| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

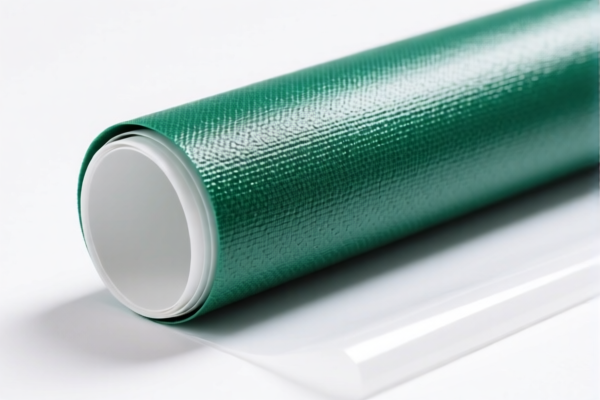

Product Name: PVC纺织复合床单

Classification HS Code: 3921121100

✅ HS CODE: 3921121100

Description:

- PVC纺织复合床单,由聚氯乙烯(PVC)制成,并与纺织材料结合。

- 符合HS编码3921的归类描述,其中塑料重量占比超过70%,纺织成分中人造纤维重量超过任何其他单一纺织纤维。

- 适用于类似产品如枕套、靠垫套等。

📊 Tariff Summary (as of now):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden. -

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are applicable for this product.

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure that the product meets the HS code criteria (e.g., PVC content >70%, textile fiber composition). This will help avoid misclassification and potential penalties. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import into the destination country. -

Monitor Tariff Updates:

Keep track of any changes in tariff policies, especially the April 11, 2025 deadline, to plan your import strategy accordingly.

📌 Alternative HS Codes (for reference):

- 3921121910 – For medical-grade PVC textile composite bed sheets (if applicable).

- 3921121500 – For other PVC textile composite products (e.g., non-medical or specialized use).

These alternatives may have higher tax rates (up to 61.5%) depending on the product's specific use and composition.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Name: PVC纺织复合床单

Classification HS Code: 3921121100

✅ HS CODE: 3921121100

Description:

- PVC纺织复合床单,由聚氯乙烯(PVC)制成,并与纺织材料结合。

- 符合HS编码3921的归类描述,其中塑料重量占比超过70%,纺织成分中人造纤维重量超过任何其他单一纺织纤维。

- 适用于类似产品如枕套、靠垫套等。

📊 Tariff Summary (as of now):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden. -

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are applicable for this product.

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure that the product meets the HS code criteria (e.g., PVC content >70%, textile fiber composition). This will help avoid misclassification and potential penalties. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import into the destination country. -

Monitor Tariff Updates:

Keep track of any changes in tariff policies, especially the April 11, 2025 deadline, to plan your import strategy accordingly.

📌 Alternative HS Codes (for reference):

- 3921121910 – For medical-grade PVC textile composite bed sheets (if applicable).

- 3921121500 – For other PVC textile composite products (e.g., non-medical or specialized use).

These alternatives may have higher tax rates (up to 61.5%) depending on the product's specific use and composition.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.