| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

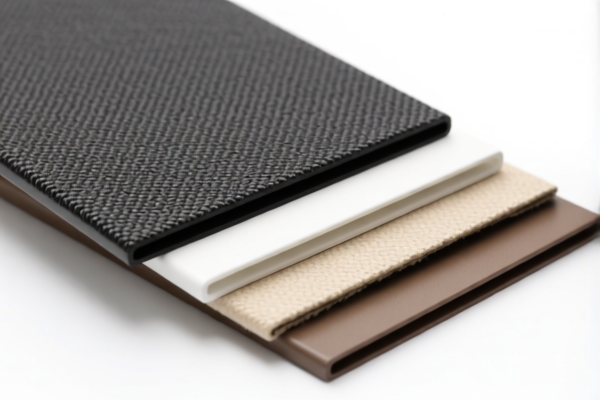

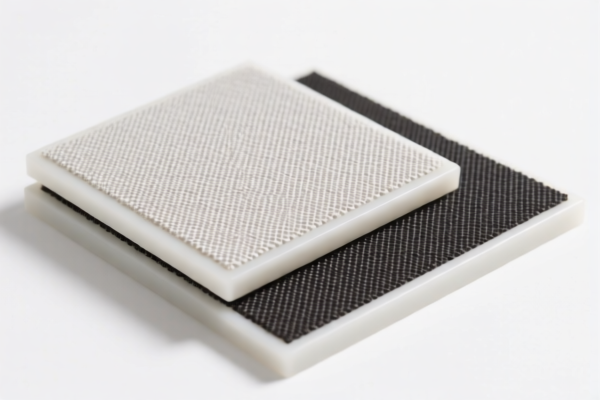

Product Name: PVC纺织复合椅垫

Classification HS Code: 3921.12.19.10 and 3921.12.11.00

🔍 HS Code Analysis and Taxation Overview

✅ HS Code 3921.12.19.10

Description:

- Plastic sheets, plates, films, foils, and strips based on polyvinyl chloride (PVC) polymer, combined with other textile materials.

- Key Condition: The product contains vegetable fiber content (by weight) that exceeds the content of any other single textile fiber.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

✅ HS Code 3921.12.11.00

Description:

- Plastic sheets, plates, films, foils, and strips based on polyvinyl chloride (PVC) polymer, combined with textile materials.

- Key Condition: The product contains man-made fiber content (by weight) that exceeds the content of any other single textile fiber.

- Plastic weight must be more than 70% of the total product weight.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to both HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, always verify with the latest customs announcements or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product meets the weight percentage criteria for either vegetable fiber or man-made fiber to qualify for the correct HS code. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., textile content verification, plastic composition analysis) are required for customs clearance. -

Plan for Tariff Increases:

If importing after April 11, 2025, be prepared for a 30% increase in the additional tariff. This could significantly impact your total import cost. -

Consult a Customs Broker:

For complex classifications or large-volume imports, it is advisable to work with a customs broker or compliance expert to ensure accurate classification and avoid delays or penalties.

Let me know if you need help determining which HS code applies to your specific product.

Product Name: PVC纺织复合椅垫

Classification HS Code: 3921.12.19.10 and 3921.12.11.00

🔍 HS Code Analysis and Taxation Overview

✅ HS Code 3921.12.19.10

Description:

- Plastic sheets, plates, films, foils, and strips based on polyvinyl chloride (PVC) polymer, combined with other textile materials.

- Key Condition: The product contains vegetable fiber content (by weight) that exceeds the content of any other single textile fiber.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

✅ HS Code 3921.12.11.00

Description:

- Plastic sheets, plates, films, foils, and strips based on polyvinyl chloride (PVC) polymer, combined with textile materials.

- Key Condition: The product contains man-made fiber content (by weight) that exceeds the content of any other single textile fiber.

- Plastic weight must be more than 70% of the total product weight.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to both HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, always verify with the latest customs announcements or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product meets the weight percentage criteria for either vegetable fiber or man-made fiber to qualify for the correct HS code. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., textile content verification, plastic composition analysis) are required for customs clearance. -

Plan for Tariff Increases:

If importing after April 11, 2025, be prepared for a 30% increase in the additional tariff. This could significantly impact your total import cost. -

Consult a Customs Broker:

For complex classifications or large-volume imports, it is advisable to work with a customs broker or compliance expert to ensure accurate classification and avoid delays or penalties.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.