| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

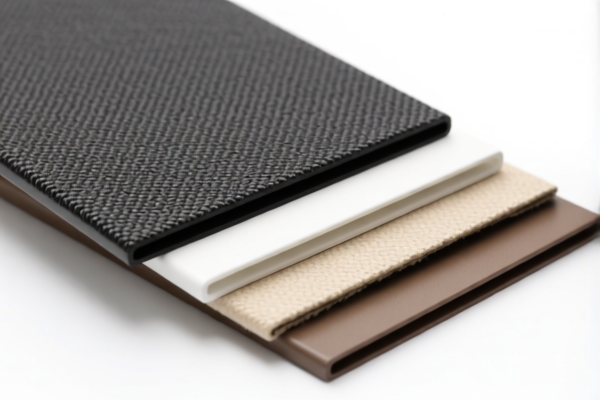

Product Name: PVC纺织复合野餐垫

Classification HS Codes and Tax Details:

✅ HS CODE: 3921121100

Description: PVC纺织复合野餐垫,符合HS编码3921的描述,PVC(聚氯乙烯聚合物)属于塑料,"纺织复合"表明与纺织材料结合,符合8-10位HS编码的"与纺织材料结合"的描述,并且野餐垫的塑料重量占比可能超过70%。

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921121910

Description: PVC加厚纺织品野餐垫,符合HS编码3921121910的描述,PVC(聚氯乙烯聚合物)是主要材料,并且产品为纺织材料结合的塑料板、片、薄膜,且产品中以重量计占主导地位的蔬菜纤维超过任何其他单一纺织纤维。

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921901500

Description: 纺织复合塑料野餐垫,符合HS编码3921901500的描述,该商品为纺织材料与塑料复合的板、片、薄膜,且重量可能在1.492千克/平方米以内,人造纤维重量超过任何其他单一纺织纤维,属于"其他"类别。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921121950

Description: PVC纺织品野餐布,符合HS编码3921.12.19.50的归类描述,因为其是PVC(聚氯乙烯聚合物)为基础的,与纺织材料结合的塑料板、片、薄膜、箔和条,且不符合植物纤维重量超过任何单一纺织纤维的要求。

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921121100 (Duplicate Entry)

Description: PVC纺织复合餐垫,符合HS编码3921的归类描述,该商品为以聚氯乙烯(PVC)为基础的纺织复合材料板材,符合8-10位HS编码的描述:以聚氯乙烯聚合物为基础,与纺织材料结合,纺织成分中人造纤维重量超过任何其他单一纺织纤维,塑料重量占比超过70%。

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

📌 Proactive Advice:

- Verify Material Composition: Ensure the product's composition (e.g., PVC weight percentage, type of textile fiber) aligns with the selected HS code.

- Check Unit Price and Certification: Confirm if any certifications (e.g., environmental, safety) are required for import.

- Monitor Tariff Changes: Be aware that the April 11, 2025 special tariff will increase the total tax rate by 30.0% for all listed HS codes.

- Consult Customs Authority: For final classification, always confirm with local customs or a qualified customs broker.

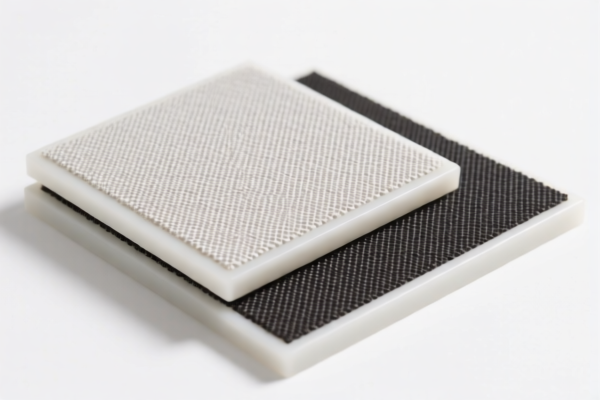

Product Name: PVC纺织复合野餐垫

Classification HS Codes and Tax Details:

✅ HS CODE: 3921121100

Description: PVC纺织复合野餐垫,符合HS编码3921的描述,PVC(聚氯乙烯聚合物)属于塑料,"纺织复合"表明与纺织材料结合,符合8-10位HS编码的"与纺织材料结合"的描述,并且野餐垫的塑料重量占比可能超过70%。

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921121910

Description: PVC加厚纺织品野餐垫,符合HS编码3921121910的描述,PVC(聚氯乙烯聚合物)是主要材料,并且产品为纺织材料结合的塑料板、片、薄膜,且产品中以重量计占主导地位的蔬菜纤维超过任何其他单一纺织纤维。

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921901500

Description: 纺织复合塑料野餐垫,符合HS编码3921901500的描述,该商品为纺织材料与塑料复合的板、片、薄膜,且重量可能在1.492千克/平方米以内,人造纤维重量超过任何其他单一纺织纤维,属于"其他"类别。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921121950

Description: PVC纺织品野餐布,符合HS编码3921.12.19.50的归类描述,因为其是PVC(聚氯乙烯聚合物)为基础的,与纺织材料结合的塑料板、片、薄膜、箔和条,且不符合植物纤维重量超过任何单一纺织纤维的要求。

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921121100 (Duplicate Entry)

Description: PVC纺织复合餐垫,符合HS编码3921的归类描述,该商品为以聚氯乙烯(PVC)为基础的纺织复合材料板材,符合8-10位HS编码的描述:以聚氯乙烯聚合物为基础,与纺织材料结合,纺织成分中人造纤维重量超过任何其他单一纺织纤维,塑料重量占比超过70%。

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

📌 Proactive Advice:

- Verify Material Composition: Ensure the product's composition (e.g., PVC weight percentage, type of textile fiber) aligns with the selected HS code.

- Check Unit Price and Certification: Confirm if any certifications (e.g., environmental, safety) are required for import.

- Monitor Tariff Changes: Be aware that the April 11, 2025 special tariff will increase the total tax rate by 30.0% for all listed HS codes.

- Consult Customs Authority: For final classification, always confirm with local customs or a qualified customs broker.

Customer Reviews

No reviews yet.