| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3924901010 | Doc | 33.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

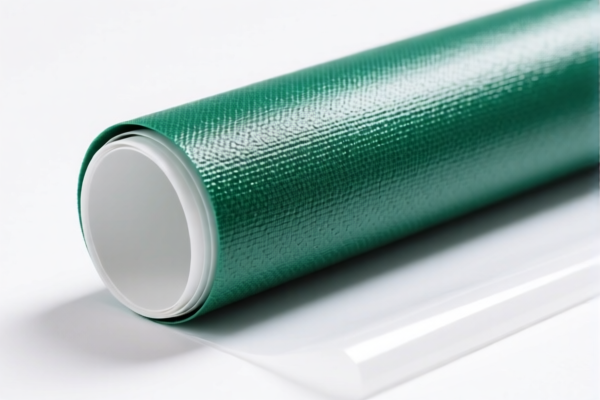

Product Name: PVC纺织复合浴帘

Classification HS Code: 3921121100

✅ HS Code Explanation:

- 3921121100 falls under Chapter 39 (Plastics and articles thereof) and Heading 3921 (Plastics and articles thereof: sheets, plates, films, foils and strips of plastics, of plastics and textile materials combined, etc.).

- This code applies to PVC textile composite products, where:

- The plastic (PVC) content exceeds 70% by weight.

- The textile component contains synthetic fibers that outweigh any other single textile fiber in weight.

- The product is a composite of plastic and textile materials (e.g., PVC-coated fabric).

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025, increasing the total tax rate to 59.2%.

- No Anti-dumping duties are currently applicable for this product.

- No specific anti-dumping duties on iron or aluminum are relevant here, as the product is PVC-based.

📌 Proactive Advice:

- Verify Material Composition: Ensure that the PVC content exceeds 70% and that synthetic fibers dominate the textile component.

- Check Unit Price and Certification: Confirm whether customs documentation (e.g., material certificates, product specifications) is required for compliance.

- Monitor Tariff Updates: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consider Alternative HS Codes: If the product is not clearly a composite of PVC and textile, consider 3924901010 (for general plastic household items like curtains).

🔄 Alternative HS Code (if applicable):

- 3924901010 – For PVC-made household items (e.g., curtains), where the plastic is the primary component and not explicitly combined with textile materials.

- Total Tax Rate: 33.3% (lower than 3921121100)

- Base Tariff: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

✅ Conclusion:

For PVC纺织复合浴帘, the most accurate HS code is 3921121100, with a total tax rate of 59.2%. Ensure your product meets the material composition criteria and be prepared for the tariff increase after April 11, 2025. If the product is not clearly a composite, consider 3924901010 for a lower tax rate.

Product Name: PVC纺织复合浴帘

Classification HS Code: 3921121100

✅ HS Code Explanation:

- 3921121100 falls under Chapter 39 (Plastics and articles thereof) and Heading 3921 (Plastics and articles thereof: sheets, plates, films, foils and strips of plastics, of plastics and textile materials combined, etc.).

- This code applies to PVC textile composite products, where:

- The plastic (PVC) content exceeds 70% by weight.

- The textile component contains synthetic fibers that outweigh any other single textile fiber in weight.

- The product is a composite of plastic and textile materials (e.g., PVC-coated fabric).

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025, increasing the total tax rate to 59.2%.

- No Anti-dumping duties are currently applicable for this product.

- No specific anti-dumping duties on iron or aluminum are relevant here, as the product is PVC-based.

📌 Proactive Advice:

- Verify Material Composition: Ensure that the PVC content exceeds 70% and that synthetic fibers dominate the textile component.

- Check Unit Price and Certification: Confirm whether customs documentation (e.g., material certificates, product specifications) is required for compliance.

- Monitor Tariff Updates: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consider Alternative HS Codes: If the product is not clearly a composite of PVC and textile, consider 3924901010 (for general plastic household items like curtains).

🔄 Alternative HS Code (if applicable):

- 3924901010 – For PVC-made household items (e.g., curtains), where the plastic is the primary component and not explicitly combined with textile materials.

- Total Tax Rate: 33.3% (lower than 3921121100)

- Base Tariff: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

✅ Conclusion:

For PVC纺织复合浴帘, the most accurate HS code is 3921121100, with a total tax rate of 59.2%. Ensure your product meets the material composition criteria and be prepared for the tariff increase after April 11, 2025. If the product is not clearly a composite, consider 3924901010 for a lower tax rate.

Customer Reviews

No reviews yet.