| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

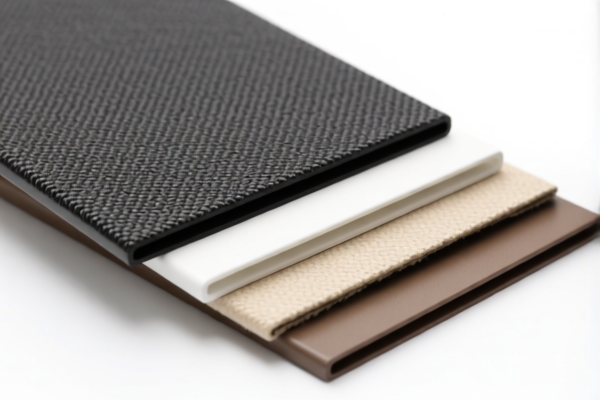

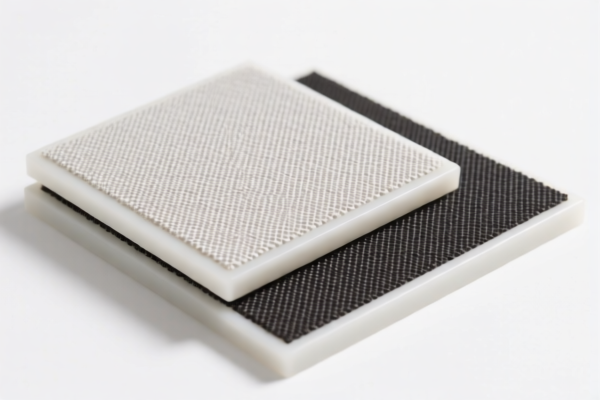

Product Name: PVC纺织复合宠物垫

Classification HS Code Analysis:

- HS CODE: 3921121100

- Description: PVC纺织复合宠物垫,符合HS编码3921的归类描述,塑料重量占比超过70%。

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to products where the plastic component (PVC) accounts for more than 70% of the total weight.

-

HS CODE: 3921121910

- Description: PVC涂层纺织品宠物垫,符合HS编码3921121910的归类描述,不满足蔬菜纤维含量超过任何其他单一纺织纤维的要求。

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to products where the textile component does not meet the requirement of vegetable fiber content exceeding any other single fiber type.

-

HS CODE: 3921121100 (repeated for different product types)

- Description: PVC纺织复合地垫 / PVC纺织复合椅垫,符合HS编码3921的归类描述,塑料重量占比超过70%。

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is also applicable to other products like floor mats or chair pads, provided the plastic content is over 70%.

-

HS CODE: 3921121910 (repeated for different product types)

- Description: PVC纺织复合椅垫,符合HS编码3921121910的归类描述,蔬菜纤维含量超过任何单一纺织纤维。

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to products where the vegetable fiber content exceeds that of any other single fiber type.

✅ Key Tax Rate Changes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all the above HS codes after this date.

- Anti-dumping duties: Not applicable for this product category.

- Base Tariff: Varies between 4.2% and 5.3% depending on the specific HS code.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product's plastic content is accurately measured and documented, especially if it exceeds 70%.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., safety, environmental compliance) are required for import.

- Review HS Code Classification: Double-check the classification based on the exact product type (e.g., pet pad, chair pad, floor mat) and fiber composition.

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the additional 30.0% tariff.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: PVC纺织复合宠物垫

Classification HS Code Analysis:

- HS CODE: 3921121100

- Description: PVC纺织复合宠物垫,符合HS编码3921的归类描述,塑料重量占比超过70%。

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to products where the plastic component (PVC) accounts for more than 70% of the total weight.

-

HS CODE: 3921121910

- Description: PVC涂层纺织品宠物垫,符合HS编码3921121910的归类描述,不满足蔬菜纤维含量超过任何其他单一纺织纤维的要求。

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to products where the textile component does not meet the requirement of vegetable fiber content exceeding any other single fiber type.

-

HS CODE: 3921121100 (repeated for different product types)

- Description: PVC纺织复合地垫 / PVC纺织复合椅垫,符合HS编码3921的归类描述,塑料重量占比超过70%。

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is also applicable to other products like floor mats or chair pads, provided the plastic content is over 70%.

-

HS CODE: 3921121910 (repeated for different product types)

- Description: PVC纺织复合椅垫,符合HS编码3921121910的归类描述,蔬菜纤维含量超过任何单一纺织纤维。

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to products where the vegetable fiber content exceeds that of any other single fiber type.

✅ Key Tax Rate Changes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all the above HS codes after this date.

- Anti-dumping duties: Not applicable for this product category.

- Base Tariff: Varies between 4.2% and 5.3% depending on the specific HS code.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product's plastic content is accurately measured and documented, especially if it exceeds 70%.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., safety, environmental compliance) are required for import.

- Review HS Code Classification: Double-check the classification based on the exact product type (e.g., pet pad, chair pad, floor mat) and fiber composition.

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the additional 30.0% tariff.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.