| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3924901010 | Doc | 33.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

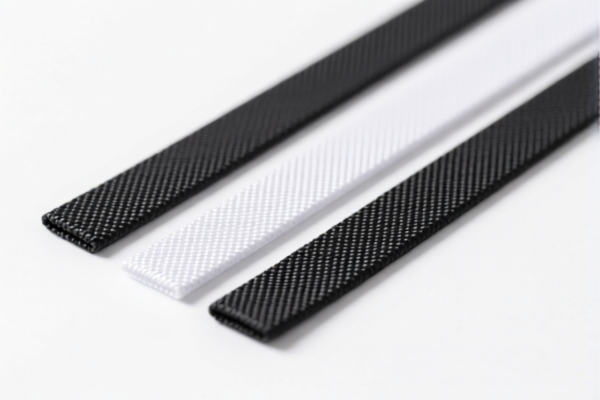

Product Name: PVC纺织复合餐垫

Classification HS Code Analysis:

- HS CODE: 3921121100

- Description: PVC纺织复合餐垫,符合HS编码3921的归类描述,塑料重量占比超过70%

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to products where the plastic component weighs more than 70% of the total weight.

-

HS CODE: 3921121950

- Description: PVC纺织品餐垫,符合HS编码3921.12.19.50的归类解释,商品描述中含有"PVC"和"纺织品"

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for products containing both PVC and textile materials, but with a lower base tariff compared to 3921121100.

-

HS CODE: 3924901010

- Description: PVC餐垫,符合HS编码3924901010的解释,该HS编码描述的是塑料制成的餐垫

- Total Tax Rate: 33.3%

- Tax Breakdown:

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to general plastic table mats without specific textile components. It has the lowest base tariff rate among the options.

Key Considerations:

-

Material Composition: The classification heavily depends on the weight ratio of plastic to textile. If the plastic content is over 70%, it falls under HS CODE 3921121100. If it contains both PVC and textile, it may fall under 3921121950.

-

Tariff Changes After April 11, 2025: All options will be subject to an additional 30.0% tariff, regardless of the base rate. This is a time-sensitive policy and must be accounted for in cost estimation.

-

Anti-Dumping Duties: Not applicable for this product category (no mention of anti-dumping duties on iron or aluminum).

-

Certifications Required: Ensure that the product meets customs compliance standards, including material declarations and weight verification. If the product is exported or imported, certifications such as product composition reports may be required.

Proactive Advice:

- Verify the exact composition and weight ratio of the product to determine the correct HS code.

- Check the unit price and total cost after applying all applicable tariffs, especially the April 11, 2025 special tariff.

- Consult with customs brokers or classification experts if the product contains multiple materials or if the classification is unclear.

-

Keep documentation such as material test reports and product specifications for customs inspections. Product Name: PVC纺织复合餐垫

Classification HS Code Analysis: -

HS CODE: 3921121100

- Description: PVC纺织复合餐垫,符合HS编码3921的归类描述,塑料重量占比超过70%

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to products where the plastic component weighs more than 70% of the total weight.

-

HS CODE: 3921121950

- Description: PVC纺织品餐垫,符合HS编码3921.12.19.50的归类解释,商品描述中含有"PVC"和"纺织品"

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for products containing both PVC and textile materials, but with a lower base tariff compared to 3921121100.

-

HS CODE: 3924901010

- Description: PVC餐垫,符合HS编码3924901010的解释,该HS编码描述的是塑料制成的餐垫

- Total Tax Rate: 33.3%

- Tax Breakdown:

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to general plastic table mats without specific textile components. It has the lowest base tariff rate among the options.

Key Considerations:

-

Material Composition: The classification heavily depends on the weight ratio of plastic to textile. If the plastic content is over 70%, it falls under HS CODE 3921121100. If it contains both PVC and textile, it may fall under 3921121950.

-

Tariff Changes After April 11, 2025: All options will be subject to an additional 30.0% tariff, regardless of the base rate. This is a time-sensitive policy and must be accounted for in cost estimation.

-

Anti-Dumping Duties: Not applicable for this product category (no mention of anti-dumping duties on iron or aluminum).

-

Certifications Required: Ensure that the product meets customs compliance standards, including material declarations and weight verification. If the product is exported or imported, certifications such as product composition reports may be required.

Proactive Advice:

- Verify the exact composition and weight ratio of the product to determine the correct HS code.

- Check the unit price and total cost after applying all applicable tariffs, especially the April 11, 2025 special tariff.

- Consult with customs brokers or classification experts if the product contains multiple materials or if the classification is unclear.

- Keep documentation such as material test reports and product specifications for customs inspections.

Customer Reviews

No reviews yet.