| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

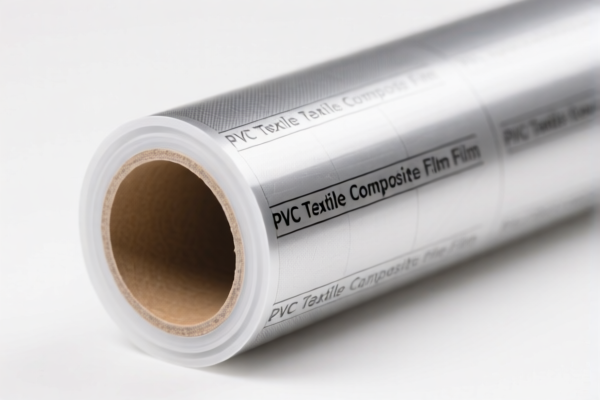

Product Classification: PVC Textile Composite Automotive Interior Materials

Below is the detailed classification and tariff information for the declared product "PVC纺织复合汽车内饰" (PVC Textile Composite Automotive Interior) based on the provided HS codes and tax details:

🔍 HS Code Classification Overview

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3921121100 | PVC纺织复合汽车内饰,塑料重量占比超过70% | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921121910 | PVC纺织复合汽车内饰布,植物纤维重量超过其他单一纺织纤维 | 60.3% | 5.3% | 25.0% | 30.0% |

| 3921121500 | PVC纺织品汽车内饰,由氯乙烯聚合物制成并结合纺织材料 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921121950 | PVC纺织品汽车内饰布,不符合植物纤维重量超过其他单一纺织纤维的要求 | 60.3% | 5.3% | 25.0% | 30.0% |

| 5903102500 | PVC涂层聚酯纤维汽车内饰布,属于纺织品制品 | 62.5% | 7.5% | 25.0% | 30.0% |

📌 Key Notes on Tax Rates

- Base Tariff: Varies from 4.2% to 7.5%, depending on the specific HS code.

- Additional Tariff: 25.0% applied to all listed HS codes.

- April 11, 2025 Special Tariff: 30.0% added after April 11, 2025, for all listed HS codes.

- Total Tax Rate: Ranges from 59.2% to 62.5%, depending on the HS code.

⚠️ Important Alerts

- April 11, 2025 Special Tariff: This is a time-sensitive policy. Ensure your customs clearance is completed before April 11, 2025, if possible, to avoid the additional 30% tariff.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable for PVC or textile products.

- Material Composition: The classification depends heavily on the weight ratio of PVC to textile and the type of textile fiber used (e.g., plant fiber vs. synthetic fiber).

✅ Proactive Advice for Importers

- Verify Material Composition: Confirm the PVC weight percentage and textile fiber type (e.g., plant fiber, polyester, etc.) to ensure correct HS code classification.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., textile origin, environmental compliance).

- Consult Customs Broker: For complex classifications, especially when multiple HS codes are applicable, seek professional customs advice.

- Plan for Tariff Increases: With the 30% additional tariff after April 11, 2025, consider adjusting pricing or sourcing strategies accordingly.

Let me know if you need help determining the most accurate HS code for your specific product composition. Product Classification: PVC Textile Composite Automotive Interior Materials

Below is the detailed classification and tariff information for the declared product "PVC纺织复合汽车内饰" (PVC Textile Composite Automotive Interior) based on the provided HS codes and tax details:

🔍 HS Code Classification Overview

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3921121100 | PVC纺织复合汽车内饰,塑料重量占比超过70% | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921121910 | PVC纺织复合汽车内饰布,植物纤维重量超过其他单一纺织纤维 | 60.3% | 5.3% | 25.0% | 30.0% |

| 3921121500 | PVC纺织品汽车内饰,由氯乙烯聚合物制成并结合纺织材料 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921121950 | PVC纺织品汽车内饰布,不符合植物纤维重量超过其他单一纺织纤维的要求 | 60.3% | 5.3% | 25.0% | 30.0% |

| 5903102500 | PVC涂层聚酯纤维汽车内饰布,属于纺织品制品 | 62.5% | 7.5% | 25.0% | 30.0% |

📌 Key Notes on Tax Rates

- Base Tariff: Varies from 4.2% to 7.5%, depending on the specific HS code.

- Additional Tariff: 25.0% applied to all listed HS codes.

- April 11, 2025 Special Tariff: 30.0% added after April 11, 2025, for all listed HS codes.

- Total Tax Rate: Ranges from 59.2% to 62.5%, depending on the HS code.

⚠️ Important Alerts

- April 11, 2025 Special Tariff: This is a time-sensitive policy. Ensure your customs clearance is completed before April 11, 2025, if possible, to avoid the additional 30% tariff.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable for PVC or textile products.

- Material Composition: The classification depends heavily on the weight ratio of PVC to textile and the type of textile fiber used (e.g., plant fiber vs. synthetic fiber).

✅ Proactive Advice for Importers

- Verify Material Composition: Confirm the PVC weight percentage and textile fiber type (e.g., plant fiber, polyester, etc.) to ensure correct HS code classification.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., textile origin, environmental compliance).

- Consult Customs Broker: For complex classifications, especially when multiple HS codes are applicable, seek professional customs advice.

- Plan for Tariff Increases: With the 30% additional tariff after April 11, 2025, consider adjusting pricing or sourcing strategies accordingly.

Let me know if you need help determining the most accurate HS code for your specific product composition.

Customer Reviews

No reviews yet.