| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

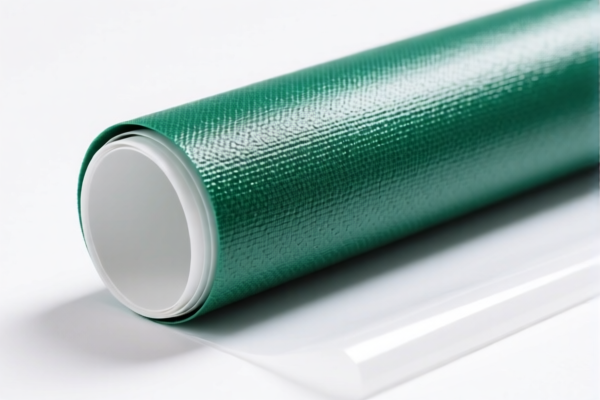

Product Name: PVC纺织复合隔热布

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121910

Description:

- PVC纺织复合隔热布,由PVC(聚氯乙烯)与纺织材料结合,属于塑料板、片、薄膜、箔和条类。

- 该产品中纺织成分中“蔬菜纤维”(可能为“植物纤维”的误译)重量占主导地位,超过其他任何单一纺织纤维。

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 5903101500

Description:

- PVC涂层聚酯纤维隔热布,属于“塑料浸渍、涂层或覆盖的纺织织物”。

- 聚酯纤维为人造纤维,符合该HS CODE的归类要求。

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

✅ HS CODE: 5903101800

Description:

- PVC涂层聚酯纤维隔热布,属于“塑料浸渍、涂层或覆盖的纺织织物”。

- 与上一个HS CODE类似,但归类更具体,适用于特定涂层或加工方式。

Tariff Summary:

- Base Tariff Rate: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

✅ HS CODE: 3921901100

Description:

- 纺织复合塑料隔热布,属于“其他塑料板、片、薄膜、箔和条”,且满足以下条件:

- 与其他纺织材料结合,重量不超过1.492千克/平方米

- 纺织成分中人造纤维重量超过其他任何单一纺织纤维

- 塑料重量超过70%

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921121910 (Duplicate Entry)

Note: This HS CODE is repeated in the input. The tax details and description are the same as the first entry.

📌 Important Notes and Recommendations:

- Verify Material Composition: Ensure the product's composition (e.g., percentage of PVC, type of textile fiber) matches the HS CODE description to avoid misclassification.

- Check Unit Price and Certification: Some HS CODEs may require specific certifications (e.g., textile or plastic content verification).

- April 11, 2025 Tariff Alert: A 30% additional tariff will apply after this date for all listed HS CODEs. Plan accordingly for cost estimation.

- Anti-Dumping Duties: Not explicitly mentioned in the data, but always verify if the product is subject to anti-dumping duties on iron or aluminum (if applicable).

- Consult Customs Authority: For final confirmation, especially if the product is close to the boundary of multiple HS CODEs.

Let me know if you need help with customs documentation or further classification clarification.

Product Name: PVC纺织复合隔热布

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121910

Description:

- PVC纺织复合隔热布,由PVC(聚氯乙烯)与纺织材料结合,属于塑料板、片、薄膜、箔和条类。

- 该产品中纺织成分中“蔬菜纤维”(可能为“植物纤维”的误译)重量占主导地位,超过其他任何单一纺织纤维。

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 5903101500

Description:

- PVC涂层聚酯纤维隔热布,属于“塑料浸渍、涂层或覆盖的纺织织物”。

- 聚酯纤维为人造纤维,符合该HS CODE的归类要求。

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

✅ HS CODE: 5903101800

Description:

- PVC涂层聚酯纤维隔热布,属于“塑料浸渍、涂层或覆盖的纺织织物”。

- 与上一个HS CODE类似,但归类更具体,适用于特定涂层或加工方式。

Tariff Summary:

- Base Tariff Rate: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

✅ HS CODE: 3921901100

Description:

- 纺织复合塑料隔热布,属于“其他塑料板、片、薄膜、箔和条”,且满足以下条件:

- 与其他纺织材料结合,重量不超过1.492千克/平方米

- 纺织成分中人造纤维重量超过其他任何单一纺织纤维

- 塑料重量超过70%

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921121910 (Duplicate Entry)

Note: This HS CODE is repeated in the input. The tax details and description are the same as the first entry.

📌 Important Notes and Recommendations:

- Verify Material Composition: Ensure the product's composition (e.g., percentage of PVC, type of textile fiber) matches the HS CODE description to avoid misclassification.

- Check Unit Price and Certification: Some HS CODEs may require specific certifications (e.g., textile or plastic content verification).

- April 11, 2025 Tariff Alert: A 30% additional tariff will apply after this date for all listed HS CODEs. Plan accordingly for cost estimation.

- Anti-Dumping Duties: Not explicitly mentioned in the data, but always verify if the product is subject to anti-dumping duties on iron or aluminum (if applicable).

- Consult Customs Authority: For final confirmation, especially if the product is close to the boundary of multiple HS CODEs.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.