| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918104010 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103110 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

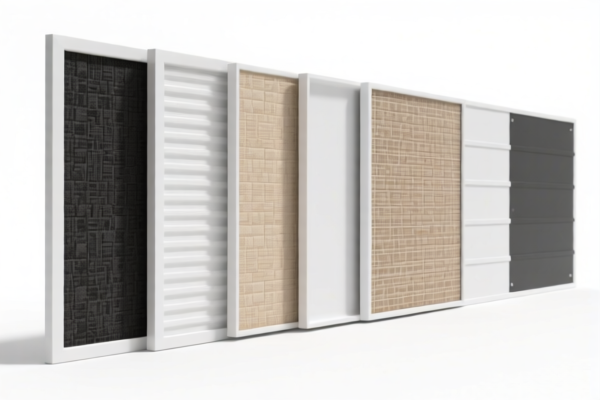

Product Name: PVC纺织复合墙布 (PVC Textile Composite Wall Fabric)

Classification: Plastic products combined with textile materials, used as wall coverings.

✅ HS CODE Classification Overview

Below are the relevant HS codes and their corresponding tax details for PVC纺织复合墙布:

🔢 HS CODE: 3921121910

Description: PVC纺织复合墙布,属于塑料板、片、薄膜、箔和条,与纺织材料结合的墙布

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

🔢 HS CODE: 3918104010

Description: PVC纺织复合墙布,属于塑料制的带有纺织纤维背衬的墙面覆盖物

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

🔢 HS CODE: 3921121100

Description: PVC纺织复合墙布,属于乙烯基聚合物(PVC)制成的、与纺织材料结合、且纺织组分中人造纤维重量超过任何其他单一纺织纤维、塑料重量超过70%的塑料板、片、薄膜、箔和条

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

🔢 HS CODE: 3918103110

Description: PVC纺织壁布,属于塑料制的带有纺织纤维背衬的墙面材料

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

🔢 HS CODE: 3921121910 (Alternative Use: Advertising Fabric)

Description: PVC纺织复合广告布,属于塑料板、片、薄膜、箔和条,与纺织材料结合的广告布

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: This is a time-sensitive policy. If your goods are imported after April 11, 2025, the additional 30.0% tariff will apply.

- Material Composition: Ensure the product description clearly states the percentage of plastic vs. textile components, especially if using HS CODE 3921121100 (which requires plastic to be over 70%).

- Certifications: Confirm if any import certifications or product standards are required for the specific use (e.g., wall coverings vs. advertising fabric).

- Unit Price: Verify the unit price and material breakdown to ensure correct classification and avoid misclassification penalties.

📌 Proactive Advice

- Double-check the product composition (e.g., percentage of PVC vs. textile) to determine the most accurate HS code.

- Consult with customs brokers or import agents to confirm the latest regulations and ensure compliance.

- Keep records of product specifications and supplier documentation to support customs declarations.

Let me know if you need help with customs declaration forms or tariff calculation tools.

Product Name: PVC纺织复合墙布 (PVC Textile Composite Wall Fabric)

Classification: Plastic products combined with textile materials, used as wall coverings.

✅ HS CODE Classification Overview

Below are the relevant HS codes and their corresponding tax details for PVC纺织复合墙布:

🔢 HS CODE: 3921121910

Description: PVC纺织复合墙布,属于塑料板、片、薄膜、箔和条,与纺织材料结合的墙布

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

🔢 HS CODE: 3918104010

Description: PVC纺织复合墙布,属于塑料制的带有纺织纤维背衬的墙面覆盖物

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

🔢 HS CODE: 3921121100

Description: PVC纺织复合墙布,属于乙烯基聚合物(PVC)制成的、与纺织材料结合、且纺织组分中人造纤维重量超过任何其他单一纺织纤维、塑料重量超过70%的塑料板、片、薄膜、箔和条

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

🔢 HS CODE: 3918103110

Description: PVC纺织壁布,属于塑料制的带有纺织纤维背衬的墙面材料

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

🔢 HS CODE: 3921121910 (Alternative Use: Advertising Fabric)

Description: PVC纺织复合广告布,属于塑料板、片、薄膜、箔和条,与纺织材料结合的广告布

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0% after April 11, 2025)

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: This is a time-sensitive policy. If your goods are imported after April 11, 2025, the additional 30.0% tariff will apply.

- Material Composition: Ensure the product description clearly states the percentage of plastic vs. textile components, especially if using HS CODE 3921121100 (which requires plastic to be over 70%).

- Certifications: Confirm if any import certifications or product standards are required for the specific use (e.g., wall coverings vs. advertising fabric).

- Unit Price: Verify the unit price and material breakdown to ensure correct classification and avoid misclassification penalties.

📌 Proactive Advice

- Double-check the product composition (e.g., percentage of PVC vs. textile) to determine the most accurate HS code.

- Consult with customs brokers or import agents to confirm the latest regulations and ensure compliance.

- Keep records of product specifications and supplier documentation to support customs declarations.

Let me know if you need help with customs declaration forms or tariff calculation tools.

Customer Reviews

No reviews yet.