| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

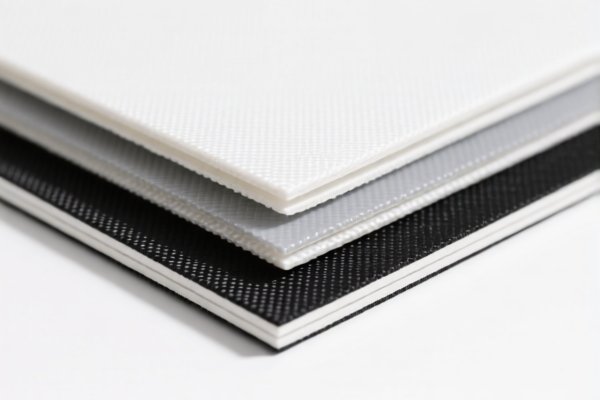

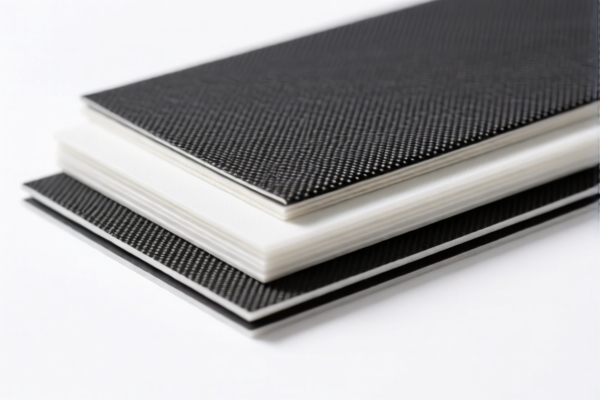

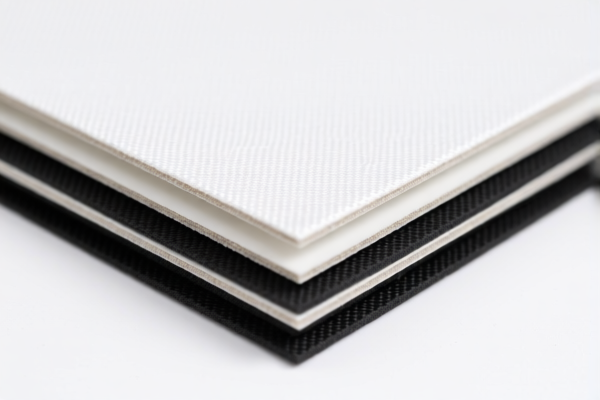

Product Name: PVC纺织复合地毯

Classification HS Code: 3921121100 (Primary) / 3920435000 / 3921121910 (Alternative)

🔍 HS Code Classification Summary

- 3921121100

- Description: PVC纺织复合地毯,属于蜂窝塑料,以聚氯乙烯聚合物为基础,与纺织材料结合,纺织成分中人造纤维重量超过任何其他单一纺织纤维,且塑料重量占比超过70%。

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3920435000

- Description: PVC地毯,属于氯乙烯聚合物制成的塑料板、片、薄膜,通常含有增塑剂以增加柔韧性。

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3921121910

- Description: PVC纺织品地垫,属于塑料板、片、薄膜、箔和条,未明确说明纺织成分重量超过任何单一纺织纤维的重量,归类为“其他”类别。

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes and Policies

- April 11, 2025 Special Tariff:

- Applies to all three HS codes listed above.

-

Additional 30.0% tariff will be imposed after April 11, 2025.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product category (PVC纺织复合地毯).

📌 Proactive Advice for Importers

- Verify Material Composition:

- Ensure the product meets the criteria for 3921121100 (e.g., plastic content >70%, synthetic fiber dominates textile components).

-

If unsure, consider 3921121910 as a fallback category.

-

Check Unit Price and Certification:

-

Confirm the unit price and whether certifications (e.g., fire resistance, environmental compliance) are required for import.

-

Monitor Tariff Updates:

-

Be aware of the April 11, 2025 deadline for the special tariff. Consider adjusting pricing or sourcing strategies accordingly.

-

Consult Customs Broker:

- For accurate classification and compliance, especially if the product has mixed materials or unclear composition.

✅ Summary Table

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) |

|---|---|---|---|---|---|

| 3921121100 | PVC纺织复合地毯,塑料含量>70% | 59.2% | 4.2% | 25.0% | 30.0% |

| 3920435000 | PVC地毯,氯乙烯聚合物制成 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921121910 | PVC纺织品地垫,未明确纺织成分占比 | 60.3% | 5.3% | 25.0% | 30.0% |

If you have more details about the product (e.g., exact composition, intended use, or country of origin), I can provide a more tailored classification and compliance strategy.

Product Name: PVC纺织复合地毯

Classification HS Code: 3921121100 (Primary) / 3920435000 / 3921121910 (Alternative)

🔍 HS Code Classification Summary

- 3921121100

- Description: PVC纺织复合地毯,属于蜂窝塑料,以聚氯乙烯聚合物为基础,与纺织材料结合,纺织成分中人造纤维重量超过任何其他单一纺织纤维,且塑料重量占比超过70%。

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3920435000

- Description: PVC地毯,属于氯乙烯聚合物制成的塑料板、片、薄膜,通常含有增塑剂以增加柔韧性。

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3921121910

- Description: PVC纺织品地垫,属于塑料板、片、薄膜、箔和条,未明确说明纺织成分重量超过任何单一纺织纤维的重量,归类为“其他”类别。

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes and Policies

- April 11, 2025 Special Tariff:

- Applies to all three HS codes listed above.

-

Additional 30.0% tariff will be imposed after April 11, 2025.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product category (PVC纺织复合地毯).

📌 Proactive Advice for Importers

- Verify Material Composition:

- Ensure the product meets the criteria for 3921121100 (e.g., plastic content >70%, synthetic fiber dominates textile components).

-

If unsure, consider 3921121910 as a fallback category.

-

Check Unit Price and Certification:

-

Confirm the unit price and whether certifications (e.g., fire resistance, environmental compliance) are required for import.

-

Monitor Tariff Updates:

-

Be aware of the April 11, 2025 deadline for the special tariff. Consider adjusting pricing or sourcing strategies accordingly.

-

Consult Customs Broker:

- For accurate classification and compliance, especially if the product has mixed materials or unclear composition.

✅ Summary Table

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) |

|---|---|---|---|---|---|

| 3921121100 | PVC纺织复合地毯,塑料含量>70% | 59.2% | 4.2% | 25.0% | 30.0% |

| 3920435000 | PVC地毯,氯乙烯聚合物制成 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921121910 | PVC纺织品地垫,未明确纺织成分占比 | 60.3% | 5.3% | 25.0% | 30.0% |

If you have more details about the product (e.g., exact composition, intended use, or country of origin), I can provide a more tailored classification and compliance strategy.

Customer Reviews

No reviews yet.