| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

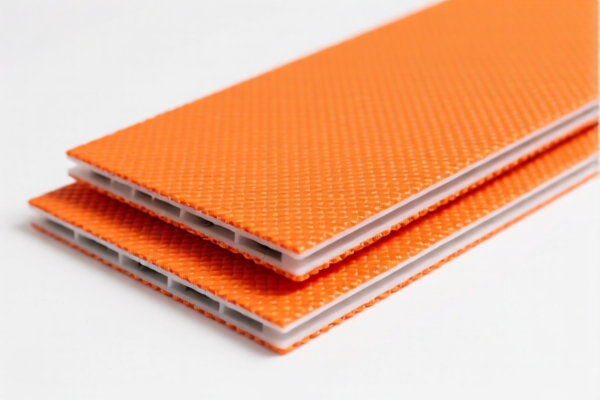

Product Name: PVC纺织复合阻燃布 (PVC Fire-Resistant Textile Composite Fabric)

Classification Analysis:

Below are the HS codes and corresponding tax details for the product PVC纺织复合阻燃布 (PVC fire-resistant textile composite fabric), based on the provided data:

✅ HS CODE: 3921121910

Description:

- PVC纺织复合阻燃布符合该HS编码,因其由聚氯乙烯(PVC)制成,并与纺织材料结合。

- Summary: This code applies to PVC-based textile composites with fire-resistant properties.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921901100

Description:

- 塑料纺织复合阻燃布符合该HS编码,因其为其他塑料板、片、薄膜、箔和条,与其他纺织材料结合且重量不超过1.492千克/平方米。

- Summary: Applies to plastic-textile composites with fire-resistant properties, where the plastic is not PVC and the composite weight is ≤1.492 kg/m².

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 5903101800

Description:

- PVC涂层聚酯纤维阻燃布符合该HS编码,因其为浸渍、涂覆、覆盖或层压有塑料的纺织品,以人造纤维为基础。

- Summary: Applies to fire-resistant textile products coated with PVC, based on synthetic fibers (e.g., polyester).

Tariff Details:

- Base Tariff Rate: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

✅ HS CODE: 3921121100

Description:

- PVC涂层阻燃布符合该HS编码,因其为塑料板、片、薄膜、箔和条,与纺织材料结合。

- Summary: Applies to PVC-coated fire-resistant textiles where the plastic is in the form of sheets, films, etc., combined with textile materials.

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 5903102010

Description:

- PVC涂层阻燃布符合该HS编码,因其为塑料浸渍、涂层、包覆或层压的纺织品,特别是用聚氯乙烯包覆纱线的纺织品。

- Summary: Applies to fire-resistant textiles coated with PVC, especially those with PVC-coated yarns.

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes.

-

This is a time-sensitive policy and should be considered in cost planning.

-

Material and Certification Check:

- Confirm the exact composition (e.g., whether it is PVC or other plastics, and the type of textile base).

-

Verify if fire-resistant certification or safety compliance documents are required for import.

-

Unit Price and Classification:

-

For HS codes like 3921901100, the weight per square meter is a critical factor. Ensure the product meets the ≤1.492 kg/m² requirement.

-

Tariff Variability:

- The base tariff varies significantly (from 0.0% to 14.1%), so HS code classification is crucial for accurate tax calculation.

🛑 Proactive Advice:

- Double-check the product composition and weight to ensure correct HS code selection.

- Consult customs or a compliance expert if the product is used in specific industries (e.g., construction, fire safety, etc.), as additional regulations may apply.

- Keep updated on policy changes, especially regarding the April 11, 2025 tariff adjustment.

Product Name: PVC纺织复合阻燃布 (PVC Fire-Resistant Textile Composite Fabric)

Classification Analysis:

Below are the HS codes and corresponding tax details for the product PVC纺织复合阻燃布 (PVC fire-resistant textile composite fabric), based on the provided data:

✅ HS CODE: 3921121910

Description:

- PVC纺织复合阻燃布符合该HS编码,因其由聚氯乙烯(PVC)制成,并与纺织材料结合。

- Summary: This code applies to PVC-based textile composites with fire-resistant properties.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921901100

Description:

- 塑料纺织复合阻燃布符合该HS编码,因其为其他塑料板、片、薄膜、箔和条,与其他纺织材料结合且重量不超过1.492千克/平方米。

- Summary: Applies to plastic-textile composites with fire-resistant properties, where the plastic is not PVC and the composite weight is ≤1.492 kg/m².

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 5903101800

Description:

- PVC涂层聚酯纤维阻燃布符合该HS编码,因其为浸渍、涂覆、覆盖或层压有塑料的纺织品,以人造纤维为基础。

- Summary: Applies to fire-resistant textile products coated with PVC, based on synthetic fibers (e.g., polyester).

Tariff Details:

- Base Tariff Rate: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

✅ HS CODE: 3921121100

Description:

- PVC涂层阻燃布符合该HS编码,因其为塑料板、片、薄膜、箔和条,与纺织材料结合。

- Summary: Applies to PVC-coated fire-resistant textiles where the plastic is in the form of sheets, films, etc., combined with textile materials.

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 5903102010

Description:

- PVC涂层阻燃布符合该HS编码,因其为塑料浸渍、涂层、包覆或层压的纺织品,特别是用聚氯乙烯包覆纱线的纺织品。

- Summary: Applies to fire-resistant textiles coated with PVC, especially those with PVC-coated yarns.

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes.

-

This is a time-sensitive policy and should be considered in cost planning.

-

Material and Certification Check:

- Confirm the exact composition (e.g., whether it is PVC or other plastics, and the type of textile base).

-

Verify if fire-resistant certification or safety compliance documents are required for import.

-

Unit Price and Classification:

-

For HS codes like 3921901100, the weight per square meter is a critical factor. Ensure the product meets the ≤1.492 kg/m² requirement.

-

Tariff Variability:

- The base tariff varies significantly (from 0.0% to 14.1%), so HS code classification is crucial for accurate tax calculation.

🛑 Proactive Advice:

- Double-check the product composition and weight to ensure correct HS code selection.

- Consult customs or a compliance expert if the product is used in specific industries (e.g., construction, fire safety, etc.), as additional regulations may apply.

- Keep updated on policy changes, especially regarding the April 11, 2025 tariff adjustment.

Customer Reviews

No reviews yet.