Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

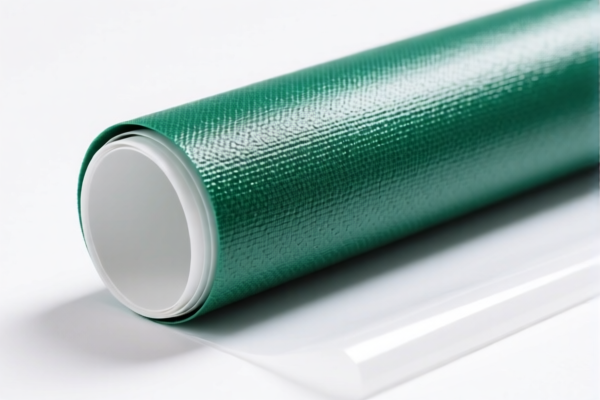

Product Name: PVC纺织复合枕套

Classification HS Code: 3921121100

🔍 HS Code Explanation:

- HS Code: 3921121100

- Description: PVC纺织复合制品,如枕套、靠垫套、床单等,符合HS编码3921的描述,适用于以聚氯乙烯聚合物为基础的蜂窝塑料,与纺织材料结合,且塑料重量占比超过70%。

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff is imposed on products classified under this HS code after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Composition: The product must have plastic (PVC) weight exceeding 70% to qualify under this HS code. If the plastic content is less than 70%, it may be classified under a different code (e.g., 6307 for textile products).

- Certifications Required: Ensure that the product meets any required certifications (e.g., safety, environmental compliance) for import into the target market.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of PVC in the product to ensure correct HS code classification.

- Check Unit Price: The final tax amount will depend on the product's value, so ensure accurate pricing for customs declaration.

- Review Certification Requirements: Some markets may require specific certifications (e.g., REACH, RoHS) for PVC-based products.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or classification rules, especially after April 11, 2025.

If you have more details about the product (e.g., exact composition, intended market), I can provide a more tailored classification and compliance strategy.

Product Name: PVC纺织复合枕套

Classification HS Code: 3921121100

🔍 HS Code Explanation:

- HS Code: 3921121100

- Description: PVC纺织复合制品,如枕套、靠垫套、床单等,符合HS编码3921的描述,适用于以聚氯乙烯聚合物为基础的蜂窝塑料,与纺织材料结合,且塑料重量占比超过70%。

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff is imposed on products classified under this HS code after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Composition: The product must have plastic (PVC) weight exceeding 70% to qualify under this HS code. If the plastic content is less than 70%, it may be classified under a different code (e.g., 6307 for textile products).

- Certifications Required: Ensure that the product meets any required certifications (e.g., safety, environmental compliance) for import into the target market.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of PVC in the product to ensure correct HS code classification.

- Check Unit Price: The final tax amount will depend on the product's value, so ensure accurate pricing for customs declaration.

- Review Certification Requirements: Some markets may require specific certifications (e.g., REACH, RoHS) for PVC-based products.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or classification rules, especially after April 11, 2025.

If you have more details about the product (e.g., exact composition, intended market), I can provide a more tailored classification and compliance strategy.

Customer Reviews

No reviews yet.