| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

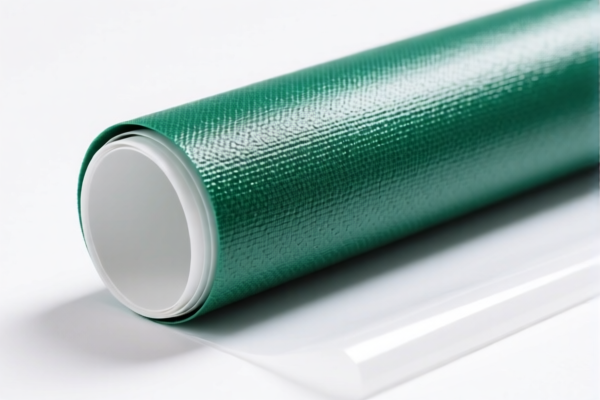

Product Name: PVC纺织复合靠垫套

Classification HS Code: 3921121100, 3921121500, 3921121910

✅ HS Code Classification Summary:

- HS Code 3921121100

- Description: PVC纺织复合靠垫套,由PVC(聚氯乙烯)与纺织材料结合,其中纺织成分中人造纤维重量超过其他单一纤维,且塑料重量占比超过70%。

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3921121500

- Description: PVC纺织品靠垫套,由氯乙烯聚合物制成,与其他纺织材料结合,纺织材料重量超过其他单一纤维。

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3921121910

- Description: PVC纺织复合椅垫,以聚氯乙烯为基础,与其他纺织材料结合,其中蔬菜纤维含量超过其他单一纺织纤维。

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes:

- April 11, 2025 Special Tariff:

- Applies to all three HS codes.

- Additional 30.0% tariff will be imposed after April 11, 2025.

-

This is a time-sensitive policy and must be considered in cost planning.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product category (PVC纺织复合 products are not subject to these duties).

📌 Proactive Advice for Importers:

- Verify Material Composition:

- Ensure the product meets the HS code criteria (e.g., plastic weight >70%, textile fiber type, etc.).

-

Misclassification may lead to higher tariffs or customs delays.

-

Check Unit Price and Certification Requirements:

- Confirm whether any certifications (e.g., textile standards, safety compliance) are required for import.

-

Some countries may require documentation for textile content or chemical composition.

-

Plan for Tariff Increases:

- If importing after April 11, 2025, budget for the 30.0% additional tariff.

-

Consider alternative HS codes or product modifications if cost is a concern.

-

Consult with Customs Broker:

- For accurate classification and compliance, especially if the product has mixed materials or unclear composition.

📊 Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3921121100 | PVC纺织复合靠垫套 (人造纤维) | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921121500 | PVC纺织品靠垫套 (纺织材料) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921121910 | PVC纺织复合椅垫 (蔬菜纤维) | 5.3% | 25.0% | 30.0% | 60.3% |

If you have more details about the product (e.g., exact composition, end-use, or country of origin), I can provide a more tailored classification and compliance strategy.

Product Name: PVC纺织复合靠垫套

Classification HS Code: 3921121100, 3921121500, 3921121910

✅ HS Code Classification Summary:

- HS Code 3921121100

- Description: PVC纺织复合靠垫套,由PVC(聚氯乙烯)与纺织材料结合,其中纺织成分中人造纤维重量超过其他单一纤维,且塑料重量占比超过70%。

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3921121500

- Description: PVC纺织品靠垫套,由氯乙烯聚合物制成,与其他纺织材料结合,纺织材料重量超过其他单一纤维。

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3921121910

- Description: PVC纺织复合椅垫,以聚氯乙烯为基础,与其他纺织材料结合,其中蔬菜纤维含量超过其他单一纺织纤维。

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes:

- April 11, 2025 Special Tariff:

- Applies to all three HS codes.

- Additional 30.0% tariff will be imposed after April 11, 2025.

-

This is a time-sensitive policy and must be considered in cost planning.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product category (PVC纺织复合 products are not subject to these duties).

📌 Proactive Advice for Importers:

- Verify Material Composition:

- Ensure the product meets the HS code criteria (e.g., plastic weight >70%, textile fiber type, etc.).

-

Misclassification may lead to higher tariffs or customs delays.

-

Check Unit Price and Certification Requirements:

- Confirm whether any certifications (e.g., textile standards, safety compliance) are required for import.

-

Some countries may require documentation for textile content or chemical composition.

-

Plan for Tariff Increases:

- If importing after April 11, 2025, budget for the 30.0% additional tariff.

-

Consider alternative HS codes or product modifications if cost is a concern.

-

Consult with Customs Broker:

- For accurate classification and compliance, especially if the product has mixed materials or unclear composition.

📊 Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3921121100 | PVC纺织复合靠垫套 (人造纤维) | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921121500 | PVC纺织品靠垫套 (纺织材料) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921121910 | PVC纺织复合椅垫 (蔬菜纤维) | 5.3% | 25.0% | 30.0% | 60.3% |

If you have more details about the product (e.g., exact composition, end-use, or country of origin), I can provide a more tailored classification and compliance strategy.

Customer Reviews

No reviews yet.