs Authority: For precise classification, it is recommended to consult with local customs or a customs broker to ensure compliance and avoid delays.

Customer Reviews

No reviews yet.