| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

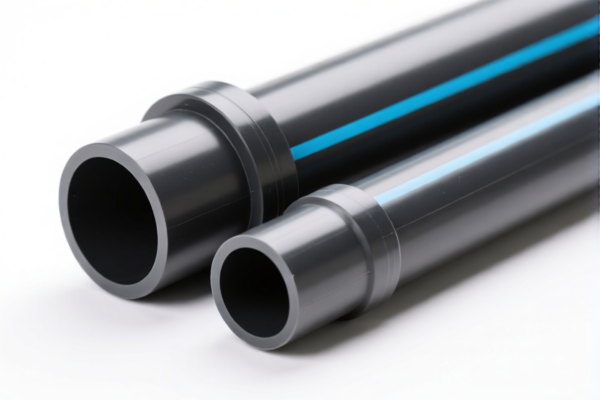

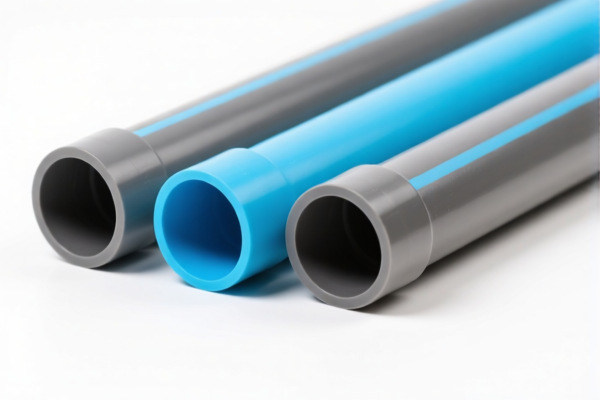

Product Classification: PVC给水管 (PVC Water Supply Pipes)

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 3917390020

Description: PVC给水管,材料为聚氯乙烯(PVC)制成的塑料管和管件

Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product

- Note: This code is for general PVC water supply pipes and fittings.

- Proactive Advice: Confirm the exact product description and whether it includes fittings or only pipes.

✅ HS CODE: 3917230000

Description: PVC给水管,PVC是乙烯基聚合物的一种,给水管属于硬质管件

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code applies to rigid PVC pipes used in water supply systems.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3917320010).

✅ HS CODE: 3917320010

Description: PVC给水管,该HS编码专门针对聚氯乙烯(PVC)制成的塑料管

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is specifically for PVC pipes, not fittings.

- Proactive Advice: Clarify whether the product is a pipe or a fitting to avoid misclassification.

✅ HS CODE: 3917400060

Description: PVC给水管件,其他塑料管件:聚氯乙烯制成

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for PVC fittings and other plastic fittings.

- Proactive Advice: Confirm if the product is a fitting or a complete pipe system.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Verification: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a blend or composite material.

- Certifications: Check if any certifications (e.g., ISO, CE, or local standards) are required for import.

- Unit Price: Verify the unit price and whether the product is sold as a complete set or individual components.

Recommendation:

For accurate customs clearance and cost estimation, it is essential to confirm the exact product description, material composition, and whether it is classified as a pipe or fitting. If in doubt, consult a customs broker or use the official HS code lookup tool.

Product Classification: PVC给水管 (PVC Water Supply Pipes)

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 3917390020

Description: PVC给水管,材料为聚氯乙烯(PVC)制成的塑料管和管件

Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product

- Note: This code is for general PVC water supply pipes and fittings.

- Proactive Advice: Confirm the exact product description and whether it includes fittings or only pipes.

✅ HS CODE: 3917230000

Description: PVC给水管,PVC是乙烯基聚合物的一种,给水管属于硬质管件

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code applies to rigid PVC pipes used in water supply systems.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3917320010).

✅ HS CODE: 3917320010

Description: PVC给水管,该HS编码专门针对聚氯乙烯(PVC)制成的塑料管

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is specifically for PVC pipes, not fittings.

- Proactive Advice: Clarify whether the product is a pipe or a fitting to avoid misclassification.

✅ HS CODE: 3917400060

Description: PVC给水管件,其他塑料管件:聚氯乙烯制成

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for PVC fittings and other plastic fittings.

- Proactive Advice: Confirm if the product is a fitting or a complete pipe system.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Verification: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a blend or composite material.

- Certifications: Check if any certifications (e.g., ISO, CE, or local standards) are required for import.

- Unit Price: Verify the unit price and whether the product is sold as a complete set or individual components.

Recommendation:

For accurate customs clearance and cost estimation, it is essential to confirm the exact product description, material composition, and whether it is classified as a pipe or fitting. If in doubt, consult a customs broker or use the official HS code lookup tool.

Customer Reviews

HS编码3917400060的关税详情非常清晰。我特别喜欢关于反倾销税不适用的说明。

关于确认产品是管道还是配件的主动建议在避免错误分类方面非常有帮助。

我正在寻找PVC供水管的HS编码详细信息,这个页面包含了我需要的一切。解释清晰且准确。

这个页面有些重复,但信息是准确的。我发现在材料验证部分非常有用。

HS编码3917390020的33.1%税率的详细信息正是我出口项目所需要的。