| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

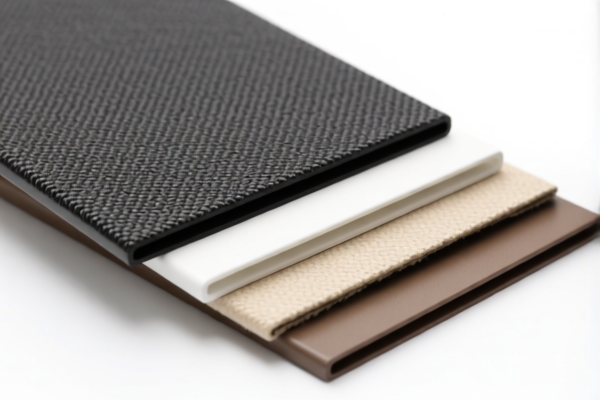

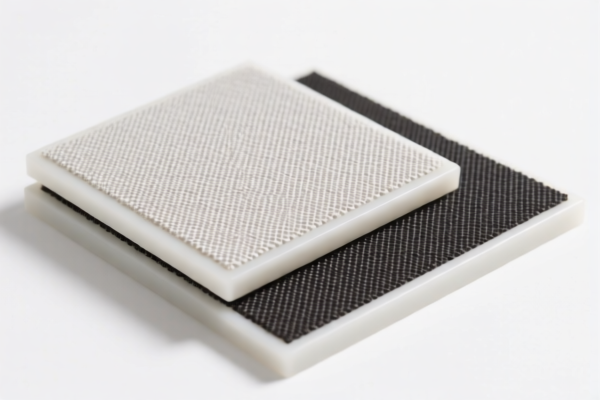

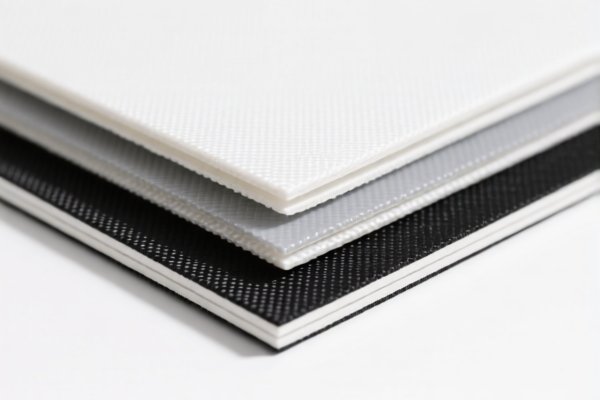

Product Classification: PVC Textile Composite Table Mat

HS CODE: 3921121910 or 3921121100 (depending on composition and fiber content)

🔍 Classification Summary:

- HS CODE 3921121910

- Applies to PVC textile composite table mats where vegetable fiber content exceeds any single textile fiber by weight.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

-

HS CODE 3921121100

- Applies to PVC textile composite table mats where plastic (PVC) weight exceeds 70%, and synthetic fiber content is higher than any other single textile fiber.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

📌 Key Tax Rate Changes:

- April 11, 2025 Special Tariff:

- Applies to both HS codes (3921121910 and 3921121100)

- 30.0% additional tariff will be imposed after April 11, 2025

-

This is a time-sensitive policy and must be considered in cost planning.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product (PVC textile composite table mats are not iron or aluminum-based).

🛠️ Proactive Advice:

- Verify Material Composition:

-

Confirm the weight percentage of PVC and fiber content (especially synthetic vs. vegetable fibers) to determine the correct HS code.

-

Check Unit Price and Certification:

-

Ensure the product meets customs compliance standards and any required certifications (e.g., textile content verification, plastic composition analysis).

-

Monitor Tariff Updates:

-

Keep track of April 11, 2025 and any potential additional tariffs that may affect your import costs.

-

Consider Alternative HS Codes:

- If the product is not textile-composite (e.g., pure PVC without textile), HS CODE 3920435000 may be applicable, but it has similar tax rates (59.2%).

✅ Conclusion:

- HS CODE 3921121910 is more likely if the product contains vegetable fiber content higher than any single textile fiber.

- HS CODE 3921121100 is more likely if PVC weight exceeds 70% and synthetic fiber is dominant.

- Total tax rate is 60.3% or 59.2%, with a 30.0% additional tariff after April 11, 2025.

- Act now to ensure compliance and cost control.

Product Classification: PVC Textile Composite Table Mat

HS CODE: 3921121910 or 3921121100 (depending on composition and fiber content)

🔍 Classification Summary:

- HS CODE 3921121910

- Applies to PVC textile composite table mats where vegetable fiber content exceeds any single textile fiber by weight.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

-

HS CODE 3921121100

- Applies to PVC textile composite table mats where plastic (PVC) weight exceeds 70%, and synthetic fiber content is higher than any other single textile fiber.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

📌 Key Tax Rate Changes:

- April 11, 2025 Special Tariff:

- Applies to both HS codes (3921121910 and 3921121100)

- 30.0% additional tariff will be imposed after April 11, 2025

-

This is a time-sensitive policy and must be considered in cost planning.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product (PVC textile composite table mats are not iron or aluminum-based).

🛠️ Proactive Advice:

- Verify Material Composition:

-

Confirm the weight percentage of PVC and fiber content (especially synthetic vs. vegetable fibers) to determine the correct HS code.

-

Check Unit Price and Certification:

-

Ensure the product meets customs compliance standards and any required certifications (e.g., textile content verification, plastic composition analysis).

-

Monitor Tariff Updates:

-

Keep track of April 11, 2025 and any potential additional tariffs that may affect your import costs.

-

Consider Alternative HS Codes:

- If the product is not textile-composite (e.g., pure PVC without textile), HS CODE 3920435000 may be applicable, but it has similar tax rates (59.2%).

✅ Conclusion:

- HS CODE 3921121910 is more likely if the product contains vegetable fiber content higher than any single textile fiber.

- HS CODE 3921121100 is more likely if PVC weight exceeds 70% and synthetic fiber is dominant.

- Total tax rate is 60.3% or 59.2%, with a 30.0% additional tariff after April 11, 2025.

- Act now to ensure compliance and cost control.

Customer Reviews

No reviews yet.