Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

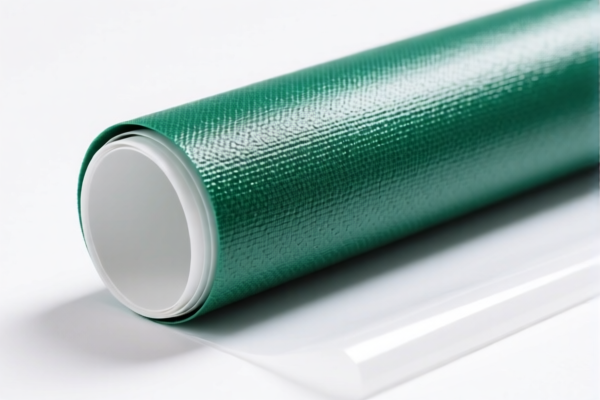

Product Name: PVC纺织复合收纳箱

HS CODE: 3921121100

✅ Classification Summary:

- The product is classified under HS CODE 3921121100, which falls under Chapter 39 (Plastics and articles thereof) and Heading 3921 (Plastic plates, sheets, film, foil and strip, of plastics, not elsewhere specified or included).

- The product is a composite of PVC (Polyvinyl Chloride) and textile materials, with plastic content exceeding 70% by weight.

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 59.2%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are applicable for this product.

- Material Verification Required: Ensure that the plastic content is over 70% by weight, as this is a key criterion for classification under HS CODE 3921121100.

- Certifications: Confirm if any customs or product certifications (e.g., material composition, safety standards) are required for import.

📌 Proactive Advice:

- Verify the exact composition of the product (PVC vs. textile ratio) to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult with customs brokers or trade compliance experts for accurate documentation and tariff calculation, especially with the upcoming April 11, 2025 tariff change.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Product Name: PVC纺织复合收纳箱

HS CODE: 3921121100

✅ Classification Summary:

- The product is classified under HS CODE 3921121100, which falls under Chapter 39 (Plastics and articles thereof) and Heading 3921 (Plastic plates, sheets, film, foil and strip, of plastics, not elsewhere specified or included).

- The product is a composite of PVC (Polyvinyl Chloride) and textile materials, with plastic content exceeding 70% by weight.

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 59.2%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are applicable for this product.

- Material Verification Required: Ensure that the plastic content is over 70% by weight, as this is a key criterion for classification under HS CODE 3921121100.

- Certifications: Confirm if any customs or product certifications (e.g., material composition, safety standards) are required for import.

📌 Proactive Advice:

- Verify the exact composition of the product (PVC vs. textile ratio) to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult with customs brokers or trade compliance experts for accurate documentation and tariff calculation, especially with the upcoming April 11, 2025 tariff change.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Customer Reviews

No reviews yet.