| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

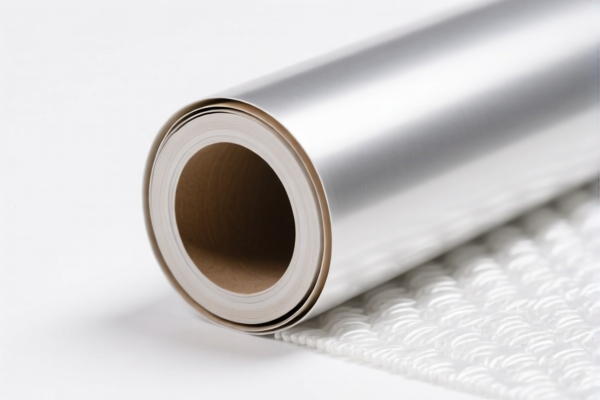

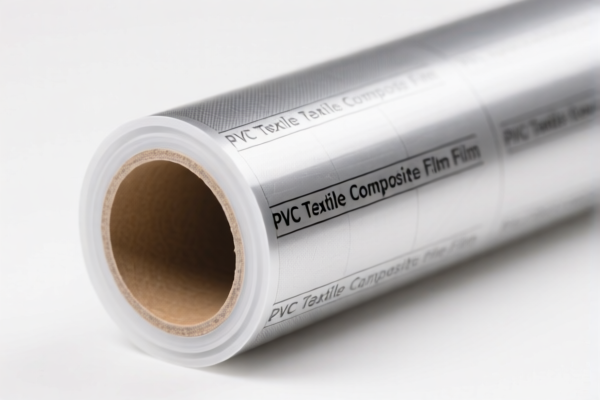

Product Name: PVC纺织复合防辐射布

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121910

Description:

- This code applies to PVC textile composite radiation-shielding fabric.

- The product is based on polyvinyl chloride (PVC) polymer combined with textile materials.

- The textile component contains vegetable fibers (e.g., cotton) that dominate in weight over any other single textile fiber.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921121950

Description:

- This code applies to PVC textile composite radiation-shielding fabric.

- The product is a plastic sheet, film, foil, or strip combined with textile materials.

- Does not meet the requirement that vegetable fibers dominate in weight over any other single textile fiber.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921901100

Description:

- This code applies to textile composite plastic radiation-shielding fabric.

- The product is a plastic sheet, film, or similar material combined with textile materials.

- Requirements:

- Weight ≤ 1.492 kg/m²

- Synthetic fibers dominate in weight over any other single textile fiber

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

📌 Important Notes and Recommendations:

- Material Verification: Confirm the exact composition of the fabric (e.g., PVC content, fiber types, and weight ratios) to ensure correct HS code classification.

- Unit Price and Certification: Check if any certifications (e.g., radiation shielding standards, safety approvals) are required for import.

- April 11, 2025 Policy Alert: Additional tariffs of 30% will apply after this date. Ensure compliance with updated regulations.

- Anti-Dumping Duties: Not applicable for this product category (plastic-textile composites), but always verify with customs or a compliance expert for the latest updates.

🛠️ Proactive Action Steps:

- Confirm the dominant fiber type (vegetable vs. synthetic) and PVC content.

- Review product specifications and certifications required for import.

- Consider tariff planning if importing in large quantities after April 11, 2025.

Product Name: PVC纺织复合防辐射布

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121910

Description:

- This code applies to PVC textile composite radiation-shielding fabric.

- The product is based on polyvinyl chloride (PVC) polymer combined with textile materials.

- The textile component contains vegetable fibers (e.g., cotton) that dominate in weight over any other single textile fiber.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921121950

Description:

- This code applies to PVC textile composite radiation-shielding fabric.

- The product is a plastic sheet, film, foil, or strip combined with textile materials.

- Does not meet the requirement that vegetable fibers dominate in weight over any other single textile fiber.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921901100

Description:

- This code applies to textile composite plastic radiation-shielding fabric.

- The product is a plastic sheet, film, or similar material combined with textile materials.

- Requirements:

- Weight ≤ 1.492 kg/m²

- Synthetic fibers dominate in weight over any other single textile fiber

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

📌 Important Notes and Recommendations:

- Material Verification: Confirm the exact composition of the fabric (e.g., PVC content, fiber types, and weight ratios) to ensure correct HS code classification.

- Unit Price and Certification: Check if any certifications (e.g., radiation shielding standards, safety approvals) are required for import.

- April 11, 2025 Policy Alert: Additional tariffs of 30% will apply after this date. Ensure compliance with updated regulations.

- Anti-Dumping Duties: Not applicable for this product category (plastic-textile composites), but always verify with customs or a compliance expert for the latest updates.

🛠️ Proactive Action Steps:

- Confirm the dominant fiber type (vegetable vs. synthetic) and PVC content.

- Review product specifications and certifications required for import.

- Consider tariff planning if importing in large quantities after April 11, 2025.

Customer Reviews

No reviews yet.